In a nutshell

Between November 2020 and February 2021, there were some improvements in labour force participation and employment in Morocco and Tunisia, as well as falls in unemployment. Wage workers in all four countries have experienced layoffs, and reduced hours and earnings, particularly in the informal sector.

Although the majority of employers and the self-employed report that their businesses are open and operating, hours are reduced and most report lower revenues compared with 2019. Half of households report that their income has decreased; in most countries, the poor have experienced the largest income losses.

In most countries, social protection measures have reached only a small fraction of the population, a declining share from November 2020 to February 2021, and social protection systems remain poorly targeted.

This column summarises the results of the second wave of the Covid-19 MENA Monitor (CMM) survey carried out by the ERF in February 2021, which are laid out in more detail in Kraftt et al (2021). The results of the second wave of the CMM indicate some improvement in the main labour market aggregates since November 2020, but income and employment levels are still well below their pre-pandemic levels.

The second wave of the CMM revisits individuals interviewed in the first wave in Morocco and Tunisia and adds two new countries: Egypt and Jordan. In all cases, the survey collects retrospective data on the situation of individuals and their households just prior to the pandemic in February 2020, which allows for comparison of their status in February 2021 to their status before Covid-19.

The microdata from both waves of the ERF Covid-19 MENA monitor surveys are now publicly available through ERF’s Open Access Data Initiative (OAMDI).

Covid-19 and the MENA policy response

The four countries represented in the CMM had divergent trajectories in the way they experienced the pandemic and in government responses to it. The initial stages of the pandemic were fairly similar in all four countries, with Jordan having the lowest number of cumulative deaths per million people due to Covid-19 at the end of April 2020 (0.8), and Egypt, Morocco, and Tunisia in close proximity with deaths per million ranging from 3.5 to 4.6 (Roser et al, 2020).

All four countries adopted somewhat restrictive regimes with regard to closures during that period, with Jordan having the most stringent regime, followed by Morocco and Tunisia, and then Egypt (Hale et al, 2020). They adopted restrictions in all relevant areas, with Egypt being somewhat looser in workplace restrictions and the banning of gatherings, and Jordan being strictest with the initial stay-at-home orders, which initially lacked exceptions for even essential trips.

Jordan was credited with a very effective early response from a public health standpoint, but one that may have exacted a high economic and social cost (Jensenhaugen, 2020). Its stringent response eventually proved unsustainable, ultimately failing to contain the pandemic, as indicated below. Egypt and Morocco maintained high levels of restrictions in May and June, but Jordan and Tunisia loosened their closure restrictions appreciably (Hale et al, 2020).

The last quarter of 2020 and the first quarter of 2021 saw a resurgence of the disease in Jordan, Morocco and Tunisia, and a relative stabilisation in Egypt (Roser et al, 2020). The death rate soared in Jordan to 672 per million by the end of March 2021, compared with just six at the end of September. This led to a further tightening of restrictions (Hale et al, 2020).

There was also a sharp aggravation of the pandemic in Tunisia with the death rate reaching 745 per million by the end of March 2021, also leading to a substantial tightening of restrictions (Hale et al, 2020; Roser et al, 2020). Morocco experienced a more moderate resurgence, also leading to the reinstatement of some restrictions, but without a large change in the average stringency index (Hale et al, 2020; Roser et al, 2020). With a more limited advance of the pandemic, Egypt mostly maintained its previous moderately restrictive stance (Hale et al, 2020; Roser et al, 2020).

The economies of the four countries were differentially affected by the pandemic. Egypt, which had the least restrictive closure regime, had a positive GDP growth rate of 3.6% in 2020, albeit a slowdown from its 2019 rate of 5.6% (World Bank, 2021a). Jordan’s economy contracted by 1.8% in 2020 after growing at 2.0% in 2019 (World Bank, 2021b). Morocco’s economy contracted even more sharply at a rate of 7.0% and Tunisia’s by 8.8% in 2020, after having grown by 2.5% (Morocco) and 1.0% (Tunisia) in 2019 (World Bank, 2021c, 2021d).

Each of the four countries adopted a set of economic and social policies to mitigate the effects of the crisis (International Monetary Fund, IMF, 2021). The policy stance included a mix of supports for workers and firms.

Morocco dedicated funds amounting to 3% of GDP to their Covid-19 response whereas Tunisia created an emergency plan amounting to 2.3% of GDP (IMF, 2021). Egypt announced a series of stimulus policies amounting to 1.8% of GDP (IMF, 2021). Jordan’s economic and social support measures amounted to 8% of GDP (IMF, 2021). These policy responses are discussed in more detail in Kraftt et al (2021).

Labour market outcomes during Covid-19

The pandemic led to reductions in employment and increases in unemployment and in exits from the labour force altogether (Krafft et al, 2021). There are, however, some promising signs that the situation is starting to improve in Morocco and Tunisia, the two countries for which we have comparisons with November 2020. Most of the recovery in labour force participation and employment rates was concentrated among men, although there was a slight increase in employment for women in Tunisia and a more appreciable one in Morocco.

At the start of the pandemic and as lockdowns and economic downturns set in, workers were temporarily or permanently laid off as job opportunities dried up. A substantial fraction of those who were employed in February 2020 had lost their jobs and had become unemployed in the aftermath of the pandemic, but some of those who lost their jobs initially in Tunisia and Morocco appear to have regained jobs (Krafft et al, 2021).

Women, and particularly women who were working in the private sector, were especially likely to exit employment. Their relative inability to hold on to these jobs during the pandemic can likely be attributed to their suddenly increased care-giving responsibilities.

Whether workers experienced employment challenges and the nature of the challenges they experienced during the pandemic depended enormously on their type of pre-pandemic work. The picture that emerges is that the wage workers who were already the most vulnerable in the labour market, those in informal wage employment and especially those working outside of establishments are bearing the brunt of the pandemic’s impact on the labour market.

Although the ability to work from home is rare for wage workers in general (14-22% across countries), it is particularly rare for informal private wage workers working outside establishments (6-14% are able to work from home across countries). The nature of work more than the nature of technology in MENA appeared to constrain work from home options.

Changes in income and social protection

Almost half of MENA households experienced income declines between February 2020 and February 2021. How income losses were concentrated varied substantially by country.

In Morocco, the first (lowest-income) quartile experienced by far the steepest income losses, with 65% experiencing some decrease in income, compared with 31% of those in the fourth (highest-income) quartile. In Egypt, these differences ranged from 49% (lowest-income quartile losing income) to 29% (highest-income quartile losing income).

Differences were smaller in Jordan, from 48% of the first quartile to 43% of the fourth quartile losing income (although the highest-income quartile also had the largest increases in income, 15%, compared to 6% for the lowest income quartile). In Tunisia, the second and third quartiles had the greatest losses (49%), although, again, the fourth, highest income quartile had the most increases in income (13%).

The substantial challenges facing MENA households, especially low-income households, have been met by a social safety net (of both pre-existing programmes and emergency response measures) that remains sparse in most countries.

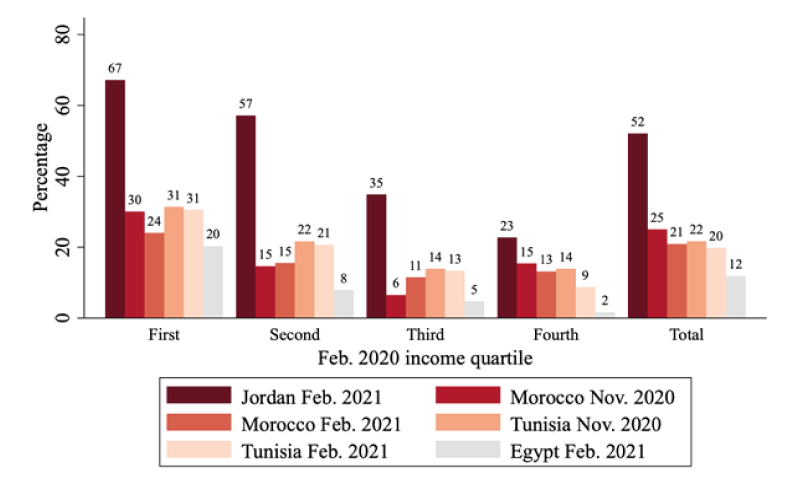

Figure 1 shows the percentage of households receiving either regular social assistance through a longstanding programme or recent (past month) Covid-19-related government assistance, by income quartile. Jordan had the greatest coverage of social assistance, 52%, while Tunisia and Morocco were 20-21% in February 2021 and Egypt 12%. Notably, assistance decreased from 25% in November 2020 to 21% in February 2021 in Morocco and from 22% to 20% in Tunisia over the same period.

Figure 1: Receiving government assistance (percentage of households), by country and February 2020 income quartile

Source: Authors’ calculations based on February 2021 Covid-19 MENA Monitor (Egypt, Jordan, Morocco, Tunisia).

Note: Excluding ration cards in Egypt

Supporting vulnerable workers in a difficult labour market

The CMM February 2021 wave illustrates how persistent labour market challenges are in the face of the pandemic and associated economic downturn. A year into the pandemic, there are some glimmers of hope in slight increases in employment rates and labour force participation, as well as reduced unemployment rates.

Yet only a fraction of those who were employed in February 2020 and lost jobs have returned to employment. Moreover, wage workers, especially vulnerable, informal workers, face persistent layoffs and reduced earnings.

While the social safety net and countercyclical policies might be able to cushion the challenges created by the pandemic, the coverage of social transfers remains sparse. Most assistance is the continuation of longstanding transfer programmes. Policies, such as Egypt’s assistance for irregular workers, have reached only a small fraction of those affected. Moreover, the safety net has not expanded (and indeed slightly contracted) in Morocco and Tunisia over time.

Expanding, as well as better targeting the social safety net is critically important to reducing the harms and negative coping strategies that result from income losses among vulnerable households. Cash assistance for those struggling with not only job loss, but also reduced earnings, is critically important during the crisis to increase demand for goods and services and thus help to support economic rebound.

Acknowledgements

This column is based on a recent ERF Policy Brief by the same authors (Krafft et al, 2021). The results are primarily based on mobile phone survey data from the second wave of the ERF Covid-19 MENA Monitor Survey, which was carried out in February 2021 in Egypt, Jordan, Morocco and Tunisia. ERF acknowledges generous funding from the Foreign, Commonwealth and Development Office and International Labour Organization for the data, and the Agence Française de Développement for the analysis.

Further reading

Hale, Thomas, Noam Angrist, Emily Cameron-Blake, Laura Hallas, Beatriz Kira, Saptarshi Majumdar, Anna Petherick, Toby Phillips, Helen Tatlow and Samuel Webster (2020) ‘Oxford COVID-19 Government Response Tracker’, Blavatnik School of Government.

IMF (2021) ‘Policy Responses to COVID-19: Policy Tracker’.

Jensenhaugen, Jorgen (2020) ‘Jordan and COVID-19: Effective Response at a High Cost’, PRIO Middle East Center Mideast Policy Brief No. 03-2020, Oslo.

Krafft, Caroline, Ragui Assaad and Mohamed Ali Marouani (2021) ‘The Impact of COVID-19 on Middle Eastern and North African Labor Markets: Glimmers of Progress but Persistent Problems for Vulnerable Workers a Year into the Pandemic’, ERF Policy Brief No. 57.

Roser, Max, Hannah Ritchie, Esteban Ortiz-Ospina, and Joe Hasell (2020) ‘Coronavirus Pandemic (COVID-19) [Online Resource]’, published online at OurWorldInData.Org.

World Bank (2021a) ‘Egypt’s Economic Update April 2021′.

World Bank (2021b) ‘Jordan’s Economic Update April 2021’.

World Bank (2021c) ‘Morocco’s Economic Update April 2021’.

World Bank (2021d) ‘Tuinisia’s Economic Update April 2021’.