In a nutshell

According to measures such as the Gini index, inequality is relatively low in the Arab region; yet it is perceived as a major factor behind the uprisings of 2011.

Harmonised data for 12 Arab countries provide a unique opportunity to examine trends in inequality of outcome and inequality of opportunity over time.

Redistribution of income to workers in the lowest quintiles is likely to result in both higher growth per capita and more rapid poverty reduction.

According to measures such as the Gini index, inequality is relatively low in the Arab region (Page, 2007). Yet inequality is perceived as a major factor behind the uprisings of 2011 (Verme, 2014).

The World Bank (2015) calls this the ‘Arab inequality puzzle’. The puzzle shows that despite improved data infrastructure and a rapidly evolving body of research in recent years compared with 2010 (Bibi and Nabli, 2010), there are still many gaps in our understanding of trends in both money metric inequality and multidimensional inequality in Arab states.

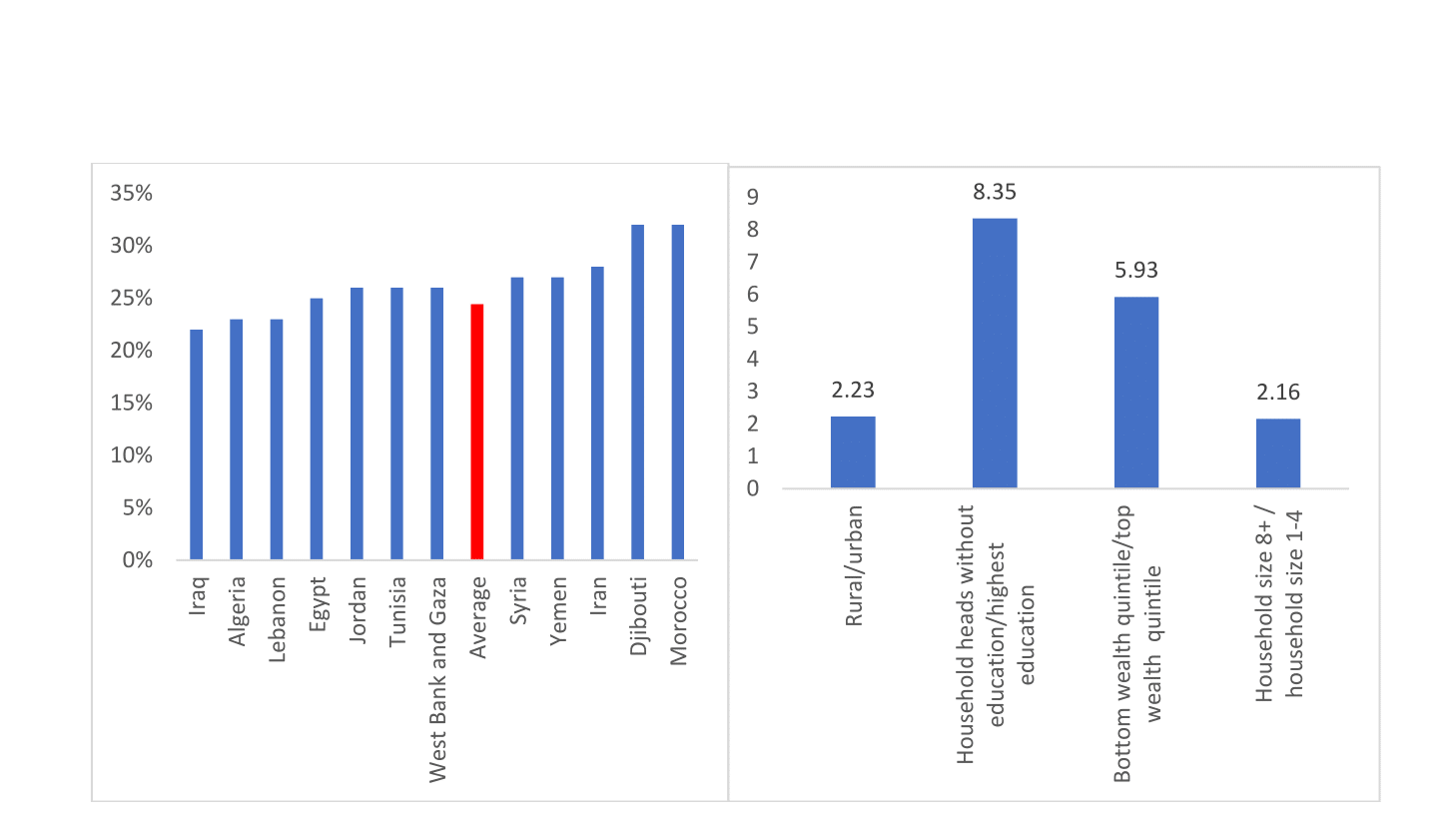

For example, Figure 1 shows the share of the top decile for MENA countries averaging at around 26.4%, which reveals a relatively moderate level of inequality, and the evidence shows that this share has declined over time in most MENA countries. On the other hand, the visible manifestations of high and growing economic and social inequalities stand in direct contrast with this empirical stylised fact.

Moreover, although we are still missing a broader narrative on multidimensional inequality, the latest findings on multidimensional poverty show strikingly sub-national disparities in headcount poverty between specific groups, especially between households with highly educated and uneducated heads (where poverty is more than eight times higher among the latter compared with the former).

Figure 1:

Share of top decile in expenditure and ratio of multidimensional poverty between households with different characteristics (most recent surveys from 2011-2015)

Source: Calculations based on World Bank online database (Povcal.Net) and ESCWA et al, 2017

For this reason, the United Nations Economic and Social Commission for Western Asia (ESCWA) and ERF are joining forces to examine the issue in some depth in a forthcoming report with the tentative title ‘Rethinking inequality in Arab states’. The following three questions are important to address:

- First, why study inequality in the first place: does it matter?

- Second, inequality is a multifaceted subject that lends itself to a variety of theoretical approaches and measurement frameworks. Therefore, it is important to be clear about what form of inequality we are interested in examining and from which theoretical standpoint.

- Third, inequality between whom?

Once these basic questions are answered, the more mundane yet no less important issues related to data and measurement methodology can be addressed. Though of interest to students and inequality scholars, the ultimate objective of this exercise is to provide practical and relevant policy considerations to an audience of policy-makers.

The first question may seem absurd from an egalitarian perspective. But it is still valid, particularly if, as evidence suggests, the poorest of the poor are better off today in absolute terms than their parents and grandparents were several decades ago.

To this fundamental question our simple answer is: yes, inequality matters a great deal. For example, as Michael Kalecki observed, ‘capitalists earn what they spend and workers spend what they earn.’ Hence, redistribution will necessarily have an impact on economic growth. Lance Taylor later developed this insight in structuralist macroeconomic models where the impact of redistribution on growth depends on whether the economy is wage- or profit-led.

This debate is enormously important for Arab countries where, as in the case of most developing countries, evidence suggests a wage-led pattern of economic growth. Hence, even if we set aside equity considerations (and there is no reason why we should), then a redistribution of income to workers in the lowest quintiles will result in both higher growth per capita and more rapid poverty reduction.

Complementing this argument, empirical work from the International Monetary Fund (Berg and Ostry, 2017) points out that a low level of inequality may be essential to produce long and stable growth spells. In short, most economists would agree that there is a causal relationship between inequality and growth, though the nature of this relationship may not be perfectly understood and the direction of causality may differ depending on the theoretical framework.

Likewise, country experiences in the context of health and education repeatedly inform us that progress in social indicators at the aggregate level is influenced not only by the quantity of public expenditure but also by its spatial and sectoral distribution. Hence, the case for achieving the Sustainable Development Goals is one and the same as that for reducing social inequality.

Turning to the second question, the body of research on inequality of outcomes in the region is well established in the money metric domain. As noted above, the conventional wisdom is that inequality of expenditure was generally low and declining from 1990 to 2013, with the fastest decline in Gini recorded in Algeria, Iran and Jordan.

There is, however, a serious flaw with the conventional wisdom in that it does not tally with the story coming from national accounts. Many of the countries with a reported moderate level of Gini (such as Egypt, Jordan, Syria before 2010 and Morocco) record large and rising discrepancies in average expenditure between household expenditure surveys and household final consumption expenditures from national accounts.

This suggests that inequality may be much higher and rising if we factor in the expenditure of the richest 1% in these countries (who are typically excluded from these surveys). For example, Alvaredo et al (2017) combine household surveys, national accounts, income tax data and wealth data to estimate the level and evolution of income concentration in the Middle East for the period 1990-2016.

Consistent with what one would expect in rentier economies, their findings show that the Middle East appears to be the most unequal region in the world, with a top decile income share as large as 61%, compared with 36% in Western Europe, 47% in the United States and 55% in Brazil. Clearly, the traditional story on income inequality in the region is problematic at the methodological and empirical level. This clearly contradicts with the story emerging from Figure 1.

Given the many limitations of cross-country analysis of money metric poverty and inequality, there has recently been a growing appeal for the use of multidimensional inequality, based on the capability approach of Nobel laureate Amartya Sen.

According to this approach, poverty can be viewed as the inability (or lack of capability) to enjoy the basic rights and freedoms of life. Our approach to inequality is heavily influenced by this school of thought. This means that in response to the second question, our analysis in the report will be mainly focused on inequality in the non-income dimensions: health, education and living conditions.

This brings us to the third question: inequality between whom? As explained by Iqbal (2012), ‘deepening inter-group inequality’ may encourage revolts and uprisings. Hence inter-group inequality between selected demographic groups (rich and poor, men and women, rural and urban, educated and non-educated, etc.) may be a partial explanation for the Arab inequality puzzle (Ramadan et al, 2018).

Whether money metric or multidimensional measures are used, the main research challenge is to decide on which of the two forms of inequality to focus: inequality of outcome or inequality of opportunity – and why? Most recent academic analysis of inequality in the region has been focused on inequality of opportunity.

This attention is well justified. Inequality of outcomes (such as inequality in the distribution of income, wealth, infant mortality, etc.) does not account for individual responsibility for such outcomes. Recently, there has been a growing consensus that societies seeking social and economic justice or equity in living standards should promote equality of opportunity by compensating for inequality arising from ‘circumstances’ beyond individuals’ control, while at the same time, letting individuals bear the consequences of actions or ‘effort’ for which they can be held responsible.

Moreover, both kinds of inequality are correlated as the living conditions into individuals are born may affect their future outcomes (Galal and El Enbaby, 2015). But as noted by Atkinson (2015), the best way to reduce inequality of opportunity is to address inequality of outcomes. Therefore, the report takes a balanced approach with equal attention given to both lines of analysis.

Why now? Building on the recent report on Arab multidimensional poverty (ESCWA et al, 2017), there is now harmonised data for 12 Arab countries covering at least two points in time: one in the early 2000s and another after 2010. Hence, there is a unique opportunity to examine trends in outcome and opportunity inequalities across time and, in response to the third key question, inequality between rich and poor wealth quintiles, men and women, rural and urban areas, and households with highly educated and uneducated heads.

This will not only fill a significant void in the current body of research, but it will also help to evaluate the impact of socio-economic policies over the past decade. At the heart of this task is the question of the effectiveness of public policy in Arab states.

Policies to reduce inequality will obviously depend on the results of our analysis. Still, the forthcoming report will present a policy framework from three distinct angles.

The first angle relates to fiscal policies and employment generation. The report will provide some concrete fiscal redistribution policy actions, specifically, social expenditure and employment schemes for vulnerable groups.

The second angle is a focus on social policies and which interventions can best solve the challenge of reducing both inequality and poverty. Here the experience from other regions and our longstanding partnership with the multidimensional poverty peer network (managed by the Oxford Poverty and Human Development Initiative, OPHI) plays a key role in informing this debate.

Third, and equally important, there needs to be a unifying political economy narrative to assimilate all this information and present it in a historical context. A related question is whether the old social contract (or lack thereof) is sustainable in the context of these findings and if not, what are the urgent institutional reforms from an inequality-focused viewpoint.

We hope this collaborative effort will result not only in answers to these many questions, but also perhaps more importantly, the creation of a regional network with strong links to regional and global centres of excellence that will lead future work on inequality in the MENA and Arab states.

Further reading

Alvaredo, F, L Assouad and T Piketty (2017) ‘Measuring Inequality in the Middle East 1990-2016: The World’s Most Unequal Region?’, CEPR Discussion Paper No. 12405.

Atkinson, AB (2015) Inequality, Harvard University Press.

Berg, A, and J Ostry (2017) ‘Inequality and Unsustainable Growth: Two Sides of the Same Coin?’, IMF Economic Review.

Bibi, S, and MK Nabli (2010) ‘Equity and Inequality in the Arab Region’, ERF Policy Research Report No. 33.

Galal, R, and H El Enbaby (2015) ‘Inequality of Opportunity in Individuals’ Wages and Households’ Assets in Egypt’, ERF Working Paper No. 942.

Iqbal, Z (2012) ‘The Economic Determinants of Arab Democratization’, Middle East Institute.

Page, J (2007) ‘Boom, Bust, and the Poor: Poverty Dynamics in the Middle East and North Africa, 1970-1999’, Quarterly Review of Economics and Finance 46: 832-51.

Ramadan, R, V Hlasny and V Intini (2018) ‘Inter-group Expenditure Gaps in the Arab Region and their Determinants: Application to Egypt, Jordan, Palestine and Tunisia’, Review of Income and Wealth.

ESCWA, UNICEF, OPHI and LAS (2017) ‘Multidimensional Poverty in Arab States’, United Nations Economic and Social Commission for Western Asia, United Nations Children’s Fund, Oxford Poverty and Human Development Initiative and League of Arab States.

Verme, P (2014) ‘Facts and Perceptions of Inequality’, in Inside Inequality in the Arab Republic of Egypt: Facts and Perceptions across People, Time, and Space by P Verme, B Milanovic, S Al-Shawarby, S El Tawila, M Gadallah and A El-Majeed, World Bank.

World Bank (2015) Inequality, Uprisings, and Conflict in the Arab World.