In a nutshell

Strategies such as cutting marketing costs, overhead expenses, and research and development (R&D) expenditure, and increasing investment in information technology can enhance a firm’s resilience to sanctions.

Factors such as having a solid business plan, access to finance and technology, well-educated owners, a focus on exporting, and connections to other businesses also play a role in a firm’s ability to withstand sanctions.

Some of these strategies – such as cutting expenditure on R&D – may have long-term negative impacts on the expansion of businesses, and jeopardise the prospects for sustainable development in Iran.

Several studies have examined the impact of a country being put under economic sanctions. By disrupting production and increasing the cost of doing business and trade, the experience can have negative effects on the country’s formal and informal economy as well as on people’s wellbeing (Neuenkirch and Neumeier, 2015; Haidar, 2017; Gharibnavaz and Waschik, 2018; Farzanegan and Hayo, 2019; Laudati and Pesaran, 2021; Zamani et al, 2021).

In an effort to ease these problems, countries under sanctions may try different strategies, such as resisting the sanctions, being more aggressive in their actions, and implementing temporary solutions. In addition, firms that are affected by sanctions adopt persistent approaches to escape the grip of sanctions, to reduce economic pressures, and to protect their profitability.

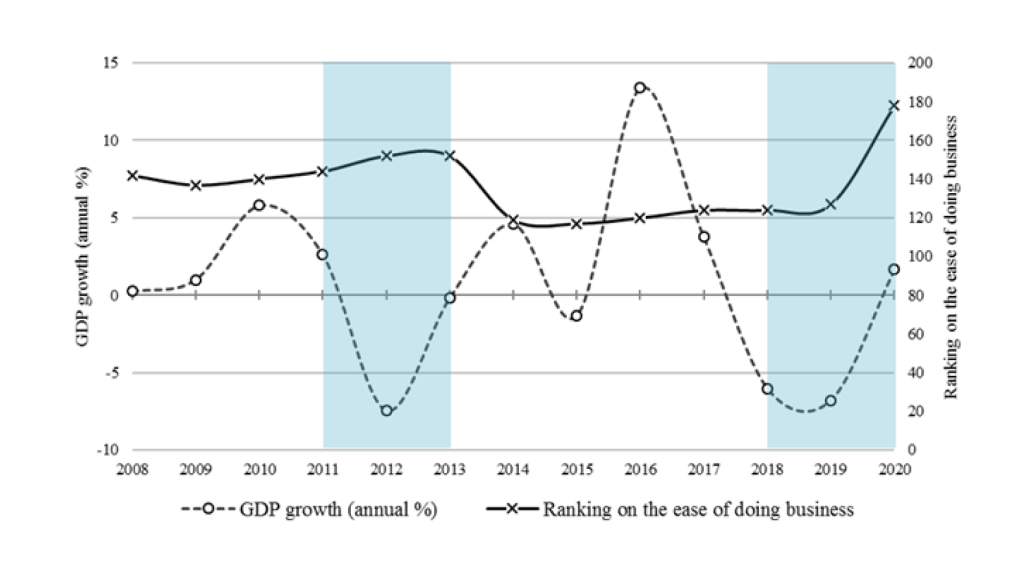

In 2018, the United States decided to leave the Joint Comprehensive Plan of Action (JCPOA), which led to the reinstatement of sanctions on Iran’s financial and energy sectors. Afterwards, Iran’s GDP growth rate collapsed from 13.39% in 2016 to -6.02% and -6.78% in 2018 and 2019, respectively (see Figure 1). The size of the fall in Iranian growth rates during the years of sanctions had not been seen since the end of the Iran-Iraq war.

There is currently no clear perspective on the lifting of sanctions. Under these uncertain conditions, companies are now facing the challenge of understanding how to manage and operate their business under sanctions, rather than the effects of the sanctions themselves.

Our survey

The case of persistent approaches of micro, small and medium-sized enterprises (MSMEs) under sanctions, which was amplified in 2020 by the Covid-19 pandemic, has not yet been investigated for Iran. Our study (Cheratian et al, 2023) aims to fill this gap and to provide the first empirical evidence on the characteristics that influence the persistence of firms under sanctions in Iran.

The data for this study were gathered through surveys managed by the Academic Center for Education, Culture, and Research (ACECR) at Tarbiat Modares University between December 2019 and September 2020. The focus of the survey was on MSMEs in Iran, specifically those with between one and 49 employees.

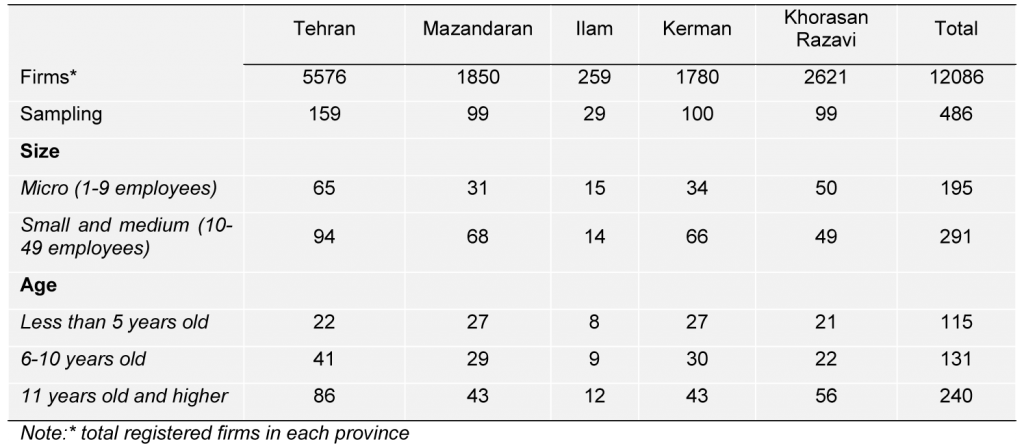

The sample comprised 486 businesses from five different provinces in Iran, taking into account the provinces’ geographical location and level of development. The provinces selected were Tehran and Khorasan Razavi, which have higher levels of development; Mazandaran and Kerman, which have medium levels of development; and Ilam, which has a lower level of development.

Out of the businesses surveyed, 14% were in the food and beverage industry, 13% in the rubber and plastic industry, 8% in the chemical materials and products industry, 8% in the manufacturing of machinery and equipment, 7% in the metals industry, 7% in the production of metal products, 7% in the electrical devices and machinery industry, and 5% in the clothing and textile industry. The remaining businesses surveyed were in other industries, but with a smaller percentage.

This project involved interviewing business owners and high-level managers to gather information about how MSMEs in Iran were doing. The survey included a broad range of topics such as how the businesses were being run, how they were getting funding, how the business environment was affecting them, how sanctions were affecting them, what their goals and values were, how they were marketing themselves, what kinds of education and skills their employees had, how many jobs they were creating, and how they were dealing with government laws and bureaucracy.

The key characteristics of the collected survey are listed in Table 1.

Table 1. Survey of technical data

Our analysis and main results

The firm’s managers were asked to specify: ‘How have sanctions affected your business?’ The responses were grouped into three categories: ‘it has caused an increase in business’; ‘it has caused a decline in business’; and ‘it has had no effect’. The study focused on the ineffectiveness of sanctions. We identify factors that may have contributed to the probability of ineffectiveness of the sanctions on these businesses.

Our findings show that strategies such as cutting marketing costs, overhead expenses, and research and development (R&D) expenditure, and increasing investment in information technology can enhance a firm’s resilience to sanctions. Conversely, reducing production and cutting or freezing staff pay do not help in this regard.

Factors such as having a solid business plan, access to finance and technology, well-educated owners, a focus on exporting, and connections to other businesses also play a role in a firm’s ability to withstand sanctions. Additionally, smaller companies tend to be more resistant to the negative effects of sanctions.

Some of these strategies, such as cutting R&D costs, may have long-term negative impacts on the expansion of businesses and sustainable development of the country.

Further reading

Cheratian, I, S Goltabar and MR Farzanegan (2023) ‘Firms persistence under sanctions: Micro-level evidence from Iran’, The World Economy 00: 1-42.

Farzanegan, MR, and B Hayo (2019) ‘Sanctions and the shadow economy: Empirical evidence from Iranian provinces’, Applied Economics Letters 26(6): 501-05.

Gharibnavaz, MR, and R Waschik (2018) ‘A computable general equilibrium model of international sanctions in Iran’, The World Economy 41(1): 287-307.

Haidar, JI (2017) ‘Sanctions and export deflection: evidence from Iran’, Economic Policy 32(90): 319-55.

Laudati, D, and MH Pesaran (2021) ‘Identifying the effects of sanctions on the Iranian economy using newspaper coverage’, CESifo Working Paper No. 9217.

Neuenkirch, M, and F Neumeier (2015) ‘The impact of UN and US economic sanctions on GDP growth’, European Journal of Political Economy 40: 110-25.

Zamani, O, MR Farzanegan, JP Loy and M Einian (2021) ‘The impacts of energy sanctions on the black-market premium: evidence from Iran’, Economics Bulletin 41(2): 432-43.