In a nutshell

The negative supply and demand shocks associated with Covid-19 are expected to be relatively short-lived but dramatic, with widespread effects across many sectors and countries.

The speed of the recovery will depend on how swiftly and decisively governments take measures to mitigate the economic and financial dislocations from the health crisis.

The two shocks of Covid-19 and oil price collapse are intertwined, yet distinct; the two shocks differ in their duration, but also their likely potential consequences and associated risks of inaction.

The novel coronavirus, which Chinese authorities first reported to the World Health Organization (WHO) on 31 December 2019, has spread globally. The virus has infected more than 1.2 million people, causing over 65,000 deaths (as of 5 April 2020), although more than a quarter of a million individuals have now recovered. Countries in the Middle East and North Africa (MENA) face a dual shock: the Covid-19 pandemic and a collapse in oil prices.

The virus has seriously affected Iran and has spread to other MENA countries. As of 5 April 2020, Iran had reported more than 58,000 infections and more than 3,600 deaths. The rapid rise in domestic infections is disrupting the country’s production and trade. Other MENA countries have also reported infections and subsequently imposed preventive measures. As of 5 April 2020, Saudi Arabia had reported 2,370 cases; Qatar, 1,325; Bahrain, 688; Iraq, 878; Kuwait, 556; and the United Arab Emirates (UAE), 1,505. Algeria, Egypt, Lebanon, Morocco, and Tunisia have all also reported infections.

The ability to contain the virus depends on the strength of the region’s public health systems, which – with some exceptions such as Yemen and Djibouti – WHO ranks relatively high globally (Tandon et al, 2000). Nonetheless, the need for transparency and a freely available information flow is pervasive. The region risks dramatic consequences if transparency and information flow issues are not addressed expeditiously during this health crisis.

The virus will not only claim lives: its spread will confront MENA countries with both a negative supply shock and a negative demand shock (Baldwin and Weder di Mauro, 2020). The negative supply shock initially stems from a reduction in labour. This happens directly because workers are sidelined by the virus, and indirectly due to travel restrictions, quarantine efforts and workers staying home to take care of sick family members or children. Supply will also be affected by a reduction in materials, capital and intermediate inputs due to disruptions in transport and businesses within MENA countries.

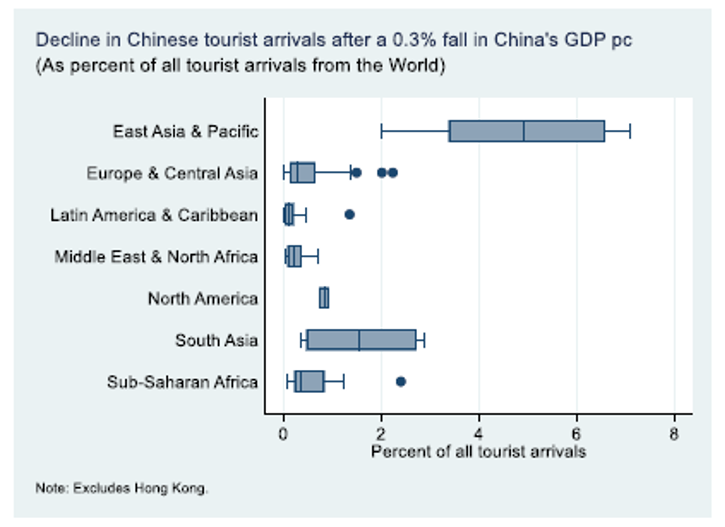

The negative demand shock is both global and regional. Economic difficulties around the world and the disruption of global value chains will reduce demand for the region’s goods and services, most notably oil and tourism. The reduction in GDP growth in China is expected to have a limited effect on tourism activity in MENA (Figure 1). But the spread of the virus to other countries (especially to Europe), and the preventive health measures they are enforced to implement, is expected to have a much larger impact on MENA economies.

Regional demand will also decline as a result of the abrupt reduction in regional business activity and as concerns about infection reduce international travel. In addition, uncertainty about the spread of the virus and the level of aggregate demand could hurt the region’s investment and consumption levels. Collapsing oil prices may further depress demand in MENA, where oil and gas is the most important sector in many economies. Finally, potential financial market volatility could further disrupt aggregate demand.

The negative supply and demand shocks associated with Covid-19 are expected to be relatively short-lived but dramatic, with widespread effects across many sectors and countries. Demand and supply will recover once the pandemic subsides, but how quickly this will occur depend on the length and depth of the disruption.

In addition to the shock from Covid-19, the breakdown in negotiations between OPEC and its allies led to what is likely to be a persistent collapse in oil prices. On 5 March 2020, OPEC proposed a 1.5 million barrels per day (mb/d) production cut for the second quarter of 2020, of which 1 mb/d would come from OPEC countries and 0.5 mb/d from non-OPEC but aligned producers, most prominently Russia. The following day, Russia rejected the proposal, prompting Saudi Arabia (the world’s largest oil exporter) to boost production to 12.3 mb/d, its full capacity. Saudi Arabia also announced unprecedented discounts of almost 20% in key markets.

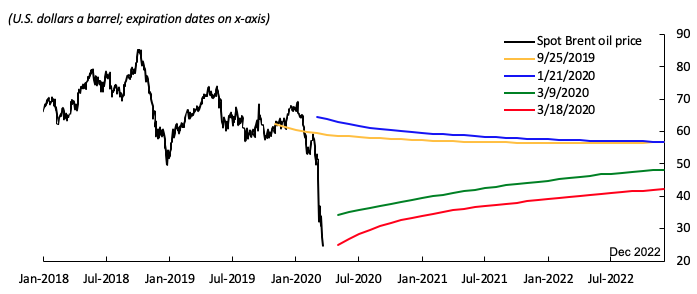

The result was an immediate drop of more than 30% in prices and continuing declines since. The benchmark West Texas Intermediate (WTI) crude oil price reached a low of $22.39 per barrel in the intraday session on 20 March 2020. This was less than half the price compared with the beginning of the month. The futures curve suggests that the market expects oil prices to recover slowly, not reaching $40 per barrel until the end of 2022 (Figure 2).

Intertwined but distinct

The two shocks of Covid-19 and oil price collapse are intertwined, yet distinct. On the one hand, the demand component of the oil shock is linked to the sharp reduction in oil consumption stemming from precautionary measures to stop the spread of the virus. This includes lockdowns, which have brought economies around the world to a standstill. The estimated 10% reduction in oil consumption from 2019 (about 10mb/d) is the result of reduced air and road travel, according to Rystad Energy. While the depth and duration of the pandemic shock is uncertain, it is expected to be short-lived.

Indeed, the severity of the shock has triggered unprecedented domestic measures in advanced and developing countries, and the imperative of global coordination to eradicate the virus will hopefully prevail. The international financial institutions are critical to the effort of developing countries fighting Covid-19 (which have acute balance of payments or fiscal problems). These institutions (which can offer zero- to low-interest financing and long maturities) are best equipped to help MENA and other developing countries deal with the dual shock.

The cost of inaction, both economic and social, would be large. The payoff for action is large. Previous experience in fighting smallpox suggests the benefit-cost ratio for assisting its eradication exceeded 400 to 1 (Barrett, 2007).

Once the spread of the virus is stopped, the preventive measures at the root of the economic recession will be rolled back. The speed of that recovery will depend on how swiftly and decisively governments take measures to mitigate the economic and financial dislocations from the health crisis. But the supply component of the oil shock is likely to be persistent and drive oil prices lower for longer. The two shocks differ in their duration, but also their likely potential consequences and associated risks of inaction.

When assessing the impact of oil prices on the global economy, economists typically distinguish between supply- and demand-driven oil shocks. Demand-driven shocks are related to the evolution of global demand and are not expected to have an independent effect on the global economy.

In contrast, supply-driven oil shocks would normally be expected to give an independent boost to the global economy. There are several reasons why, in this case, they might not. Not least, the financial propagation effects of the collapse in oil prices have caused the markets for equities, bonds and non-oil commodities to tumble.

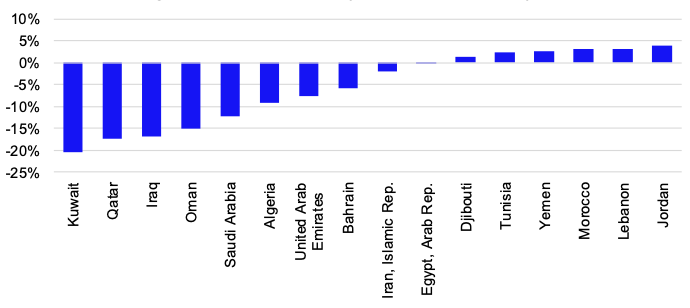

For MENA countries specifically, lower prices are generally good for oil-importing countries and bad for oil exporters. A simple way to get a sense of the size of the real income effect of an oil price change is to multiply the difference between production and consumption (net oil export) as a share of GDP by the percentage point change in the oil price.

For example, based on hypothetical assumption that oil prices will stay 48% below the 2019 level, Kuwait (where net oil exports account for 43% of GDP) would experience a decline in real income of about 20% of GDP, while importer Morocco would experience an increase in real income equivalent to 3% of GDP (Figure 3).

But in MENA it is likely that lower oil prices will hurt both importers and exporters. Exporters may be hit directly, and importers indirectly (from reduced foreign direct investment, remittances, tourism, and grants from exporters). Arezki et al (2020) show that aggregate spillovers from the oil exporters bloc to the oil importers bloc in MENA is positive. Depending on the geography the country-to-country spillovers can be positive and very large. Reduced remittances from MENA oil exporters also affect countries beyond MENA such as India, Bangladesh, Sri Lanka and Philippines (see bilateral remittance flows).

Some countries, such as those in the Gulf Cooperation Council, still have buffers and should use them. Other oil-exporting countries, such as Algeria and Iran, are exhausting their buffers and will have to rely on flexible exchange rates to manage the current situation and conduct much-needed reforms in private sector development and broader economic transformation. Among net oil importers (such as Lebanon, Jordan and Egypt) a recession will worsen already high levels of public debt.

Policy response

While Covid-19 caused a severe supply shock that raised unemployment and poverty, there are sizeable demand feedback loops. Aside from the loss of human lives, inaction also risks massive disruptions in supply and demand, and illiquidity in the financial sector. In other words, the Covid-19 shock could lead to household and corporate bankruptcies, with lasting scars on the economy and society. The disruptions come at a time of discontent in MENA, where the streets have been full of protests demanding better governance and an end to corruption.

In contrast, the oil price collapse is a commodity ‘terms-of-trade’ shock that affects the economy through reduced export receipts and revenues in government coffers. The shock is expected to be persistent and lead to widening twin deficits (in a country’s current balance and its government budget) and increased debt if there is no fiscal consolidation.

To deal with the dual shock, authorities should sequence and tailor their responses to the severity of the shocks. They should first focus on responding to the health emergency and the associated risk of economic depression. Authorities should postpone the fiscal consolidation associated with the persistent drop in oil price and its spillovers until the recovery from the pandemic is well underway.

In responding to Covid-19, authorities should boost spending on health, including producing or acquiring test kits, mobilising and paying health workers, adding health infrastructure and preparing for vaccination campaigns. The authorities should also use targeted cash transfers to vulnerable households and support the private sector, including small and medium-sized enterprises in the informal sector.

It is paramount to target the large number of workers in the informal sector, which provides no safety net. Many of them work hand-to-mouth. Given the large labour share and borrowing constraints in many developing countries in MENA, targeted assistance is vital and should come with larger size relative to the economy than similar efforts in advanced economies. Successful models of quickly deploying the role of technology (including digital) to fight Covid-19 and target assistance should be analysed and replicated. (See Foreign Affairs (2020) for the experience of Taiwan.)

As mentioned above, freeing up information flows, increasing transparency and promoting data disclosure to reduce leakages are all crucial elements in targeting cash transfers (which themselves will be essential to ensuring a flattening of the spread of the virus, hastening the economic recovery and limiting the rise in poverty). To limit risks of financial instability, countries in the MENA region should reduce interest rates and inject liquidity in the banking system. Where inflation is low, liquidity injection and targeted cash transfers can be financed by ‘helicopter money’, that is, essentially from money printed by central banks (Gali, 2020).

The battle against the spread of the novel coronavirus and its economic and social consequences will be made more difficult by empty government coffers. Many MENA countries are facing large balance of payments and fiscal gaps. Many also carry high sovereign risk premiums. For those countries, additional foreign borrowing on private markets will be difficult.

Moreover, countries with fixed exchange rates will find it difficult to use helicopter money because of the tension between money printing and maintenance of the peg. The region will need much international support to help it navigate an extremely rough patch.

Further reading

Arezki, R, R Yuting Fan and H Nguyen (2020) ‘Growth Spillovers within the Middle East and North Africa and Beyond: Oil Exporters and Importers are Swinging Together’, World Bank.

Barrett, S (2017) ‘The smallpox eradiation game’, Public Choice 130: 179-207.

Baldwin, R, and B Weder di Mauro (2020) Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, VoxEU ebook, CEPR Press.

Gali, J (2020) ‘Helicopter money: the time is now‘, VoxEU.

Foreign Affairs (2020) ‘How Civic Technology Can Help Stop a Pandemic’.

Lopez-Cordova, E (2020a) ‘A Slowdown of China’s Economy and its Impact on the Demand for Tourism Services’, brief.

Lopez-Cordova, E (2020b) ‘Digital Platforms and the Demand for International Tourism Services’, World Bank Policy Research Working Paper No. WPS9147.

Tandon A, CJ Murray, JA Lauer and D Evans (2000) ‘Measuring overall health system performance for 191 countries’, World Health Organization.

This column was first published at Vox.