In a nutshell

There is considerable evidence indicating that a business environment with fewer restrictions and barriers encourages innovation and the creation of new firms, contributing to economic growth and job opportunities.

Regulatory reforms aimed at simplifying the process of starting a business are typically associated with an increase in firm creation; new evidence shows that the UAE’s deregulation of ownership rules is having exactly that positive effect.

The findings have clear policy implications for countries in the Gulf Cooperation Council and beyond, highlighting the importance of creating an enabling business environment that attracts both domestic and international investors.

The quality of the business environment in a country has a significant influence on the levels of private investment and entrepreneurial activity. Research evidence indicates that an environment with fewer restrictions and barriers encourages innovation and the creation of new firms, contributing to economic growth and job opportunities (Chambers and Munemo, 2019; Divanbeigi and Ramalho, 2015; Kirkpatrick, 2014; O’Reilly, 2022).

The United Arab Emirates (UAE) has recently deregulated ownership rules for more than 1,000 commercial activities, allowing full ownership of commercial companies in the UAE without requiring a partnership with a national sponsor. Previously, foreign ownership outside free zones was capped at 49%, with a requirement for the majority stake to be held by a partner who is a UAE citizen.

This restriction often acted as a barrier to new firm creation, limiting foreign investors’ independence. The deregulation of ownership rules in the UAE is part of a broader strategy to attract foreign investment and foster entrepreneurship, a policy recommended by the International Monetary Fund (IMF).

Regulatory reform for firm creation

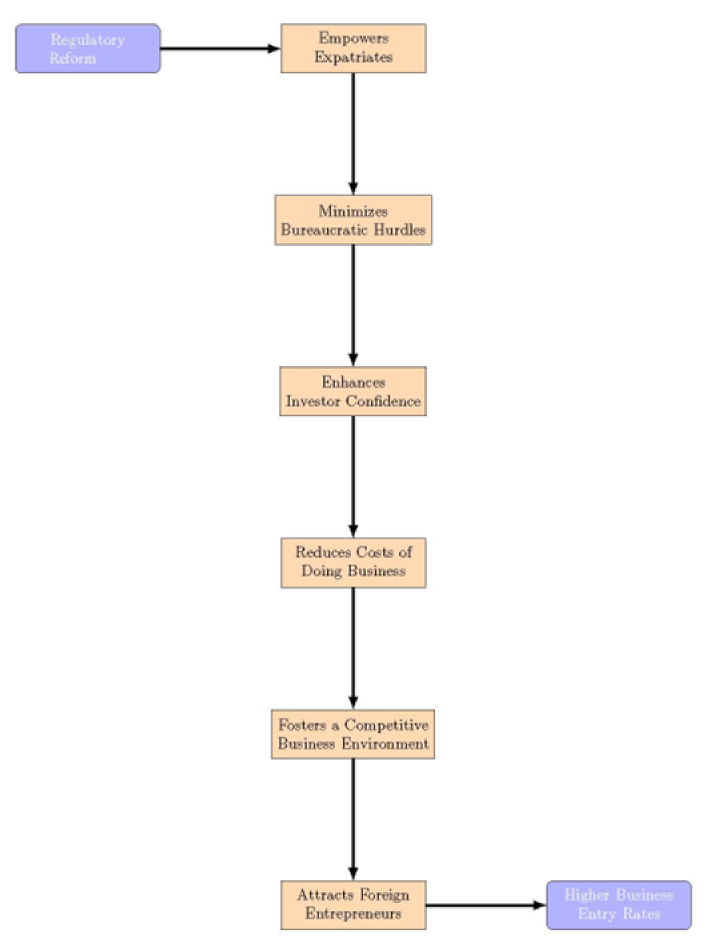

There are essentially four pathways through which regulatory reform could facilitate firm creation:

- Empowerment of foreign entrepreneurs.

- Streamlined administrative processes.

- Enhanced investor confidence.

- A lower cost of doing business.

How might these pathways lead to an improvement on the pre-reform business environment?

First, the previous ownership restrictions might have caused concerns among investors about control and decision-making authority. By allowing full ownership, the reform provides a more transparent and predictable regulatory environment, instilling greater trust and confidence among foreign investors. Foreign investors can exercise greater control and make independent decisions about their business ventures.

Second, the reform’s impact on business entry and firm creation is anticipated through the pathway of streamlined administrative processes and reduced bureaucratic hurdles. The elimination or reduction of bureaucratic hurdles is expected to encourage more individuals to enter the market, as the ease and efficiency of starting a business increase. This, in turn, is likely to stimulate higher business entry rates and the formation of new firms.

Third, the reform’s impact on the cost of doing business represents another crucial pathway influencing business entry and firm creation in the UAE. With the removal of ownership constraints, entrepreneurs can allocate resources more efficiently and effectively. Previously, ownership restrictions often led to additional costs, such as those associated with partnering or maintaining complex ownership structures. By reducing these costs, the reform is expected to create incentives for more individuals to enter the market.

Figure 1: Pathways connecting the ownership law to firm creation

The new law

In 2021, the UAE government implemented amendments to the Commercial Companies Law, allowing foreign investors to have full ownership (100%) of various business activities. Notably, these new rules on full foreign ownership do not make it necessary to have any modifications to the licensing procedures or requirements for conducting business. Furthermore, there are no additional fees, guarantees or capital requirements associated with attaining complete foreign ownership.

Effective from 1 June 2021, the new ownership rules have been implemented for 1,065 types of business activities, encompassing both commercial and industrial sectors, with the exception of two specific economic activities.

The first category comprises economic activities that possess a strategic impact, which are limited to seven sectors: security, defence, and military activities; banks, exchange houses, and finance companies; insurance; currency printing; communications; Haj and Omra services; and Quran centres. These sectors are considered strategically important and are thus excluded from the ownership reform.

The second category of business activities that remain unaffected by the reform is professional activities. In these cases, foreign investors are still required to collaborate with a UAE national to fulfil the necessary judicial formalities for starting a business. This exemption is primarily due to legal considerations, as professional licences fall under the purview of the Civil Transactions Law, while commercial and industrial licences are governed by the Commercial Companies Law.

Policy-makers decided to initiate amendments to the Commercial Companies Law first, with intentions to extend changes to the Civil Transactions Law in subsequent stages. Therefore, the new flexible ownership rules now apply to approximately 40% of the various types of economic activities.

Methodology and findings

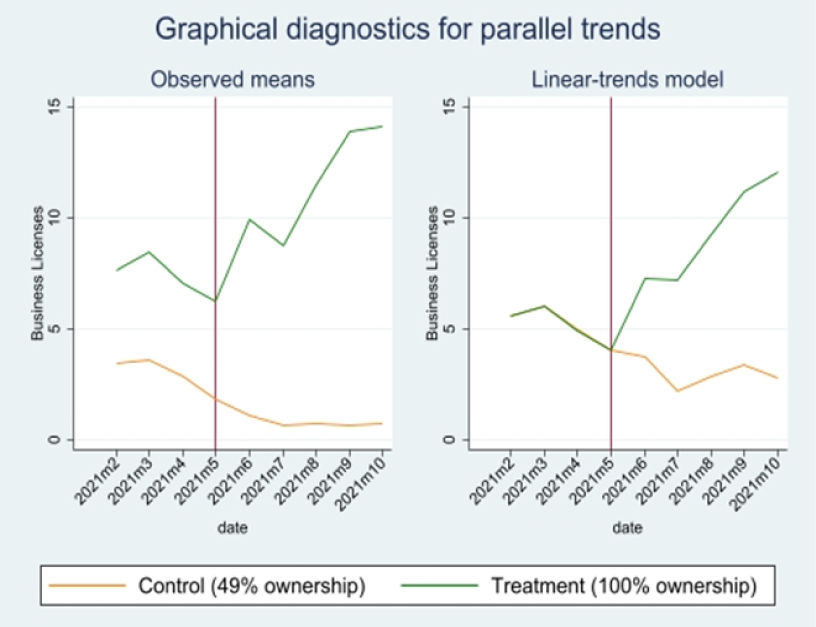

The variation in ownership regulations over time and across different business activities provides a potential instrument for identifying the causal effects of liberalisation policies on the establishment of new firms and the entry of new businesses into the market.

My research (Rashad, 2023) uses unique data on the number of newly issued business licences in Dubai as a proxy for business formation. Using a ‘difference-in-differences’ approach, the study compares the number of new licences before and after the policy change across two groups: those affected by the new ownership rules (the ‘treatment’ group) and those unaffected (the ‘control’ group).

The findings reveal a significant increase in the number of new licences following the implementation of the new ownership rules (see Figure 2). This suggests that the liberalisation policy had a substantial positive effect on business activity.

Figure 2: The impact of ownership liberalisation on business activity

Conclusion

Previous studies have consistently demonstrated that regulatory reforms aimed at simplifying the process of starting a business are associated with an increase in new business formation (Freund and Bolaky, 2008). The UAE’s deregulation of ownership rules represents a significant step towards promoting foreign investment and entrepreneurship.

This study provides early evidence that flexible ownership rules can stimulate business creation and economic dynamism. These findings have significant policy implications for countries in the Gulf Cooperation Council, highlighting the importance of creating an enabling business environment that attracts both domestic and international investors.

Further reading

Chambers, D, and J Munemo (2019) ‘Regulations, institutional quality and entrepreneurship’, Journal of Regulatory Economics 55: 46-66.

Divanbeigi, R, and R Ramalho (2015) ‘Business regulations and growth’, World Bank Policy Research Working Paper No. 7299.

Freund, C, and B Bolaky (2008) ‘Trade, regulations, and income’, Journal of Development Economics 87(2): 309-21.

Kirkpatrick, C (2014) ‘Assessing the impact of regulatory reform in developing countries’, Public Administration and Development 34(3): 162-68.

O’Reilly, C (2022) ‘Barriers to entry, entrepreneurship and income inequality within the USA’, Journal of Entrepreneurship and Public Policy (ahead-of-print).

Rashad, A (2023) ‘The effect of flexible ownership regulations on foreign investments in the UAE: An impact evaluation study using a quais-experimental method’, ERF Conference Paper.