In a nutshell

Despite the economic crisis precipitated by Covid-19, the Arab region’s economic elites have further increased their grip on regional assets, in terms of both share and absolute value: the wealthiest 1% individuals saw their control over assets swell by 44% in 2020.

At the centre and lower end of the wealth ladder, there have been significant losses; an individual in the middle of the regional wealth ladder saw a wealth decline of 28%; the poorest half of the population saw their average wealth fall by a third.

Half of the 16 countries with the highest increase in wealth inequality worldwide in 2020, and a third of the 20 most unequal countries in 2020 are Arab countries; in 2019, ‘only’ two Arab countries were among the top 20 most wealth-unequal countries.

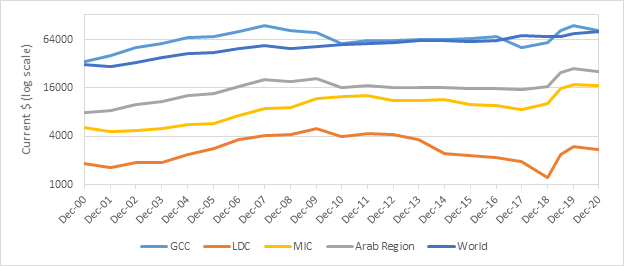

Over the period from 2000 to 2009, Arab nationals’ average personal wealth was growing at a steady pace across all Arab sub-regions. The years 2008-10 saw a slowdown as a result of a negative correction in the GCC (Gulf Cooperation Council) countries due to the global financial crisis.

After 2010, however, the wealth of GCC country nationals, like that of global citizens, continued growing. At the same time, the wealth of nationals in Arab middle-income, low-income and conflict-affected countries started to decline in 2012, particularly in the Arab low-income and conflict-affected countries.

Across the Arab region as a whole, on average, people’s personal wealth stagnated during the period 2010-18. Consequently, at the end of 2018, nationals of Arab middle-income countries (MICs) controlled the same level of wealth as a decade previously, while nationals of the Arab low-income and conflict-affected countries were poorer than at the turn of the millennium.

This is in nominal terms, even as the purchasing power (or real inflation-adjusted value) of people’s wealth is likely to have declined over the two decades. For various reasons highlighted in detail in Hlásny (2022), it is difficult to report inflation-adjusted wealth values or in terms of purchasing power parity (PPP).

Figure 1: Mean net personal wealth, December 2000 to December 2020 ($, log scale)

Authors’ estimates based on Credit Suisse data and using methodology in ESCWA (United Nations Economic and Social Commission for Western Asia) 2022

Increasing wealth concentration

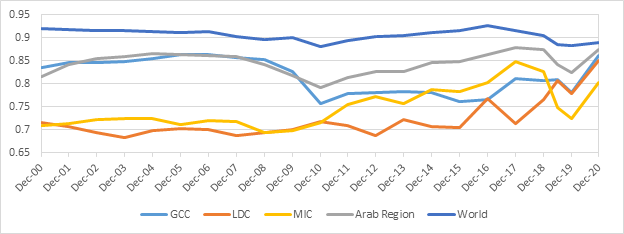

Wealth inequality in the Arab region increased over the period 2001-05 before falling back to the year-2000 values on the eve of the 2011 Arab Spring uprisings. Wealth inequality bottomed out in 2010, but then grew rapidly until 2017. Region-wide inequality dipped again in 2018-19 because of decreases in inequality in all Arab sub-regions, particularly the group of Arab middle-income countries.

The recent sharp drop in inequality in the middle-income countries follows a period of stagnation during 2001-07, reaching a bottom in 2008, and a big rise in inequality during the following decade. The Gini index of wealth inequality rose 16 points from 0.69 in 2008 to 0.85 in 2017. Between 2019 and 2020, the first year of the pandemic, wealth inequality increased in most world regions, and particularly substantially in the Arab region. This was seen in all Arab sub-regions.

Figure 2: Gini index of wealth inequality, December 2000 to December 2020

Authors’ estimates based on Credit Suisse data and using methodology in ESCWA 2022

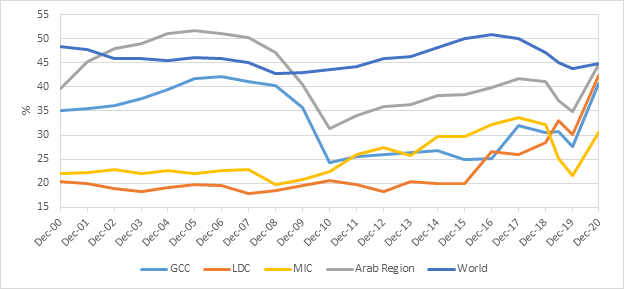

With respect to the aggregate share held by the wealthiest 1% of nationals, the story is similar. In the first year of the pandemic, wealth concentration in the hands of a small number of elites shot up in all Arab sub-regions. By contrast, concentration of wealth worldwide grew at a subdued rate, as the global south has continued catching up with the global north.

Thus, during the period 2010-20, the wealthiest 1% of Arab nationals increased their control of regional assets from 31.4% to 44.9%. The wealthiest 10% of Arab nationals increased their control of regional assets from 69.7% to 81.1%. In the Arab least developed (LDCs) and conflict-affected countries alone, the wealthiest 1% of nationals increased their control from 20.0% to 42.5%, and the wealthiest 10% increased their holdings from 58.2% to 77.9%.

Figure 3: The wealthiest 1% individuals’ share of aggregate wealth, December 2000 to December 2020

Authors’ estimates based on Credit Suisse data and using methodology in ESCWA 2022

Contracting lower and middle class wealth along with rising poverty

While a large number of individuals broke through the $1 million or higher wealth marks throughout the 2010s and into the pandemic, many more individuals in the lower half and middle wealth groups lost or ‘dis-saved’ their ‘rainy-day funds’. The result is that the middle wealth class in the Arab region has significantly contracted.

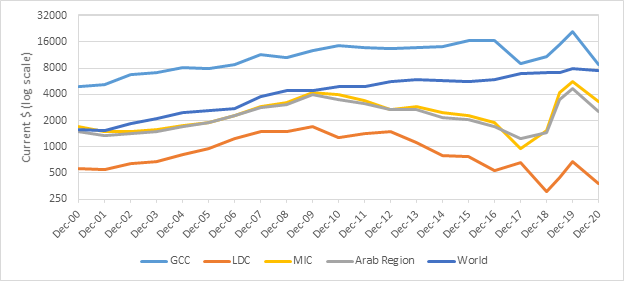

The median personal wealth holdings in the Arab region (and, by extension, in its middle-income countries) grew during the years 2001-09 at the same pace as globally, but have since fallen back significantly, only to recover partially and temporarily in 2019.

The story differs across the Arab sub-regions. While median personal wealth in the GCC countries grew consistently throughout 2001-16, and only dipped during 2017-20, in the Arab least developed and conflict-affected countries, individuals’ wealth lagged behind the rest of the Arab region without any sign of convergence throughout the two decades. In fact, it was in free fall during the period 2010-20.

As a result, the median citizen of Arab middle-income countries was as well off in 2018 as at the turn of the millennium, while the median citizen of the Arab least developed and conflict-affected countries was 45% poorer than in the year 2000. Once again, this is in nominal terms, even as the purchasing power of people’s wealth declined over the two decades.

Figure 4: Median net personal wealth, December 2000 to December 2020 ($, log scale)

Authors’ estimates based on Credit Suisse data and using methodology in ESCWA 2022

Along with rising wealth inequality, income poverty has increased. The two phenomena are related. Extreme income poverty was monotonically falling in the region over several decades since consistent records started in 1985. But since around 2013, it has been on the rise. On the eve of the pandemic, it reached back to 1993 levels, suggesting that two decades of pro-poor development had been reversed over the span of only five or so years, mainly due to the impact of conflicts.

The Arab region is the only world region with increasing poverty rates during the 2010s regardless of the poverty line applied. Thus, with the poverty line set at $3.5/day (the average value of national poverty lines for Arab low- and middle-income countries) non-GCC Arab countries recorded an average poverty headcount ratio of 30.9 in 2019 compared with 25.3 in 2010.

The pandemic has accentuated these trends. Millions more are estimated to have fallen into poverty since 2019: an additional 10-15 million poor individuals using national poverty lines, according to ESCWA.

There are two implications of this: first, a declining share of the middle-income group as they slip into poverty (ESCWA, 2015); and second, the declining wealth held by these middle- and lower-income groups as they use their meagre wealth reserves to smooth consumption during difficult times.

Policy conclusions

The sheer degree of concentration of the region’s wealth in the hands of just a small percentage of its population should in itself be a wake-up call for a renewed regional and national policy dialogue on inclusive growth strategies – and for policy action. Of particular concern is the implication of these trends for inequality of opportunity.

Prior to the pandemic, a notable decline in outcome inequalities along with rapid progress in achievements in most basic social indicators has been highlighted. But as shown in the 2019 ESCWA-ERF report on rethinking inequality in Arab countries, inequality of opportunities has risen for many of these same indicators.

This signifies that these outcomes were mainly dictated by exogenous (or non-effort-related) factors. As family wealth is the most significant of such factors, it is likely that inequality of opportunities will continue to rise after the pandemic even if outcome inequalities improve, which may not be the case after Covid-19.

A 2021 report by UNESCO, UNICEF and the World Bank confirms this suspicion in the case of education: educational inequalities have clearly widened for children and youth, with estimates showing that around 40% or 39 million children and adolescents, who were considered digitally poor, were unable to access remote education during lockdowns.

In summary, the most enduring legacy of the pandemic may be that Arab countries will see a wealth-inequality-driven deterioration in inequality in opportunities coinciding with rising inequality in outcomes in some social indicators, notably education.

To remedy the growing poverty and inequality in the region, a robust policy response is needed. Reducing inequality and vulnerability to poverty calls for assisting the poor in alleviating their socio-economic challenges, and working with the wealthy in putting their wealth to the best social use in a sustainable and equitable way. We call for an integrated approach based on a portfolio of three complementary measures.

First, social protection and relief efforts should be the immediate measure taken towards mitigating inequality and poverty. This is especially urgent in countries experiencing economic hardships, such as Lebanon, and in conflict-affected countries.

The good news is that the cost of closing the money metric poverty gap is quite low in most Arab countries: it is estimated not to exceed 1.5% of the wealth of the richest decile in middle-income countries. But for poorer countries such as Yemen, relief efforts are in dire need of donor support.

ESCWA’s proposal for a wealth solidarity tax is applicable in many Arab middle-income countries due to the relatively high wealth concentration levels and the lower cost of reducing poverty as compared with the least developed countries (ESCWA, 2020). Norway is an example of a country that implemented a wealth fund to serve the purpose of effective inequality reduction (World Inequality Report, 2022).

How can this be done practically? This takes us to the second proposal: properly valuing the assets of the ultrawealthy. This is just as essential since it will provide more accurate details on the composition of their wealth, which significantly influences the options for taxation policy. Inspection and enforcement mechanisms are also necessary, and tax authorities should focus on mitigating weak compliance, which is a notable fiscal policy challenge in most Arab countries.

Third, and perhaps more importantly, addressing the root causes of the rising poverty and wealth inequality challenges requires structural transformation of Arab economies. This in turn requires significant changes to their governance frameworks and macroeconomic policies. A brief comparison of how economic policies implemented in most Arab countries over the past three decades were supposed to have worked versus how they actually worked helps to explain.

Economic policy reforms have two components: a short-term stabilisation component; and a longer-term structural adjustment component. Stabilisation primarily aims to reduce inflation and deficits (budget and balance of payments), and to correct ‘wrong’ prices. Two examples of such wrong prices that have haunted many Arab governments are the overvalued official exchange rate, and undervalued or heavily subsidised fuel or commodity prices.

If accompanied by complementary medium- and long-term structural adjustment policies such as the trade liberalisation and regulatory/governance reforms, stabilisation is assumed to lead to higher private sector and foreign investment, growth, employment generation and productivity growth. Poverty reduction and an expanding middle class are the final outcomes. Not surprisingly, restoring macroeconomic stability is the first and foremost concern of reform agreements between governments and the International Monetary Fund.

Did this formula work in practice? The evidence is mixed. Let’s take the part where it does seem to work. Many country experiences, including in this region, show that austerity measures can restore macroeconomic stability in the short term and possibly even resume growth (as in the case of Egypt after 2015).

But the longer-term part of the story is more problematic. Structural adjustment policies have failed to induce higher productivity and long-term growth, and evidence suggests that some key components of economic reform programmes – such as trade liberalisation, privatisation and financial deregulation – have led to greater rentierism, crony capitalism and socio-economic inequality.

Thus, the debate has been less focused on whether these stylised facts hold, rather on whether they are due to poor governance or to poor economic policy choices. Although each country narrative is different, it is probably a combination of both factors.

In summary, addressing development challenges in Arab countries has seldom been only a problem of lack of resources. Rather, it has been one of short-sighted macroeconomic policies as well as governance and institutional weaknesses.

Further reading

Abu-Ismail, K, and V Hlásny (2020) ‘Wealth Inequality and Closing the Poverty Gap in Arab Countries: The Case of a Solidarity Wealth Tax’, ESCWA Technical Paper.

Hlásny, V (2022) ‘Greater Concentration and General Erosion of Wealth in the Arab Region: The Legacy of COVID-19’.

ESCWA (2015) ‘Arab Middle Class: Measurement and Role in Driving Change’.

ESCWA and ERF (2019) ‘Rethinking Inequality in Arab Countries’.

UNESCO, UNICEF and World Bank (2021) ‘COVID-19 Learning Losses: Rebuilding Quality Learning for All in the Middle East and North Africa’.