In a nutshell

Falling resource rents imply that the lavish social contracts that have been a main pillar of regional development policies for the past four decades are on their way to becoming a thing of the past.

The Arab rentier state, with its current institutional capacity and governance framework, is ill-equipped to address the multiple challenges it faces.

Arab countries need to think beyond temporary fixes and address the root causes of endemic development challenges – such as youth unemployment, low labour productivity with high informality, and environmental fragility – which are not isolated from one another.

Natural resource endowments have been shaping Arab economies for decades, especially in the nine resource-rich net oil-exporters (the six Gulf Cooperation Council, GCC, countries and the three other members of OPEC). In these countries, high per capita rents in the form of government provision of subsidies, low tax rates and public sector employment have been a pillar of development policy since the 1950s.

Natural resource riches have also influenced the remaining Arab economies, which are oil-poor and non-oil exporting but which receive capital inflows from the resource-rich countries, especially via investment, remittances and tourism.

These rents and their spillover effects have thus played the lead role in promoting social and economic development over the past four decades across most Arab countries. But they have also cemented authoritarianism and, in some countries, directly or indirectly led to rising political instability and conflict.

The key question is whether the region’s development prospects can be separated from these resource rents – and if so, when and how?

In his keynote lecture at ERF’s 25th anniversary conference in March 2019, Paul Collier suggested two strategic development policy shifts that would allow this separation: capitalising on the demographic dividend; and reforming institutions.

In a column on MENA Generation 2030 posted on The Forum in April 2019, Khalid Abu-Ismail and Arthur Van Diesen discuss policies that would favour a productive economic transformation to capitalise on the region’s receding youth bulge.

Here, we focus on the more intricate challenge of reforming institutions. More specifically, what incentives would encourage Arab regimes to embark on difficult governance reforms? While this is clearly not an easy question to answer, Professor Collier suggests that declining rents per capita are key to establishing the case for the urgency for such reforms. Accordingly, we ask three questions:

- What would happen to per capita natural resource rents by 2030 if they continue on their post-2008 trends?

- What are the possible ramifications for oil-poor economies?

- And finally, do these projections imply a sense of urgency in terms of the need for political economy and institutional reform?

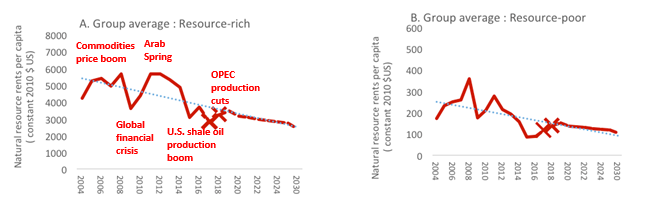

In an optimistic base-case scenario, by 2030, rents per capita are below half their 2008 level

Figures 1 (A) and (B) plot the average real natural resource rents per capita (in constant 2010 US dollars) for the two groups of Arab oil exporters and non-exporters over the period 2000-16. Based on the World Bank’s definition, total natural resources rents are the sum of oil rents, natural gas rents, coal rents (hard and soft), mineral rents and forest rents. The estimates of natural resources rents are calculated as the difference between the price of a commodity and the average cost of producing it.

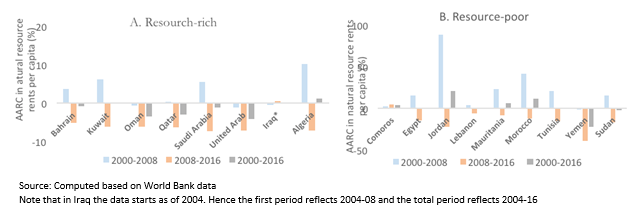

As shown, oil price drops after the global financial crisis, and particularly in 2014-15 following the growth in US shale oil production, suggest a post-2008 structural break in rents per capita, which had plunged to their lowest level since 2004. This post-2008 break is also revealed by the negative average annual rates of change in natural per capita resource rents for almost all the countries in Figure 2.

Building on these trends, our projected rents per capita in 2030 (depicted by the dotted line in Figure 1) could drop to $2,400, less than half of their 2008 level in oil-rich countries. The corresponding ratio for oil-poor countries is less than one third.

These results should ring alarm bells for all countries in the region, but especially for oil-rich countries with low rents per capita (such as Algeria and Bahrain, where rents per capita were already below $1,000 in 2016, compared with $15,000 and above for Kuwait and Qatar).

Also of concern is that these crude projections are very conservative in that they do not factor in the worst-case scenario where effects of rapidly rising rates of own natural resource consumption or declining reserves (such as the case of Algeria) are taken into account. In fact, they are based on an assumption that the recent rise in oil prices since 2016 has reversed the trend of falling rents per capita in 2017-18, which may not be the case.

To be sure, these results should be treated with caution since they are loaded with assumptions. What’s more, forecasts of oil prices (which we use as a basis for our projections of future rent per capita) are notoriously volatile. For example, a direct conflict between Iran and the United States may send oil prices soaring and may trigger a reversal of this trend (but it may also cause a major slowdown in the global economy). This is not taken into account in the base-case scenario.

Figure 1:

Real natural resource rents per capita across resource-rich and resource-poor Arab countries, 2000-16 and their projections 2017-30 (dashed part)

Source: Computed based on WDI and UN DESA population data.

The resource-rich Arab countries include Algeria, Bahrain, Iraq, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates.

The resource-poor Arab countries include Comoros, Egypt, Jordan, Lebanon, Mauritania, Morocco, Sudan, Tunisia and Yemen.

Note that for the projections in Figure 1, 2017-18 are estimates, while 2019 onwards are forecasts based on the World Bank forecasts of commodity prices published in March 2019.

Figure 2:

Average annual rate of change (AARC) in natural resource rents per capita

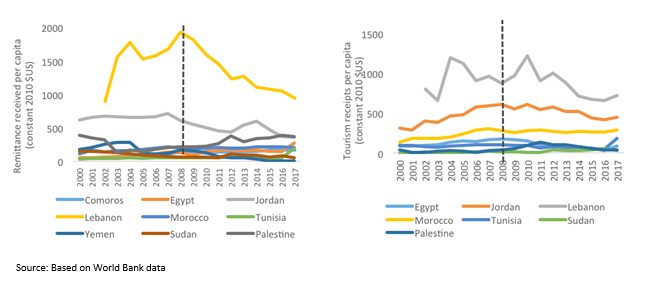

Meanwhile, remittances and tourism in resource-poor countries are not expected to fly high

Although the resource-poor economies have low levels of rents per capita, they are highly reliant on remittances and tourism inflows that are closely tied to natural resource returns. The economic booms in neighbouring oil-exporting countries have thus created spillovers in terms of increased remittances received from expatriates working there, increased investment opportunities and tourist visits, and, to a lesser extent, increased grants and assistance.

The exact opposite is anticipated in times of busts. Hence, the trends in remittances and tourism per capita across non-oil exporters are expected to coincide with those above for natural resource rents per capita (see Figure 3).

Figure 3:

Remittance and tourism receipts per capita in resource-poor Arab countries, 2000-17

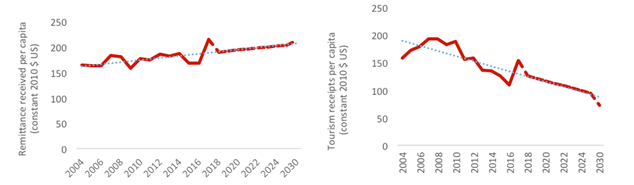

Such linkages are captured in Figures 4 (A) and (B) by plotting a linear trend projection. Guided by recent history, by 2030, per capita remittances could stagnate at their 2017 levels, while tourism receipts could decline by half (Figure 4). This is also a best-case scenario since remittances may actually decline more conspicuously with the expected rise in fiscal pressures in oil-rich economies and due to nationalization of employment.

Figure 4:

Remittances received and tourism receipts per capita, resource-poor Arab countries group average trendline projections (2018-30, dashed part)

Source: Computed based on WDI and UN DESA population data.

For remittances, the resource-poor Arab countries include Comoros, Egypt, Jordan, Lebanon, Morocco, Palestine, Sudan, Tunisia and Yemen; while for tourism, Comoros and Yemen are excluded due to data unavailability.

Policy implications

These numbers show that the lavish social contracts that have been a main pillar of regional development policies for the past four decades are on their way to becoming a thing of the past.

Although trends in oil prices underlying these projections are difficult to predict, these numbers should raise concern especially given reconstruction demands in some countries (Iraq, Libya, Syria and Yemen), high debt-to-GDP and debt service ratios (in most resource-poor, middle-income countries) and high and rising military expenditure (in most Arab countries, especially the resource-rich ones). All of this is expected to add to more downward pressures on rents per capita, thus directly affecting social expenditures.

The Arab rentier state, with its current institutional capacity and governance framework, is ill-equipped to address these multiple challenges (Abu-Ismail, 2019). Policy responses since 2010 have been offering either additional rents (in the GCC in 2011-13) and/or less space for real voice and accountability and other governance reforms (in resource-poor countries). These responses are an extension of the same policies that led to the uprisings.

Arab countries need to think beyond temporary fixes and address the root causes of endemic development challenges – such as youth unemployment, low labour productivity with high informality, and environmental fragility – which are not isolated from one another.

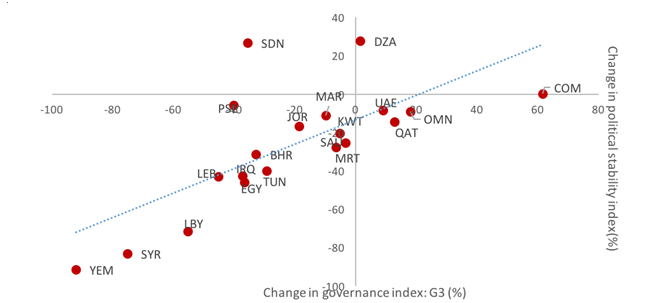

Addressing them depends, as Professor Collier noted, on the achievement of two strategic objectives: capitalising on the youth bulge (through structural transformation) and reforming institutions (which is a prerequisite for structural transformation). Failing that, Arab countries will remain trapped in a vicious cycle of low and deteriorating governance and rising political instability, as happened between 2000 and 2017 for most countries in the region (see Figure 5).

Figure 5:

Percentage change in governance and political stability indices, 2000-17

Source: Authors calculations based on World Bank Governance Indicators.

Note: Governance index calculated following Abu-Ismail et al (2016)

We conclude with few questions that would naturally arise from this chilling conclusion. To start with, the term ‘institutional reform’ itself needs to be unpacked. What kind of reforms exactly? Are some of them more urgent than others in some country contexts and why?

Which Arab countries are more likely to pioneer such reforms faster and why: those in the eye of the storm (resource-poor and resource-rich countries with large populations and rapidly dwindling per capita rents) or those on its periphery (resource-rich countries with small populations and rents per capita projected to last well beyond 2030 due to wealthy sovereign funds)?

Will the chill of the eroding rentier social contract scare the elites in the region and make them push to defeat all social movements asking for institutional reform? And does the global erosion of commitment to liberal democratic values (which is key to institutional reform) reduce the outside pressure on the region for reforms?

The answers to these questions could very well determine development prospects for Arab states from now until 2030 and even beyond.

Further reading

Abu-Ismail, Khalid (2019) ‘Beyond the Rentier State: Can Regionalism Work for Arab States?’, POMPES Studies 33, The Politics of Rentier State in the Gulf.

Abu-Ismail, Khalid, Aljaz Kuncic and Niranjan Sarangi (2016) ‘Governance Adjusted Human Development Index: The case for a broader index and its implications for Arab States’, ESCWA Technical Paper.

Selim, Hoda, and Chahir Zaki (2014) ‘The Institutional Curse of Natural Resources in the Arab World’, ERF Working Paper No. 890.

United Nations Economic and Social Commission for Western Asia (ESCWA) (2015). ‘Economic Growth, Employment and Poverty in Developing Economies: A focus on Arab Region’.

United Nations Economic and Social Commission for Western Asia (ESCWA) (2016) ‘Arab Development Outlook: Vision 2030’.

United Nations Economic and Social Commission for Western Asia (ESCWA) (2017) ‘Rethinking Fiscal Policy for the Arab Region’.

The authors are grateful to Salim Araji and Noha Mikkawy for comments on an earlier draft of this column.