In a nutshell

Increasing GDP per capita no longer corresponds to a relative increase in construction volume in MENA economies; these countries have become so mature that the relative importance of the construction activity has started to decline.

To continue to play its important role in the development strategy of countries, it would be an option for the construction sector to adjust to contemporary frameworks that promote innovative technologies, the green economy, smart cities and the like.

Such structural changes would inevitably require constraints on the construction industry’s production factors being removed, promoting easier access to financial markets and facilitating doing business in a more competitive environment.

Due to its effects on employment and supply chains, the construction industry is a central component of the economy as one of the main drivers of growth. Activities within the industry are also of importance for attaining particular development goals of a nation such as housing and infrastructure. This is true particularly for developing economies where the industry acts as an engine or stimulus that contributes to national income more than other industries do (World Bank, 1984; Ofori, 1990).

The relationship between a country’s development status and its level of construction activity has been explored by many researchers. Early studies, which date back to late 1960s and early 1970s, argue that there is a significant positive relationship between the two. In other words, the share of construction in gross domestic product (GDP) increases as GDP per capita increases (Turin, 1969), while the contribution of construction eventually starts to decline at some point when a sufficient level of national income is achieved (Strassmann, 1970) or when a stable rate of economic growth can be attained by a sufficient level of construction activity (Wells, 1986).

Following these preliminary findings, Bon (1992) articulates one of the most interesting hypotheses in construction economics, suggesting that the nexus between construction and economic development has an inverted U-shape profile. The main aspect of the proposition is that the share of construction in GDP increases in the early stages of economic development, but it slows down in the following stages as it starts to lose its significance in the overall economy.

This series of ‘stages’ has different facets of economic development represented by three types of economies: least developed countries; newly industrialised countries; and advanced industrial countries.

While this non-linear relationship, known as the ‘Bon curve’, is later confirmed by Crosthwaite (2000), Yiu et al (2004) and Girardi and Mura (2014), related research has not produced a consensus of convincing evidence supporting the hypothesis, particularly for developing economies. For example, Ruddock and Lopes (2006) find that the Bon curve holds only for the share of construction in the economy. Looking at 75 countries between 1994 and 2000, the authors reveal that construction activity does not switch from relative to absolute decline in further stages of economic development.

Wong et al (2008) complement these findings for Hong Kong. In addition, Choy (2011), using a sample of 205 economies from 1970 to 2009, states that the inverted U-shaped relationship is observable mainly within most developed countries.

Despite their mixed outcomes, these studies are unequivocal in the sense that the Bon curve may still provide an important paradigm for demonstrating the role of the construction sector in economic development. In a new study, we aim to verify the validity of the Bon curve with data on the ten biggest economies in the MENA region – namely, Saudi Arabia, Turkey, Iran, the United Arab Emirates, Egypt, Iraq, Qatar, Algeria, Kuwait and Morocco – between 1970 and 2018.

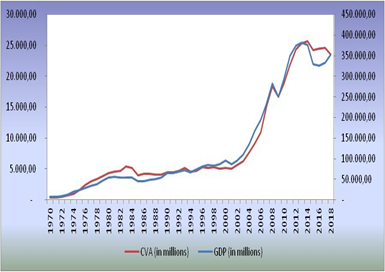

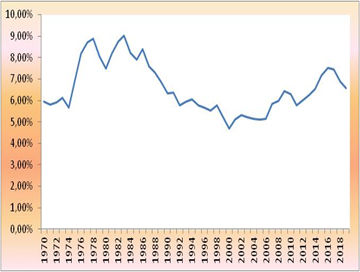

Figures 1 and 2 show the average progress in GDP and CVA among countries and the share of construction in GDP over those years.

Figure 1. Average GDP and construction values across countries from 1970 to 2018

Note: This figure shows the average improvement in GDP (on the right side) and CVA (on the left side) values among countries. Data are reported in millions and are denominated in US dollars at current prices.

Figure 2. Average construction share in GDP across countries from 1970 to 2018

Note: This figure shows the average improvement in construction share in GDP among countries.

Our research uses advanced panel data models to confirm the existence of the Bon curve: there is an inverted U-shaped pattern in the relationship between construction and economic development. Put alternatively, increasing GDP per capita no longer corresponds to a relative increase in construction volume in the economies of MENA countries in our sample. It seems that these countries have become so mature that the relative importance of the construction activity has started to decline.

Hence, the leading role of the construction industry in the economic growth of MENA countries is somewhat obscured. To continue to play its important role in the development strategy of countries, it would be an option for the construction sector to adjust to contemporary frameworks that promote innovative technologies, green economy, smart cities and the like.

Such structural changes would inevitably require constraints on the construction industry’s production factors being removed. Moreover, these countries should develop strategies to create a more institutionalised sector that has easy access to financial markets and should facilitate doing business in a more competitive environment. Governments should also carefully consider their monetary and fiscal policies in order not to distort factor prices.

Further reading

Bon, R (1992) ‘The future of international construction: secular patterns of growth and decline’, Habitat International 16(3): 119-28.

Choy, CF (2011) ‘Revisiting the “Bon curve”’, Construction Management and Economics 29(7): 695-712.

Crosthwaite, D (2000) ‘The global construction market: a cross-sectional analysis’, Construction Management and Economics 18(5): 619-27.

Girardi, D, and A Mura (2014) ‘The Construction-Development Curve: Evidence from a New International Dataset’, The IUP Journal of Applied Economics 13(3).

Ofori, G (1990) ‘The construction industry: aspects of its economics and management’, NUS Press.

Ruddock, L, and J Lopes (2006) ‘The construction sector and economic development: the “Bon curve”’, Construction Management and Economics 24(7): 717-23.

Strassmann, WP (1970) ‘The construction sector in economic development’, Scottish Journal of Political Economy 17(3): 391-409.

Turin, DA (1969) ‘The Construction Industry: Its Economic Significance and Its Role in Development’, University College Environmental Research Group.

Wells, J (1986) ‘The construction industry in developing countries: Alternative strategies for development’, Taylor & Francis.

Wong, JM, YH Chiang and TS Ng (2008) ‘Construction and economic development: the case of Hong Kong’, Construction Management and Economics 26(8): 815-26.

World Bank (1984) ‘The Construction Industry: Issues and Strategies in Developing Countries’.

Yiu, CY, XH Lu, MY Leung and WX Jin (2004) ‘A longitudinal analysis on the relationship between construction output and GDP in Hong Kong’, Construction Management and Economics 22(4): 339-45.