In a nutshell

Evidence from Egyptian microenterprises shows that three types of capital assistance – cash grants, in-kind grants and loans – seem to help the same type of people (primarily women with education); the type of support is of secondary importance.

In-kind grants increase income through increases in self-employment earnings, while the loan and cash arms have greater levels of wage income.

Improved targeting and new programme design can go hand in hand towards improving outcomes for all.

Evaluations of grant programmes have shown that the return to capital is high in developing countries (de Mel et al, 2008, Blattman et al, 2016), but the impacts of loans have only been modest (Banerjee 2015). Does this mean that entities that want to help microenterprises should focus all their efforts on providing grants?

This is difficult to answer because comparing estimates from separate evaluations requires dealing with all the factors that were different across the studies, including differences in study populations and broader economic environments. It is also not always obvious how different types of capital support will affect firms, or which are best for supporting the growth of microenterprises.

Empirically comparing grants and loans

To answer this, we implement an experiment in Egypt that compares loans and grants while keeping the sample and economic environment the same (Crépon et al, 2021). We collaborate with the Sawiris Foundation and consider three different types of support: cash grants, in-kind grants and loans.

- Cash grants: While a cash grant is the most liquid and hence easiest to allocate towards the highest return activity, it is also the easiest to allocate to other things, like consumption instead of investment. This may be due to a lack of self-control or family pressure to share those funds.

- In-kind grants: In-kind grants have the potential to mitigate these concerns due to the costs of liquidating the assets, but it also makes it more difficult for businesses to pivot to higher return opportunities that may arise (Fafchamps et al, 2014).

- Loans: Standard loans have several drawbacks, including needing to pay back the capital with interest, usually on a monthly basis. This could limit investment choices to things that have short-run and low-risk returns (Field et al, 2013). On the other hand, some make the case that forcing businesses to make monthly payments on a loan leads them to develop important discipline that improves the businesses’ ability to be streamlined and efficient (Armendáriz and Morduch, 2010).

Targeting business loan applicants in Egypt

To empirically assess which capital support programme has the best impact on microenterprises, we ran an experiment with 3,294 individuals who applied for a loan to start a new business, or to grow an existing one, in poor rural areas in southern Egypt. Conditional on being approved for the loan, we randomise individuals into one of four groups:

- A group that receives the (subsidised) loan they applied for.

- A group that receives the amount of the loan as a cash grant.

- A group that receives the items that they listed on their loan application as an in-kind grant.

- A control group that receives no capital support.

By randomising after loan approval, we are able to keep the selection of individuals constant across groups and study the impacts of grants and loans in the same economic environment – allowing us to identify how the different contract types affect enterprise performance. Follow-up data 16 months after randomisation allows us to compare the impacts of the three capital assistance programmes.

Grants and loans increase women’s incomes similarly

Our first result is that each programme had large impacts on women’s labour earnings, but no statistically significant impact on men. Strikingly, the average impacts are very similar for all three programmes. For women, the average income in the control group is 126 Egyptian pounds (EGP), compared to 220 EGP, 244 EGP and 245 EGP in the microcredit, in-kind grant and cash-grant groups, respectively.

This is surprising given that loans need to be repaid but grants don’t. For men, the incomes are much higher but also much more dispersed so that the differences between the groups have very wide confidence intervals.

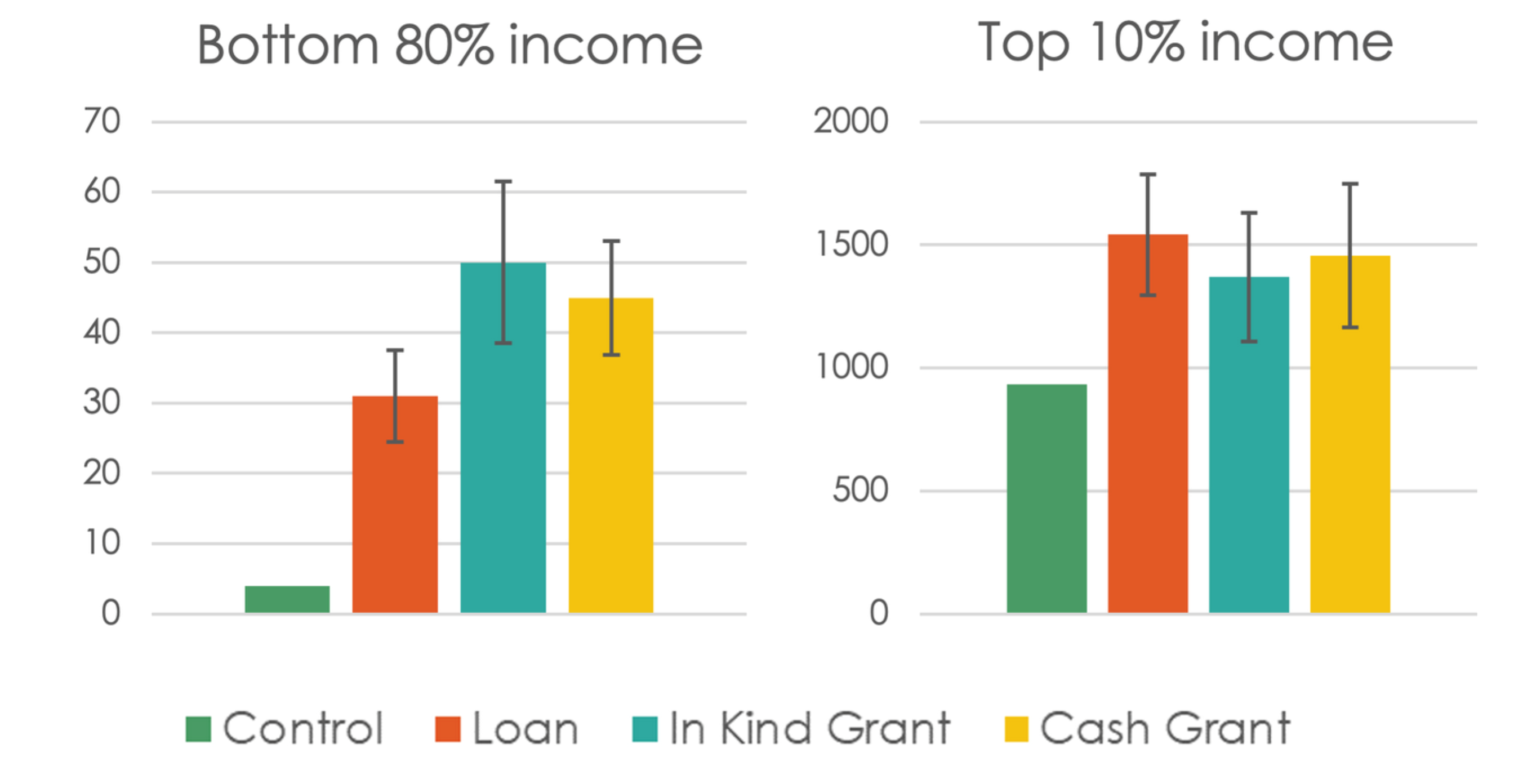

Figure 1: Labour income for each treatment, by gender

Note: Income in Egyptian pounds on the vertical axis with 95% confidence intervals

Impacts are concentrated among certain recipients

Our second result is that the positive impacts on income are concentrated at the top of the distribution of income 16 months after disbursement, with no effects on income for the rest of the sample. This is in line with vital work by Meager (2020) that shows this relationship holds in microcredit. We find that it is shared by all three types of capital assistance: cash grants, in-kind grants and loans.

Figure 2: Labour income for women, by outcome levels

Note: Income in Egyptian pounds on the vertical axis with 95% confidence intervals

We are able to reject that quantile treatment effects (QTEs) at the top of the distribution are the same as those at the bottom of the distribution. This means that there is important heterogeneity in QTEs within a treatment arm. On the other hand, we cannot reject that QTEs at the top of the distribution are equal across treatment arms.

In other words, the set of people who benefit from loans are doing about as well as the set of people who benefit from cash and in-kind grants. This reveals that the differences in impacts generated by the three capital assistance programmes are not primarily driven by the differences between the three programmes, but instead by the individuals who are participating in the study.

We further show that the baseline characteristics of those that are at the top of the distribution in each group are equivalent. This means that the same type of people are succeeding with each type of support and not that the different programmes work better for different types of people (at least not in a way we can identify from the data we collect). This result also extends to the bottom of the distribution where none of these programmes are enough to help them.

Programme design can still affect outcomes

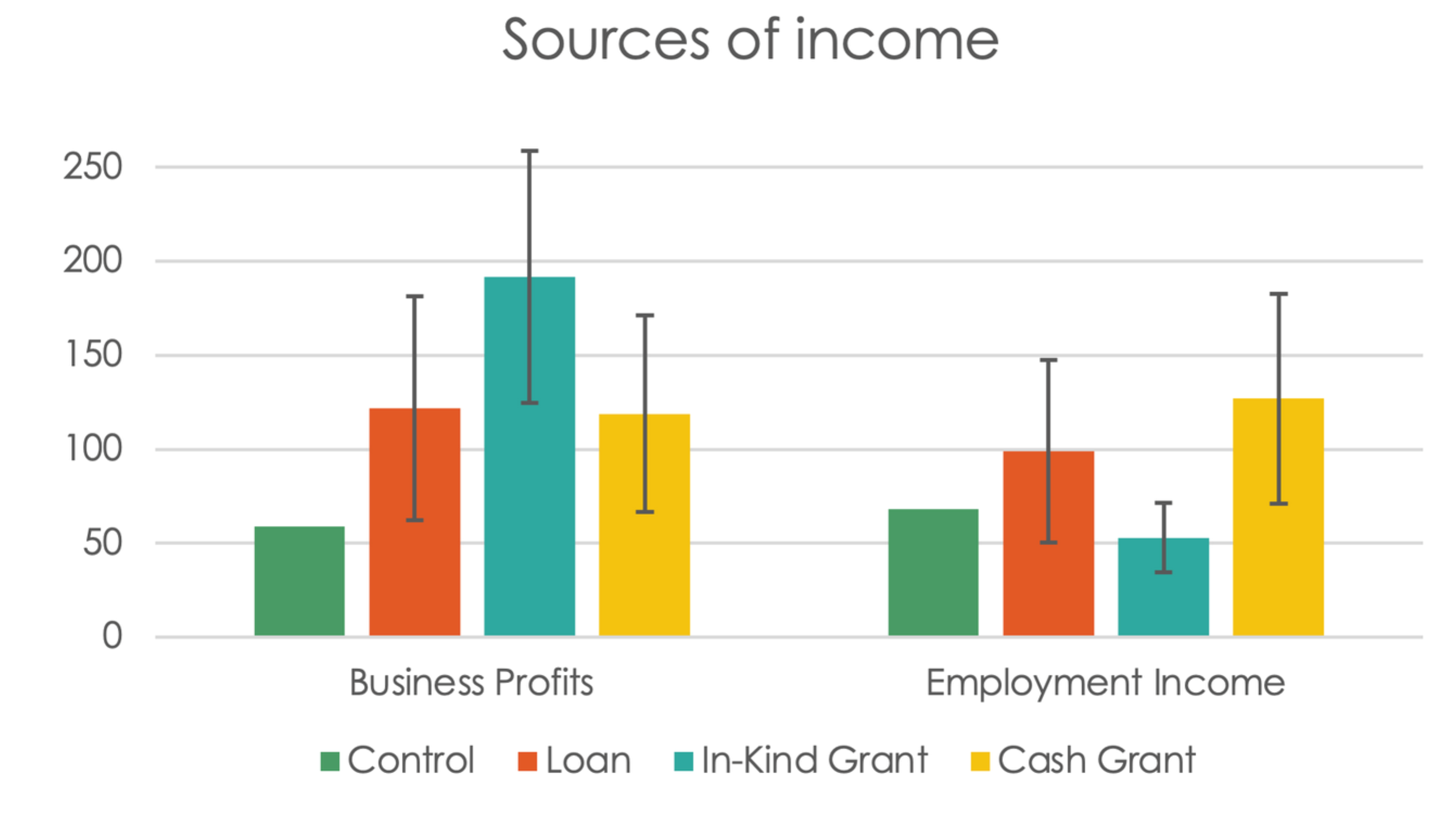

While all three programmes led to similar impacts on total labour income, it would be incorrect to conclude that programme design doesn’t matter. We find that in-kind grants increase income through increases in self-employment earnings, while the loan and cash arms have greater levels of wage income.

This shows that participants respond to the programmes by using the support they get to maximise their income given their respective programme constraints. The constraints affected participant choices but not the final outcome, similar to what is found in research on conditional versus unconditional cash transfers.

Figure 3: Sources of labour income for women

Note: Income in Egyptian pounds on the vertical axis with 95% confidence intervals

What works best and for whom?

Our results suggest that our focus on finding ‘what works best’ is incomplete. Instead, we should be focused on identifying ‘what works best and for whom?’

In our study, all three types of capital assistance seem to help the same type of people (primarily women with education) and the type of support was of secondary importance. This shows that finding ways to identify people who benefit from existing programmes more effectively is important.

At the same time, there were many who did not benefit from any of the interventions and so identifying new programmes that may work for them is also a necessary undertaking. Improved targeting and new programme design can go hand in hand towards improving outcomes for all. Recent work that uses machine-learning techniques to predict impacts better may be one fruitful path for future research in this area.

Further reading

Armendáriz, B, and J Morduch (2010) The economics of microfinance, MIT Press.

Banerjee, A, D Karlan and J Zinman (2015) ‘Six randomized evaluations of microcredit: Introduction and further steps’, American Economic Journal: Applied Economics 7: 1-21.

Blattman, C, EP Green, J Jamison, MC Lehmann and J Annan (2016) ‘The returns to microenterprise support among the ultrapoor: A field experiment in postwar Uganda’, American Economic Journal: Applied Economics 8(2): 35-64.

Crépon, B, M El-Komi and A Osman (2021) ‘Is It Who You Are or What You Get? Comparing the Impacts of Loans and Grants for Microenterprise Development‘, Working Paper.

De Mel, S, D McKenzie and C Woodruff (2008) ‘Returns to capital in microenterprises: evidence from a field experiment’, Quarterly Journal of Economics 123: 1329-72

Fafchamps, M, D McKenzie, S Quinn and C Woodruff (2014) ‘Microenterprise growth and the flypaper effect: Evidence from a randomized experiment in Ghana’, Journal of Development Economics 106: 211-26.

Field, E, R Pande, J Papp and N Rigol (2013) ‘Does the classic microfinance model discourage entrepreneurship among the poor? Experimental evidence from India’, American Economic Review 103: 2196-2226.

Meager, R (2019) ‘Understanding the average impact of microcredit expansions: A Bayesian hierarchical analysis of seven randomized experiments’, American Economic Journal: Applied Economics 11(1): 57-91.

This column was originally published at VoxDev: see the original version here.