In a nutshell

The dynamics of innovation in Tunisia are vibrant and varied: innovation per se does not seem to be the main constraint on diversification, but rather the sustainability and consolidation of such innovations, which has implications for the focus and efficacy of industrial policy.

Tunisia’s experience suggests that industrial policy choice is not between ‘horizontal’ and ‘vertical’ policies: most successful cases in terms of diversification and upgrading are supported by an appropriate combination of both types of policies.

Tunisia’s experience shows limited success for industrial policy interventions that use subsidies as the main instrument: subsidies tend to be captured and get mired in rent-seeking, slow and ineffective bureaucratic processes.

The global financial crisis of the late 2000s had the merit of reviving interest in industrial policy. It is not unreasonable to believe that the pandemic and the recession will also indicate its value at the core of the post-crisis strategies.

These crises also have the merit of demonstrating that the market mechanism is not always efficient either in the allocation of resources across sectors or in the choice of techniques, and that without decisive government intervention, the market economies of the United States and Europe may have collapsed (Stiglitz et al, 2013).

In the context of the Middle East and North Africa, despite recent attention to industrial policy (Atiyas et al, 2015) research has been limited and often based on relatively aggregate data and approaches, without looking closely at the links with diversification.

In the case of Tunisia, it has been generally recognised that openness and export promotion policies established since the early 1970s succeeded in allowing the country to achieve significant diversification and export growth, especially in low-technology manufacturing. Until recently, the general wisdom has been that the country has achieved limited success in moving up the technological ladder, increasing the sophistication of exports.

In a recent study (Ghali and Nabli, 2020), we show that this view is not warranted. Extensive diversification and sophistication have taken place over the last couple of decades, and more significantly, during the most recent period. Tunisian industry has been remarkably resilient to the political upheavals that have rocked the country.

To do so, we highlight the successes and failures of the process of diversification and investigate the role of both the ‘horizontal’ and ‘vertical’ policies pursued in Tunisia. We focus on the ‘how’ issue and explore whether and how specific policies are successful or not in meeting their objectives. Most importantly, we present a novel approach to study the dynamics of diversification and try to identify the basic reasons behind its success or failure.

Aggregate trends in export diversification and sophistication in Tunisia

To study export diversification and sophistication in Tunisia, we use a data set on exports for the period 1995-2017, which is disaggregated at the 11 digits using the HSC (Harmonized System Classification), and classify products into six different groupings. The primary and natural resource-based products are classified into three standard groups, according to their nature:

- Food products

- Fuels, oils and residuals

- Minerals, metals and products

The remaining products are manufacturing exports, classified into three groups, according to technological content and labour skills using the 6-digits level classification by UNCTAD:

- Manufactured products with low technology intensity (LTM)

- Manufactured products with medium technology intensity (MTM)

- Manufactured and semi-finished products with high technology intensity (HTM)

Total exports expressed in US dollars (at 2015 prices) have increased by more than 80% over the whole period 1995-2017, growing from around US$8 billion in 1995 to US$14.5 billion in 2017.

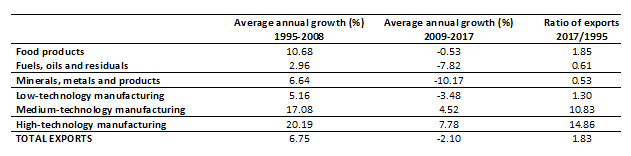

But the dynamics of growth varied considerably across product categories and sub-periods, with the onset of the Great Recession in the late 2000s as a significant disruption. Before the recession, growth of total exports was strong at 6.75% per year, even though it was weaker for petroleum products and low technology manufacturing. It was notable that medium and high technology exports were growing rapidly at double digits (see Table 1).

The trend changed dramatically after 2008, with exports of primary and resource-based products turning negative, mostly due to the disruption of the mining and transformation of phosphate and the depletion of oil and gas reserves.

The trend observed before 2008 became much stronger afterwards for manufactured products, with negative growth of traditional exports of manufactures, but continued strong growth of medium and higher technology intensity manufactures.

The most noteworthy dynamics are found in the almost 11-fold increase between 1995 and 2017 in medium technology exports (from US$0.442 billion to US$4.8 billion), and the 15-fold increase in the value of exports of high technology manufactures (from US$0.127 billion to US$1.9 billion).

Table 1: Growth of Tunisian exports by category of products, based on values expressed in US dollars 2015 prices, 1995-2017

Note: The values of exports in US dollars are calculated using figures in Tunisian dinars to which we apply the average annual exchange rate, deflating by the US import prices (base year 2015) by category of products, from the Bureau of Labor Statistics.

Dynamics of export diversification and sophistication in manufacturing

By reviewing the dynamics of growth of exports, evaluated in US dollars at 2015 prices, we were able to distinguish four types of products:

- Products that we consider as ‘mature exports’: they have been exported consistently and in significant amounts throughout the period (at least US$1 million per year, in at least 20 out of the 23 years from 1995 to 2017), and which reached at least US$100 million by the end of the period.

- Products that we call ‘emerging exports’: they have been exported in significant amounts (greater than US$1 million per year) for at least 10 years (out of 23), and whose exports continued to grow during the most recent period (2009-2017), and remained greater than US$1 Million during the most recent years.

- Products that we call ‘stalled growth exports’: they have been present as significant exports (US$1 million per year) for at least 10 out of 23 years, but whose exports were declining during the most recent period. These products were not able to sustain their growth dynamics.

- Products that we designate as ‘episodic exports’: they appear and disappear as exports, and are never sustained for any length of period.

Regarding the manufacturing exports, the number of mature products, which constitute the bulk of exports in all categories, remained small in all categories, 21 products out of a total of 863 manufacturing products. But there has been also lots of innovation and experimentation in all export categories, with varying degrees of success.

Many products (130) are ‘emerging’ and growing steadily, while others (164) failed to sustain growth. Still more striking is the large number of products that are exported only episodically for a few years, and then exit. There have been rich dynamics taking place.

Tunisian exports of primary and natural-resource-based products are highly concentrated in eight mature products: two foods (olive oil and dates), two fuels, and four phosphates and derivative chemicals. During the period 2007-09, the eight mature products accounted for 74% of total exports of primary and resource-based products.

While there have been limited attempts at diversification and innovation in the petroleum and minerals sectors, we find many emerging (20) and stalled (40) growth products in the foods sector. But these attempts seem to have little success as the volume of these exports remained small, and those stalled are more important than the ‘emerging’ growth products. The process of diversification in the minerals, metals and products sector has been weaker.

A significantly larger number of products (measured at the 4-digit level) has been exported ‘episodically’, with varying degrees of success. This pool is much larger than the one from which emerged ‘mature’, ‘emerging’ and ‘stalled’ products. This reflects a very dynamic experimentation process, and there does not seem to be any underlying industrial policies that helped this process.

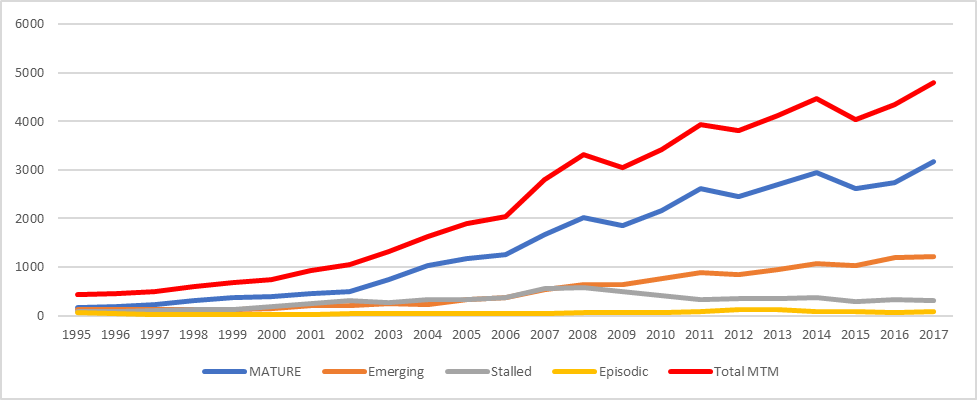

The analysis of manufacturing exports by technology category and type of growth dynamics reveals that for the medium technology exports (MTM), ‘mature’ and ‘emerging’ exports display the same dynamics (see Figure 1). The bulk of the ‘mature’ exports is concentrated in six products, which have become mature and expanded steadily.

But there has been a lot of new diversification and experimentation. We identified 58 products as ‘emerging’ and growing rapidly, even after the great recession. But many other products’ export growth has either stalled or even collapsed (43 products). There are many MTM products (88) whose export has been episodic and remained small throughout the period.

Figure 1: Medium technology manufactures (MTM) exports according to the type of growth dynamics (values in millions of USD in 2015 prices)

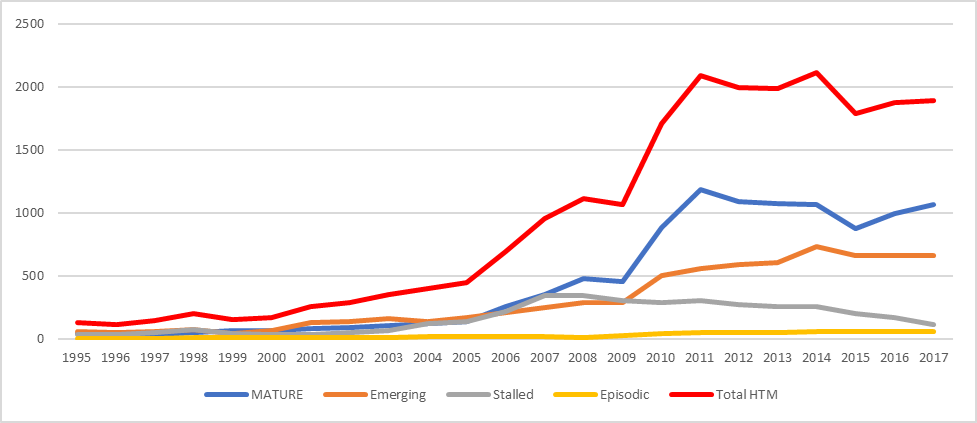

Like in the case of medium-technology products, the growth dynamics of high-technology products (HTM) for ‘mature’ and ‘emerging’ exports are remarkably similar (see Figure 2). A few products (4) are mature exports and constitute the bulk of these exports, growing steadily and reaching a high volume. But many other products (21) have also been growing in a sustained way and could mature over time. On the other hand, many other products have seen their growth stalled (11) or have been exported only ‘episodically’ (24).

Figure 2: High technology manufactures (HTM) exports according to the type of growth dynamics (values in millions of USD in 2015 prices)

Policy recommendations

Based on the detailed review and analysis of the Tunisian experience over 23 years in export diversification and the role of industrial policy (Ghali and Nabli, 2020), we are able to draw a few important conclusions that have significant policy relevance.

First, we have found limited or no successes in diversification absent either horizontal or vertical or both types of policies. For activities where no explicit and well-designed export diversification policies were attempted, no significant diversification took place. Some kind of industrial policies supported almost all cases of successful diversification.

Second, the greatest successes of industrial policy were seldom based on attempts at picking winners. They typically built on emerging dynamism and activities and tried to support their expansion. These activities tend to be consistent with comparative advantage and had a clear potential for success. The most effective support is through helping building partnerships, attracting foreign direct investment and providing technological and technical support. It tries to deal with the ‘market failures’ that hinder the diversification process.

Third, we have identified cases where only ‘horizontal’ policies or only ‘vertical’ policies were successful. The ‘offshore’ system of incentives to support manufacturing since the early 1970s is broad-based and did not focus on any specific activity. It was successful in launching the process of diversification into low-technology exports for at least two decades. Targeted policies such as support for diversification of olive oil exports into higher value-added packaging or dates were also successful when building on natural comparative advantage.

Fourth, the Tunisian experience suggests that industrial policy’s choice is not between horizontal and vertical policies. The most successful cases in terms of diversification and upgrading are supported by an appropriate combination of both types of policies. While horizontal policies create the appropriate environment and comprehensive set of incentives, targeted sectoral policies support the growth and expansion of specific products and industries. This was the case for the mechanical, electric, and electronics sector with its auto-components and non-auto components activities.

Fifth, the Tunisian experience shows limited success for industrial policy interventions that use subsidies as the main instrument. Subsidies tend to be captured and get mired into rent-seeking, slow, and ineffective bureaucratic processes.

Further reading

Aghion, Philippe, Jing Cai, Mathias Dewatripont, Luosha Du, Ann Harrison and Patrick Legros (2015) ‘Industrial Policy and Competition’, American Economic Journal: Macroeconomics 7(4): 1-32.

Aiginger, Karl, and Dani Rodrik (2020) ‘Rebirth of Industrial Policy and an Agenda for the Twenty-First Century’, Journal of Industry, Competition and Trade.

Atiyas, Izak, Ahmed Galal and Hoda Selim (2015) Structural Transformation and Industrial Policy, Volume I: A Comparative Analysis of Egypt, Morocco, Tunisia and Turkey, FEMIP, European Investment Bank.

Diop, Ndiamé, and Sofiane Ghali (2012) ‘Are Jordan and Tunisia’s Exports Becoming More Technologically Sophisticated? Analysis Using Highly Disaggregated Export Databases’, World Bank Middle East and North Africa Working Paper Series No. 54.

Ghali, Sofiane, and Mustapha K. Nabli (2020) ‘Export diversification and sophistication and industrial policy in Tunisia’, ERF Working Paper Series No. 1415.

Stiglitz, Joseph E., Justin Yifu Lin and Célestin Monga, 2013. ‘The Rejuvenation of Industrial Policy’, World Bank Policy Research Working Paper 6628, September 2013.