In a nutshell

Universities and other higher education institutions were at the centre of the civil conflict in Turkey from 1960 to 1980.

The number of new admissions and graduates in post-secondary education declined significantly due to the intense violence seen in the late 1970s in Turkey.

Individuals who would have otherwise completed a post-secondary degree would have earned much more than their actual earnings if the turmoil had never occurred.

The mass socio-political uprisings of the early twenty-first century have similarities with the student movements of the 1960s and early 1970s, which became a global phenomenon. In the United States and Europe, these movements had declined significantly by the mid-1970s (Barker, 2012), the same time at which Turkey’s protests started to mutate into violence.

Our study presents a comprehensive empirical analysis of the education and labour market consequences of this political turmoil on cohorts of young people directly exposed to educational disruptions (Ozturk and Tumen, 2019):

- First, we document that new enrolments in post-secondary education declined in the 1978/79 school year, largely due to the closure of teacher training institutes driven by their links to student violence.

- The second channel that adversely affected educational attainment was that graduation rates declined following massive student dropouts related to security concerns.

- Finally, mass student arrests in the wake of the 1980 coup kept many from completing their education.

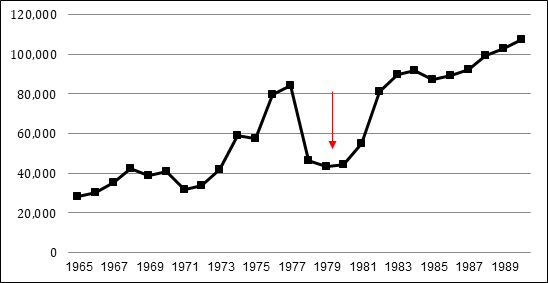

Figure 1 demonstrates this dramatic decline based on data covering the period from 1965 to 1990. Using the 2005-2008 waves of the Turkish Household Labor Force Survey, we estimate that the decline in post-secondary graduation ratio was around 6.5 percentage points for the exposed individuals.

Figure 1: New enrolments in all higher education institutions in Turkey from 1965 to 1990

Source: Authors’ calculations based on the National Education Statistics, Higher Education and Academic Year Higher Education Statistics books.

We use the decline in post-secondary education as a natural experiment and design an ‘instrumental variable’ strategy based on exposed versus non-exposed cohorts to estimate the effect of post-secondary education on labour market earnings.

Our estimates suggest that the returns to a four-year college degree are around 56-58 log points for men. This corresponds to around 15% returns to an additional year of post-secondary education. Our findings are robust to using alternative birth-cohort specifications in defining the treatment and control groups.

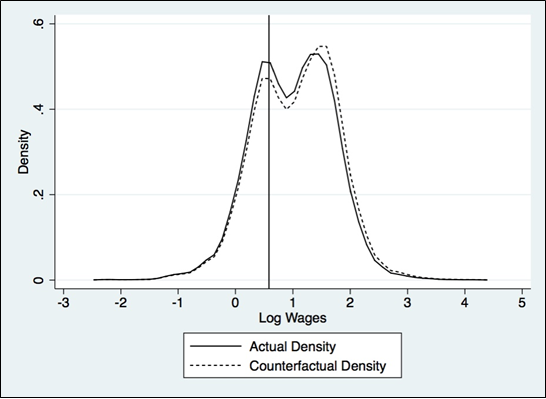

We also analyse the impact of the political turmoil on the wage distribution of exposed individuals. The estimates of the counterfactual and the actual densities are represented in Figure 2. The vertical line indicates the log minimum wage.

Figure 2: The actual and counterfactual density of log wages for the exposed group

Notes: The sample includes male wage earners aged 40-51. Observations are weighted using the sampling weights so that the results are nationally representative.

The difference between the actual and counterfactual densities represents the effect of the decline in post-secondary educational attainment – due to the political turmoil – on the distribution of wages for the exposed group.

Strikingly, the decline in post-secondary education pushes these individuals from the higher-income group towards the minimum-wage group. Those individuals who would have otherwise completed a post-secondary degree would have earned much more than their actual earnings if the turmoil had never occurred. We also show that the exposed cohorts are less likely to choose high-wage occupations.

These findings suggest that violent political turmoil and other large-scale turbulent events affecting large fractions of the productive population generate persistent negative consequences on long-term outcomes that directly measure the wellbeing of individuals.

Further reading

Ahmad, F (1993) ‘The Making of Modern Turkey’, Routledge.

Barker, C (2012) ‘Some Reflections on Student Movements of the 1960s and Early 1970s’, Revista Critica de Ciencias Sociais 81: 43-91.

Gunter, MM (1989) ‘Political Instability in Turkey during the 1970s’ Conflict Quarterly 9: 63-77.

Maurin, E, and S McNally (2008) ‘Vive la Revolution! Long-term Educational Returns of 1968 to the Angry Students’, Journal of Labor Economics 26: 1-33.

Ozturk, A, and S Tumen (2019) ‘Education and Labor Market Consequences of Student Protests in Late 1970s and the Subsequent Military Coup in Turkey’, ERF Working Paper No. 1377.