In a nutshell

Public sector reforms, including privatisation and a national taxation system, can reduce a country’s degree of dependency on natural resources.

National taxation can be an effective policy to reduce resource revenue volatility and strengthen the accountability of governance, which in turn will reduce dependency on natural resources.

It is not only economic factors but also non-economic factors of institutional quality and human development that can reduce natural resource dependency in MENA countries.

Natural resource dependency refers to a high proportion of natural resource rents in the GDP of a country. Such countries derive a high share of fiscal revenue from the natural resources-related sectors – a share that in total amounts to more than four trillion US dollars annually or 7% of global GDP (Mishrif and Al Balushi, 2018).

Abundance in natural resources used to be thought of as a source of development. Walter Rostow (1990), for example, presented a number of countries such as Australia, the United States and Britain that went from underdeveloped to industrial developed economies because of the size and variety of their natural resources.

But this view has been challenged by those pointing out the disadvantages of dependence on natural resources. For example, many resource-rich countries have experienced low life quality, despite the variety of natural resources such as oil, diamond and other minerals.

It is well known from research that natural resource dependency, in the long term, has a negative impact on economic growth (Frankel, 2012; Van der Ploeg, 2011; Venables, 2016). This phenomenon is labelled ‘the paradox of plenty’ or the ‘resource curse’.

The curse refers to a negative correlation between natural resource dependence and economic growth. This curse is transmitted to the economy in different ways, mainly through macroeconomic channels: the ‘Dutch disease’, political economy, corruption, rent-seeking, less accountability and democracy, and conflict or civil war (Badeeb et al, 2017; Boutilier, 2017).

Whereas the negative impact of natural resource dependency is observed in many resource-rich countries, average growth rates in those countries are slower than poor resource countries (Badeeb et al, 2017; Smith, 2015).

The effect of natural resource dependency

Political and economic theories suggest additional challenges due to dependency on natural resource revenues, which can be highlighted as the political and economic aspects of the resource curse.

Political theory suggests that natural resources distort politicians’ behaviour and those who come to power. The windfall revenues from resource rents may motivate politicians either to seize power through coercive strategies or to constrict electoral participation. Carreri and Dube (2017) empirically test for this effect and find that natural resources undermine democracy by distorting elections.

Natural resource-rich countries that have a high degree of dependency on resource rents often experience lower economic growth due to a reduction in accountability (Cabrales and Hauk, 2011; Collier, 2010; McGuirk, 2013).

Accountability has been widely explored as a necessary condition for development (Collier, 2010; Collier and Hoeffler, 2009; McGuirk, 2013). Studies find that considerable revenue from natural resource rents reduces governments’ need to tax their citizens, and that low tax populations may demand less accountability (Cabrales and Hauk, 2011; Jensen and Wantchekon, 2004; Ross, 2001). As a result, and as Collier and Hoeffler (2009) find, a reduction in accountability leads to lower economic growth.

Economically, the negative long-term economic growth of natural resources is linked to Dutch disease and the volatility of commodity prices. Volatility in commodity prices, which makes countries vulnerable to external shocks, represents a major threat to macroeconomic stability. This leads to higher volatility in public revenue.

Ghura and Pattillo (2012) find that instability in fiscal revenue causes pro-cyclical government spending, which leads to further volatility in public spending. This impedes the core of state development and reduces growth (Frankel, 2012; Nabli and Arezki, 2012).

Economic diversification to reduce natural resource dependency

Muhamad et al (2021) investigate the reduction of natural resource dependency, including in a number of Middle East and North Africa (MENA) countries. Dependency can be reduced through economic diversification. While this can take place in every sector of the economy, diversification as a long-term solution to reduce dependency on natural resources can take place through both private and public sector development.

The public sector can be developed to lead diversification either through privatisation of public services, or through development of a national taxation system that reduces government dependency on revenue from natural resources.

Muhamad et al (2021) use panel data for 110 countries for the period 1990-2017 to estimate the relationship between private sector development, public sector reforms, taxation systems and dependency on natural resources. They show the significant contribution of public sector reforms across the privatisation process in reducing the degree of dependency on natural resources.

The findings confirm the importance of institutions in the progress of privatisation in countries that are highly vulnerable to market price volatility. An essential result is that natural resource rents might support privatisation only in those countries that have quality institutions. Thus, the more developed institutional environments moderate the positive effect of natural resource rents on privatisation.

In an earlier study, Muhamad et al (2020) examine the determinants of private sector development in resource-rich countries. Their findings show that natural resource rents can foster the development of the private sector.

Most importantly, they observe that the speed of adjustment towards the optimal level of development of the private sector is faster in oil and gas exporting countries. Accordingly, among the MENA countries, Iran, Egypt and Algeria are the most rapidly adjusting countries in using natural resource rents to finance development of the private sector.

This result supports the finding of an earlier empirical investigation (Cammett et al, 2019), which finds that the large oil producing countries of the Gulf Cooperation Council (GCC) defeated a number of aspects of the resource curse including private sector development. The authors believe that authoritarian rulers adjust their policies in favour of the private sector to strengthen their powers.

Since 2000, a number of MENA countries have been experiencing a new era of market-oriented economy including privatisation, bank regulation and financial institutions. According to Lemonakis et al (2015), this has resulted in a significant increase in the size of the economy, expansion of the financial sector and improved efficiency of public banks as well as corporate governance especially in the GCC countries. The study reports that Oman, Algeria and Egypt have had the fastest privatisation among the MENA countries.

In addition to public sector reform, the development of a national taxation system is examined by Muhamad et al (2021). The significant variables affecting the level of taxation in resource-dependent countries are governance, the level of privatisation, dependency on natural resources and the tax capacity of the country.

High resource-dependent countries tend to reduce the vulnerability of their revenue through diversifying sources. As such, tax capacity contributes to better performance in revenue diversification. While it may be true that the strength of a tax system is a sign of overall governance capability, the impact of natural resources on taxation might vary with the level of governance and its effectiveness.

The economic diversification strategy of some countries, mainly in infrastructure and financial development, is critical in driving further economic development and less dependency on natural resources. The drop in commodity prices, especially during the oil shock of 2014, made direct effects on MENA countries through trade and indirect effects through weakening investment in their economy.

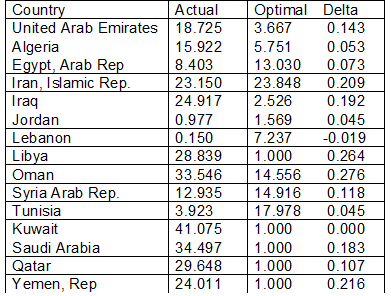

As concluded in the study by Muhamad et al (2021) and presented in Table 1, a number of large oil exporters are among the fast adjustment group, including Iraq, Saudi Arabia, the United Arab Emirates and Qatar. Reduction in the gap between actual and optimal dependency varies across countries within a year, and as such there is a variation in the adjustment parameter (Delta). The larger the speed of adjustment, the faster the country moves towards its optimal dependency.

Table 1: Country mean indicator values of dependency and its adjustment

Most of the countries have relatively high rates of adjustment towards less dependency on natural resources. Countries such as Oman, Iran and Libya adjust faster than others. As such, being relatively fast in dependency reduction indicates the need to satisfy the desire of these countries to develop non-resource-based revenues. This emphasises the development of MENA countries towards diversifying the economy.

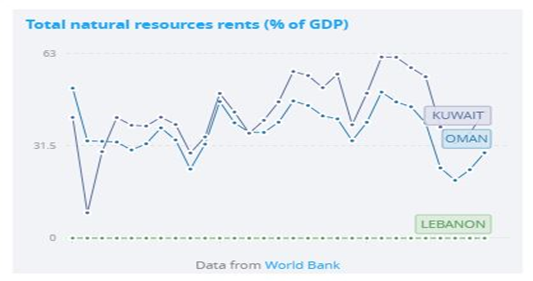

Figure 1: Total natural resource rents (% of GDP) for highest, lowest, and zero adjustment countries

One notable finding here is that while Lebanon has the lowest adjustment speed towards less dependency on natural resources, as the country has had the lowest income from natural resource rents, the result for Kuwait shows that the country per se has no adjustment towards natural resources dependency reduction.

Kuwait is one of the wealthiest nations in the world and its economy largely relies on oil and gas, which account for almost 60% of GDP. The success of the Kuwaiti economy is mainly due to implementation of several strategies to ensure the sustainable exploitation of its natural resources; the country every year, saves 10% of resource revenue to protect against possible oil shocks (Almujamed et al, 2017; Economic Freedom, 2020).

According to Muhamad et al (2021), other factors that contribute to effective reduction of relative dependency on natural resource revenue are both institutional quality and human development. The relationship between institutional quality and natural resources dependence shows that the more a government is institutionalised, the less the degree of natural resource dependence. This confirms the importance of improving the quality of institutions in promoting economic diversification of MENA countries.

Human development has been identified as the core objective of development. MENA countries have opportunities to use resource rents to improve the country level of human development. While human development is found to be a transmission mechanism to derive industrial development of resource-rich countries, the findings of this research indicate that human capital has a direct diversification and resource dependency reduction effect.

Conclusion and policy recommendations

In estimating dependency reduction, public sector reforms could have better performance in reducing natural resource dependency than private sector development. The effect of public sector reforms including privatisation and a national taxation system is observed to reduce the degree of dependency on natural resources. While the private sector might provide a normal rate of return and in the form of taxes collected, the privatisation process might also widen the tax base in many natural resource-dependent economies.

It is not only economic factors but also non-economic factors of institutional quality and human development that can reduce natural resource dependency in MENA countries. As such, economic diversification should be a policy priority for MENA countries. It requires improvement in institutions and the introduction of a policy that could engage all economic activities of the private sector towards affecting the relative degree of dependency on natural resources.

The introduction of new taxes at a later time might improve resource revenue diversification. It is recommended that resource revenue-dependent countries rely on national taxation as an effective policy to reduce resource revenue volatility and strengthen the accountability of governance, which in turn will reduce dependency on natural resources.

Further reading

Almujamed, H, Y Tahat, M Omran and T Dunne (2017) ‘Development of Accounting Regulations and Practices in Kuwait: An Analytical Review’, Journal of Corporate Accounting and Finance 28(6): 14-28.

Badeeb, RA, HH Lean and J Clark (2017) ‘The Evolution of the Natural Resource Curse Thesis: A Critical Literature Survey’, Resources Policy 51: 123-34.

Boutilier, RG (2017) ‘Raiding the Honey Pot: The Resource Curse and Weak Institutions at the Project Level’, The Extractive Industries and Society 4(2): 310-20.

Cabrales, A, and E Hauk (2011) ‘The Quality of Political Institutions and The Curse of Natural Resources’, Economic Journal 121(551): 58-88.

Cammett, M, I Diwan and A Leber (2019) ‘Is Oil Wealth Good for Private Sector Development?’, ERF Working Paper No. 1299.

Carreri, M, and O Dube (2017) ‘Do Natural Resources Influence Who Comes to Power, and How?’, Journal of Politics 79(2): 502-18.

Collier, P (2010) ‘The Political Economy of Natural Resources’, Social Research 77(4): 1105-32.

Collier, P, and A Hoeffler (2009) ‘Testing the Neocon Agenda: Democracy in Resource-Rich Societies’, European Economic Review 53(3): 293-308.

Economic Freedom (2020) ‘Index of Economic Freedom, Kuwait: Center for International Trade and Economics and Environment’, Heritage Foundation.

Frankel, JA (2012) ‘The Natural Resource Curse: A Survey of Diagnoses and Some Prescriptions’, HKS Faculty Research Working Paper No. 12-014.

Ghura, D, and C Pattillo (2012) ‘Macroeconomic Policy Frameworks for Resource-Rich Developing Countries’, IMF.

Jensen, N, and L Wantchekon (2004) ‘Resource Wealth and Political Regimes in Africa’, Comparative Political Studies 37(7): 816-41.

Lemonakis, C, F Voulgaris, K Vassakis and S Christakis (2015) ‘Efficiency, capital and risk in banking industry: the case of Middle East and North Africa (MENA) countries’, International Journal of Financial Engineering and Risk Management 2(2): 109-23.

McGuirk, EF (2013) ‘The Illusory Leader: Natural Resources, Taxation and Accountability’, Public Choice 154(3-4): 285-313.

Mishrif, A, and Y Al Balushi (2018) Economic Diversification in the Gulf Region, Volume II: Comparing Global Challenges, Springer.

Muhamad, GM, A Heshmati and NT Khayyat (2020) ‘The Dynamics of Private Sector Development in Natural Resource Dependent Countries’, Global Economic Review 49(4): 396-421.

Muhamad, GM, A Heshmati and NT Khayyat (2021) ‘How to reduce the degree of dependency on natural resources?’ Resources Policy 72: 102047.

Nabli, MK, and RM Arezki (2012) Natural Resources, Volatility, and Inclusive Growth: Perspectives from the Middle East and North Africa (Vol. 111), International Monetary Fund.

Ross, M (2001) ‘Does Oil Hinder Democracy?’ World Politics 53(3): 325-61.

Rostow, W (1990) The Stages of Economic Growth: A Non-Communist Manifesto, Cambridge University Press.

Smith, B (2015) ‘The Resource Curse Exorcised: Evidence from a Panel of Countries’, Journal of Development Economics 116: 57-73.

Van der Ploeg, F (2011) ‘Natural Resources: Curse or Blessing?’, Journal of Economic Literature 49(2): 366-420.

Venables, AJ (2016) ‘Using Natural Resources for Development: Why has it Proven so Difficult?’, Journal of Economic Perspectives 30(1): 161-84.