In a nutshell

While politically connected firms in Lebanon create more jobs than unconnected firms, the presence of such firms in a sector is correlated with lower aggregate job creation.

This finding is consistent with the hypothesis that unfair competition from politically connected firms hurts unconnected competitors so much that aggregate growth in the sector is affected negatively.

Pro-market competition policies would lead to more growth and job creation over time.

Firm-level political connections are widespread, and understanding how politicians influence the behaviour of firms is important. The economics literature on the role of political connections of firms has been growing.

Shleifer and Vishny (1994) show how politicians try to influence firms through subsidies while firms pay back to politicians through political support. Various studies have documented the effects of political connections on the value of firms (Fisman, 2001; Acemoglu et al, 2018) and the likelihood of fraud detection (Yu and Yu 2011). Others have investigated mechanisms of influence, such as bailouts (Faccio et al, 2006), access to finance (Khwaja and Mian, 2005) and procurement contracts (Goldman et al, 2013).

Diwan et al (2019) enhanced our understanding of the mechanisms used to privilege connected businesses and their possible impact on undermining the growth of firms in the Middle East. By exploiting an exogenous elections event in an identification strategy in a recent paper (Diwan and Haidar, 2019), we analysed whether political connections may affect employment decisions at the firm and sector levels in Lebanon.

Lebanon is a suitable country for this study. Part of political clientelism in Lebanon depends on the ability of politicians to find employment for their constituencies in both the public and private sectors (Corstange, 2016). Three quarters of university students surveyed by the Lebanese Center for Policy Studies (LCPS) thought that political connections were important to find jobs, and 20% said that they had used them (LCPS, 2013).

We used a unique large dataset, which includes all registered (formal) firms at the Lebanese Ministry of Finance (MoF) between 2005 and 2010. The database includes information about employment and output of an average of 122,242 firms per year. Among these firms, we were able to identify those with political connections using a three-step process:

- First, we matched the firms in our MoF dataset with more than 50 workers with firms identified in the Lebanese Commercial Register.

- Second, we drew up a list of all politicians and their main associates.

- Third, we identified firms as politically connected if at least one of their stakeholders (manager, board member or shareholder) is on that list.

Our method of identifying politically connected firms (PCFs) is closely related to Diwan et al (forthcoming).

This process allowed us to identify 497 PCFs in the MoF dataset. Overall, PCFs formed 42.7% of large firms (with more than 100 workers) and 72% of the large firms in the sectors in which they operated. On average, each PCF employed 225 workers, compared with an average of 90 employees in non-PCFs (NPCFs) in the 29 connected sectors.

As a group, the PCFs employed over 123,000 employees, which represented about 16% of the workers in the formal sector. The resulting database allowed us to analyse the micro-foundations of employment creation in Lebanon and to compare the performance of firms and sectors with and without political connections.

Our findings

Our first set of results concerns comparisons between firms. Compared with other countries, employment is concentrated more in larger firms in Lebanon. Large firms that employ 100 or more employees accounted for nearly half of total (formal) employment in Lebanon, a figure that is large by regional standards.

In addition, while small-scale activities provide the majority of jobs in the Middle East and North Africa region, the share of employment in firms with fewer than five employees is only 19.3% in Lebanon. This concentration of jobs in relatively large firms is also not explained by a lack of small firms – 87% of firms have fewer than five employees in Lebanon.

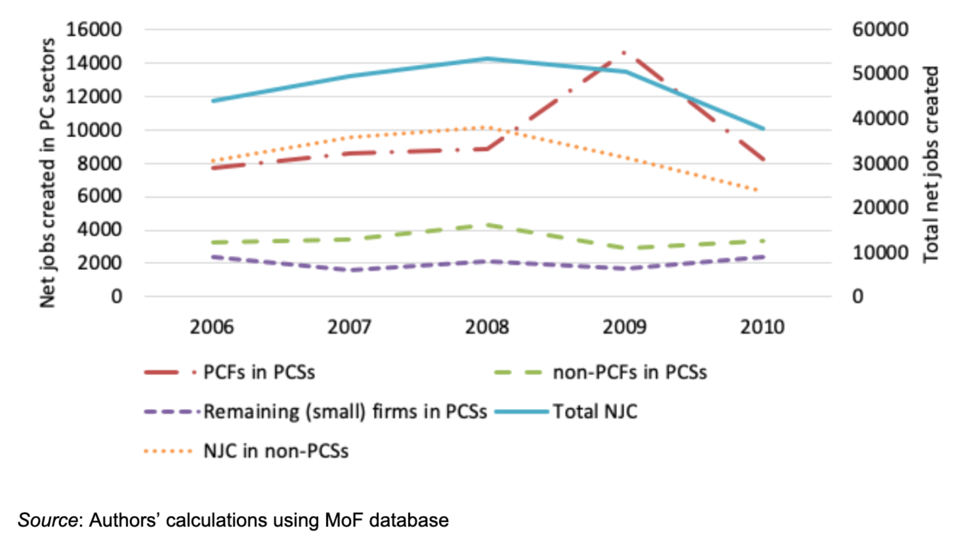

It is noteworthy that when it comes to job creation, it is the formal firms in our dataset, as opposed to the informal sector, that have been the main creator of new jobs in recent years. According to the International Labor Organization (2015), about 56,000 workers entered the market each year between 2005 and 2010. Firms in our database created between 40,000 and 50,000 new (formal) jobs per year, which is between 70% and 90% of all jobs created (Figure 1).

Figure 1: Aggregate net job creation in Lebanon

Source: Authors’ calculations using MoF database

The larger firms in Lebanon tended to pay higher wages, but without exhibiting better performance in terms of labour productivity (that is, output per worker) than smaller firms. However, once we looked at firms that were not politically connected, the more usual pattern of larger firms having higher output per worker prevailed. This result suggested that PCFs were possibly over-hiring among the constituents of their political patron in exchange of economic privileges (but which we do not observe).

Our results confirm that PCFs created more jobs, generated larger revenues and paid higher wages to their employees than comparable NPCFs (that is, firms in the same sector of activity and of similar age and size). The annual growth rate of employment in PCFs was, on average, 20.32% higher than annual growth rate of employment in NPCFs that operated within the same sector, controlling for size, age and number of PCFs in the sector.

In addition, compared with NPCFs, PCFs paid 16.29% higher wages per employee and enjoyed 26.87% more output per firm, while output per employee was 20.38% lower.

Do political connections cause over-hiring?

The tight correlation between political connectedness and job creation does not prove causality; other coherent explanations for this correlation are possible. In particular, it is possible that successful firms become connected and that they do better than non-connected firms not because of privileges they receive, but simply because they are better managed. We argue, using various pieces of evidence, including the 2009 parliamentary election, that in all likelihood, it is political connections that cause over-hiring, and not the other way around.

To investigate whether PCFs increase their employment creation around elections, we examined whether PCFs hired more than NPCFs around the 2009 parliamentary elections, compared with their behaviour during other years. We found that net job creation by PCFs was an additional 25.4% higher during 2009 than in 2006. However, the output of these firms did not rise in 2009 and, as a result, we observed a large deterioration in output per worker of about 23.3%. Such effects were not present in other (non-election) years.

The impact of political connections on job growth

In the second part of our empirical analysis, we investigated the job growth implications of political connections. The trend that NPCFs created fewer jobs in sectors where PCFs operate is plausible; due to limited market size, they were likely to shrink when connected firms expand. The question, however, is whether a connected sector as a whole ends up growing relatively less, and creating relatively fewer jobs, than an otherwise similar but unconnected sector. To answer this question, we compared sector performance as a function of the presence of PCFs in a sector.

At the sector level, we found that politically connected sectors grew less and created fewer jobs. There are several possible explanations for this correlation. The hypothesis we favour is that unfair competition reduces economic activity by reducing the incentives of both the industry leader and its distant followers to innovate (following the thesis of Aghion et al, 2001, 2009).

But there are other possibilities. It could also be that connected firms receive privileges mostly in sectors that are rent-filled and have low growth potential. It is also possible that since PCFs are likely to have more access to capital, they are more likely to produce in more capital-intensive ways. As their market shares improve, jobs get destroyed as the sector becomes more capital intensive.

We used various pieces of evidence – most centrally, the circumstances observed during the election in 2009 – to argue that our preferred competition hypothesis is most likely to be the best description of reality. In particular, we found that politically connected sectors had lower output per worker and paid higher wages than non-connected sectors, and that while all sectors grew less during the 2009 election year, politically connected sectors grew even less than non-connected sectors.

All these results support the unfair competition hypothesis, and contradict elements of the other possible hypotheses. In particular, we reject the hypothesis that PCFs tend to be more present in low-growth sectors to start with because the result noted above holds even after the addition of a battery of sector controls in all the models.

We also disprove the capital intensity hypothesis because we find that connected sectors shrink in terms of output, jobs and labour productivity. Thus, the loss of jobs in the connected sectors is not due to improved labour productivity. The conclusion, therefore, is that although PCFs over-hire, the disincentives to innovate and invest created by unfair competition in the sectors in which they operate lead to less job creation compared with non-connected sectors.

It would be tricky to draw policy implications from these results. At one level, they suggest that pro-market competition policies would lead to more growth and job creation over time, along the lines of Aghion et al (2001).

At a deeper level, however, a more competitive economic structure would not support the current oligarchic political equilibrium, and would possibly lead to political chaos unless a different political system were in place in the country. Nevertheless, a better understanding of state-business relations can support citizens with more information to influence changes that can improve the overall economic and political environment.

Further reading

Acemoglu, D, T Hassan and A Tahoun (2018) ’The Power of the Street: Evidence from Egypt’s Arab Spring’, The Review of Financial Studies 31(1): 1-42

Aghion, P, C Harris, P Howitt and J Vickers (2001) ‘Competition, Imitation and Growth with Step-by-Step Innovation’, Review of Economic Studies 68(3): 467-92.

Corstange, D (2016) The Price of a Vote in the Middle East: Clientelism and Communal Politics in Lebanon and Yemen, Cambridge University Press.

Faccio, M, R Masulis and J McConnell (2006) ’Political Connections and Corporate Bailouts’, Journal of Finance 61(6): 2597-2635.

Fisman, R (2001) ’Estimating the Value of Political Connections’, American Economic Review 91(4): 1095-1102.

Goldman, E, J Rocholl and J So (2013) ’Politically Connected Boards of Directors and The Allocation of Procurement Contracts’, Review of Finance 17(5): 1617-48.

Diwan, I, and JI Haidar (2019) ’Political Connections Reduce Job Creation’, Harvard University, mimeo.

Diwan, I, P Keefer and M Schiffbauer (forthcoming) ’Pyramid Capitalism: Political Connections, Regulation, and Firm Productivity in Egypt’, Review of International Organizations.

Diwan, I, A Malik and I Atiyas (eds) (2019) Crony Capitalism in the Middle East: Business and Politics from Liberalization to the Arab Spring, Oxford University Press.

International Labor Organization (2015) Towards Decent Work in Lebanon: Issues and Challenges in Light of the Syrian Refugee Crisis.

Khwaja, A, and A Mian (2005) ’Do Lenders Favor Politically Connected Firms? Rent Provision in an Emerging Financial Market’, Quarterly Journal of Economics 120: 1371-1411.

Lebanese Center for Policy Studies (2013) Finding a Job in Lebanon: The Hidden Cost of Using Personal Connections.

Shleifer, A, and R Vishny (1994) ’Politicians and Firms’, Quarterly Journal of Economics 109(4): 995-1025.

Yu, F, and X Yu (2012) ’Corporate Lobbying and Fraud Detection’, Journal of Financial and Quantitative Analysis 46(06): 1865-91.

This column was first published at Vox.