In a nutshell

A country’s fiscal limit is the highest level of public debt that it can sustain before the risk of default becomes critical; oil-rich economies in MENA have ample fiscal space; but non-oil economies are already operating perilously close to their fiscal limits.

Countries with low fiscal space should prioritise revenue mobilisation to expand their fiscal buffers; this may require politically difficult measures, such as expanding tax coverage and improving compliance, as well as limiting spending commitments.

Oil exporters need to prepare for a world of lower or more volatile oil prices; building fiscal stabilisation mechanisms and fostering non-oil revenue sources through economic diversification are essential to preserve fiscal space in the long run.

Over the last decade, levels of public debt have risen steadily across the Middle East and North Africa (MENA). Countries like Egypt, Lebanon and Tunisia have been accumulating debt as they grapple with one shock after the other.

Since 2011, these nations have experienced widespread uprisings demanding political and economic reforms, and resulting in prolonged periods of political instability. The humanitarian and refugee crises created by the instability have had repercussions for neighbouring countries, which have experienced declines in tourism revenues and foreign direct investment, as well as deteriorating public finances.

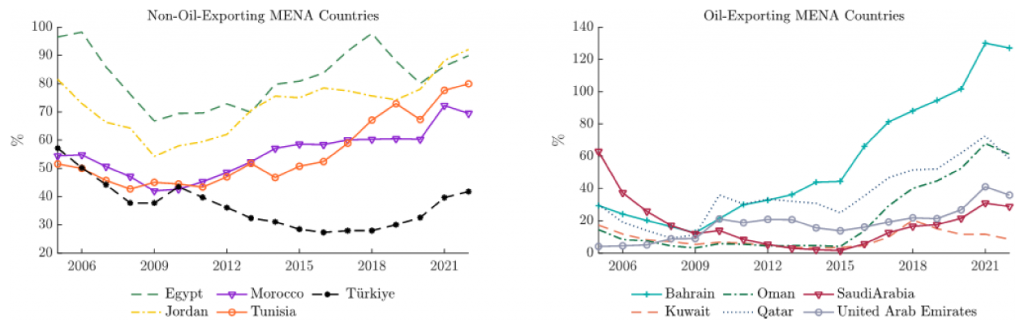

Even oil-exporting MENA nations, including those in the Gulf Cooperation Council, saw their fiscal balances deteriorate in 2014 following a sharp drop in oil prices. More recently, the Covid-19 pandemic struck the region at a time when several of its economies were already struggling to recover from protracted downturns and structural fragilities. As debt continues to mount (see Figure 1), there’s a growing conversation in the region – and it is not just happening in finance ministries. Economists, policy-makers and citizens are asking: how much debt is too much?

Figure 1: Government gross debt as a share of GDP

Measuring fiscal limits and debt sustainability

Much of the public debate relies on current debt-to-GDP ratios as a yardstick of sustainability. These are easy to measure and understand, and they often give a quick sense of whether the debt is manageable.

But a country’s ability to sustain debt depends not only on current debt levels but also on the government’s capacity to generate enough fiscal surpluses in the future to service the debt; a concept formalised in the notion of a state-dependent fiscal limit.

Several factors determine this capacity: tax revenues, government spending patterns, productivity trends and the volatility of key income sources such as oil revenues. So, the fiscal limit isn’t the same everywhere. And for some MENA economies, earlier work (Neaime and Gaysset, 2017; Sarangi and El-Ahmadieh, 2017; Khalladi, 2019) and my recent research (Yamout, 2024) show that it is shrinking fast.

In my analysis, I build a structural model, tailored to the economies of MENA, and calibrate it separately for oil-exporting and non-oil-exporting countries. The goal is to estimate each country’s fiscal limit – the highest level of debt that it can sustain before the risk of default becomes critical.

I find that oil-rich economies like Saudi Arabia and the United Arab Emirates (UAE) have ample fiscal space thanks to oil revenues that provide a buffer against fiscal shocks. But non-oil economies such as Egypt and Lebanon face more constrained fiscal positions and are already operating perilously close to their fiscal limits.

In Egypt, for example, my estimates show that the government’s fiscal limit stands at about 87% of GDP assuming a 5% probability of default. But Egypt’s actual debt in 2022 had already reached 88% of GDP, implying that the country has very limited room for issuing further debt without compromising its fiscal stability.

Lebanon’s position is even starker: with a debt-to-GDP ratio of over 250%, its fiscal space is deeply negative, and the ratio needs to be reduced to roughly a third of its current level. As such, there is a dire need for restructuring in Lebanon to bring the sovereign debt level below the estimated threshold.

Why is fiscal space so constrained in non-oil exporting economies? My analysis shows that low tax capacity, rising government transfers and vulnerability to productivity shocks all erode a country’s fiscal limit.

In non-oil exporting economies, the limited ability to raise taxes constrains revenues, while generous transfer programmes further strain budgets. For Egypt and Jordan, even modest negative shocks to productivity or higher-than-expected spending could push them into unsustainable territory.

The same applies to Tunisia, for which I estimate the fiscal space at about 43% of GDP. While this suggests some buffer, simulations show that shocks to government spending or productivity could cut Tunisia’s fiscal space by half. In a region where political instability and economic shocks are common, these vulnerabilities carry significant policy implications.

The picture looks quite different in oil-exporting economies. With oil revenues providing a buffer against default risk, countries like Saudi Arabia, Qatar and the UAE have fiscal limits that exceed 160% of GDP. But this fiscal buffer is precariously tied to volatile oil markets. In fact, simulations show that a sustained drop in oil revenues could sharply reduce fiscal space, underscoring the importance of economic diversification.

My research also explores how fiscal fundamentals, such as tax policy and transfer spending, can shift fiscal limits. Countries where transfers keep rising as a share of GDP face steeper declines in fiscal space.

Egypt and Jordan stand out. Egypt’s transfers, which average 11% of GDP, are not only large but have been growing at an average of 3% per year. If this trend keeps up, Egypt’s fiscal limit could fall below current debt levels even without a new crisis.

Jordan’s government transfers sit at 7.5% of GDP with an average annual growth rate of 2.6%. If this trend continues, Jordan’s fiscal space could also turn negative, raising serious sustainability concerns. Those findings echo concerns raised by Sarangi and El-Ahmadieh (2017), who caution that rising social spending without revenue reforms could undermine fiscal sustainability in the region.

What are the key takeaways for policy-makers?

- First, debt sustainability analysis must incorporate a dynamic fiscal limit, which is in essence shaped by revenues, spending, economic shocks and institutional factors.

- Second, countries with low fiscal space should prioritise revenue mobilisation to expand their fiscal buffer. This may require politically difficult measures, such as expanding tax coverage, reducing tax exemptions and improving compliance.

- Third, governments should be wary of persistent increases in transfers and recurrent spending. Limiting spending commitments and anchoring them to credible fiscal rules could help to maintain sustainability.

- Fourth, oil exporters need to prepare for a world of lower or more volatile oil prices. Building fiscal stabilisation mechanisms and fostering non-oil revenue sources are essential to preserve fiscal space in the long run.

- Finally, governments should explore policies to make fiscal space less sensitive to economic shocks. Here, countercyclical fiscal rules and stabilisation funds can mitigate the fiscal impact of downturns.

Looking ahead, the stakes are high. Climate shocks, geopolitical risks and global economic headwinds are already affecting MENA economies. Countries that build and protect their fiscal space today will be better equipped to weather future crises and to invest in inclusive and resilient growth. Those that don’t may find themselves trapped in a cycle of rising debt and mounting risks.

Further reading

Bi, H (2012) ‘Sovereign default risk premia, fiscal limits, and fiscal policy’, European Economic Review 56(3): 389-410.

Khalladi, HBH (2019) ‘Fiscal fatigue, public debt limits and fiscal space in some MENA countries’, Economics Bulletin 39(2): 1005–17.

Mahmah, AE, and ME Kandil (2019) ‘The balance between fiscal consolidation and non-oil growth: The case of the UAE’, Borsa Istanbul Review 19(1): 77-93.

Neaime, S, and I Gaysset (2017) ‘Sustainability of macroeconomic policies in selected MENA countries: Post financial and debt crises’, Research in International Business and Finance 40: 129-40.

Sarangi, N, and L El-Ahmadieh (2017) ‘Fiscal policy response to public debt in the Arab region’, Economic and Social Commission for Western Asia (ESCWA). Yamout, N (2024) ‘Fiscal limits in the MENA region: A structural analysis of debt sustainability’.