In a nutshell

The post-earthquake rise in economic activity in Bam County is partly explained by the fact that the disaster was geographically concentrated, allowing for a faster and more efficient response; Bam also had a relatively strong economy before the earthquake, which provided a solid foundation for recovery.

A key factor in the economic boom was the significant amount of international aid, totalling over $132 million; large-scale domestic efforts, including volunteer mobilisation and long-term government loans for reconstruction, further contributed to the recovery.

Economic activity was also fuelled by the temporary increase in Bam’s population as people from surrounding areas moved in to claim relief funds; the influx of workers, entrepreneurs and aid contributed to the growth in the intensity of night-time light in the county.

Over the past decades, Iran has experienced numerous natural disasters, ranging from floods to earthquakes, storms and droughts (Farzanegan et al, 2024). Among these events, the 2003 earthquake in the city of Bam stands out as one of the deadliest and most destructive. This earthquake, which devastated Bam and its surroundings, caused nearly 27,000 deaths and left over 250,000 people affected (EM-DAT Project, 2024). Despite the massive destruction, the disaster also sparked a remarkable recovery effort, driven by both national and international aid, and it triggered significant changes in the local economy.

In a recent study (Farzanegan and Fischer, 2024), we focus on the long-term economic impact of the Bam earthquake, specifically examining how it affected local economic activity in Bam County and its neighbouring areas. By using night-time light (NTL) data from 1992 to 2020 and applying a research technique known as the synthetic control method, we create a counterfactual scenario to estimate what the development of these regions would have been in the absence of the earthquake.

The results show a surprising economic rebound, with Bam and its neighbours experiencing a boost in economic activity in the years following the disaster. Our study highlights not only the economic resilience of these areas but also the factors that contributed to this recovery, including the flow of disaster relief, political mobilisation and the cultural significance of Bam as a UNESCO World Heritage site.

By contributing new insights into the economic effects of large-scale natural disasters, this research enhances our understanding of how regions can recover and even thrive in the aftermath of such catastrophic events. It also emphasises the importance of targeted disaster recovery policies, which can stimulate economic growth and restore communities in the long term.

Methodology

We apply the synthetic control method, first developed by Abadie and Gardeazabal (2003), to evaluate the impact of the 2003 Bam earthquake on economic activity, as measured by NTL data. This approach allows us to create a ‘synthetic’ version of the affected area by weighting unaffected counties to match the pre-disaster characteristics of Bam County. This approach is more reliable than using a single unaffected county.

We use a balanced panel dataset with pre- and post-disaster periods, ensuring the proper selection of a donor pool of counties unaffected by major disasters. The synthetic control is chosen based on matching pre-disaster characteristics, such as population growth and prior economic activity, to get the best approximation of the outcomes in the affected area.

Data and outcome variables

The primary outcome variable in our study is the natural logarithm of the sum of NTL intensity, which serves as a proxy for economic activity in Iranian counties. The NTL data, provided by Li et al (2020), offer several key advantages for studying the impact of natural disasters.

First, they provide an indicator of economic growth that is not affected by the potential errors in measuring GDP, especially in countries with less accurate (regional) economic data.

Second, NTL data capture the informal economy (as mentioned in Farzanegan and Hayo, 2019, and Farzanegan and Fischer, 2021), which is often large in developing countries and typically excluded from official GDP measures. This is crucial for assessing the full economic impact of disasters.

A third advantage is that NTL data are available for all counties and smaller geographical units, making it a consistent and comparable measure across regions. This consistency is especially important given that administrative boundaries and data reporting practices in Iran have changed over time, making GDP comparisons difficult. By using NTL data, we can account for these changes and obtain a reliable and continuous dataset spanning the period from 1992 to 2020.

In our study, we use the harmonised global NTL dataset, which includes data from 429 counties in Iran. For each county, we calculate the sum of NTL intensity, which represents the total light emitted in that area. These values are averaged annually and measured on a scale from 0 (no light) to 63 (maximum light intensity), with each pixel representing approximately 1km².

Predictor variables

To understand the factors influencing the economic impact of the 2003 Bam earthquake, we include several predictor variables based on prior research on natural disasters. These predictors help to ensure that the synthetic control accurately reflects the pre-disaster conditions of Bam County.

- Pre-disaster NTL data:We use data from every second year before the earthquake to ensure that the synthetic control matches Bam’s pre-disaster economic activity as closely as possible. This avoids potential bias from using every available year, which could distort the results by introducing excessive lag effects.

- Population growth rate:We include the population growth rate as a predictor variable, calculated as the percentage change in population over the pre-disaster period. This helps to take account of demographic changes that might influence economic recovery.

- Population density:The natural logarithm of population density is included to capture the concentration of people in a given area, which can influence the resilience of local economies.

- Natural disaster risk:We measure the risk of natural disasters as the frequency of events per 10,000km² from 1990 to 2019. This variable helps to control for the historical exposure of counties to natural disasters, which may influence their ability to recover from the Bam earthquake.

Given the limited availability of data at the county level for most of these variables, we supplement county-level data with provincial-level data. This allows us to maintain a comprehensive analysis of factors that might influence the economic recovery in Bam and the synthetic control counties.

Together, these predictors help to ensure that our synthetic control method accurately captures the pre-disaster conditions, allowing for a reliable comparison between Bam County and its synthetic counterpart to assess the impact of the earthquake.

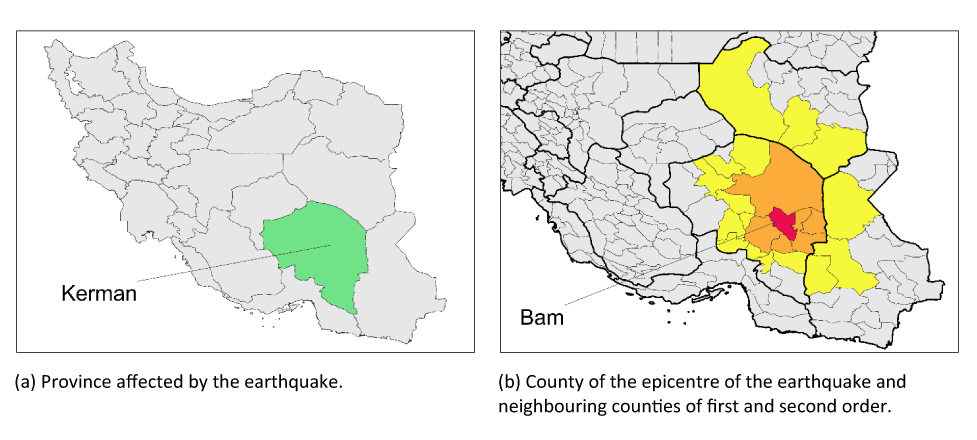

The city of Bam is located in Bam County of Kerman Province, which is in south-eastern Iran (see Figure 1).

Figure 1: Provinces and counties affected by the 2003 earthquake

Results

The synthetic Bam is generated using data from six counties in the donor pool: Bonab (39.6%), Khalkhal (19.5%), Tehran (19.2%), Tarom (10.7%), Shemiranat (7.9%) and Tabriz (3%). The weighting reflects the relative contribution of each donor unit (control group case) in constructing the synthetic counterpart to the treated unit (Bam County). These weights are chosen to minimize the difference between the pre-treatment characteristics of the treated unit (Bam) and the weighted combination of the donor units.

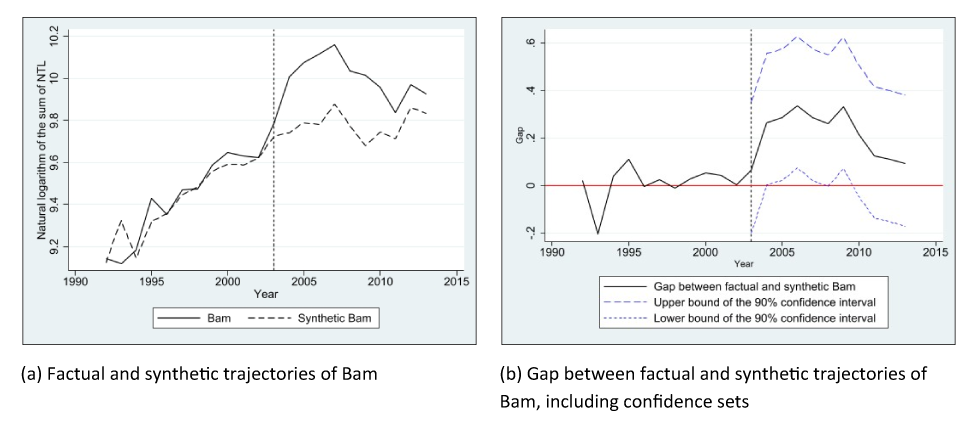

Figure 2 presents the trajectories of NTL (natural logarithm of the sum of NTL) for both factual Bam and synthetic or counterfactual Bam from 1992 to 2013. The pre-disaster trends align closely, suggesting that synthetic Bam is a good representation of what Bam would have experienced without the earthquake.

After the earthquake, the growth of NTL in factual Bam diverges positively from synthetic Bam, indicating a boost to economic activity in the affected area (Figure 2a). This suggests that the disaster might have led to increased reconstruction and economic activity in Bam, as the city is likely to have benefited from both domestic and international aid, as well as investment in rebuilding efforts.

The gap between factual and synthetic Bam reflects the impact of the earthquake. The statistical significance of this effect is confirmed through the uniform confidence sets introduced by Firpo and Possebom (2018), which allow us to assess uncertainty around the estimated treatment effect. In Figure 2b, we see that the gap between factual and synthetic Bam remains outside the zero line for seven years after the earthquake, which means that the positive economic impact on Bam is statistically significant with 90% confidence.

While the results suggest a positive economic impact from the earthquake, it is important to assess the robustness of this finding. Several placebo tests are used to examine the validity of the synthetic control approach.

For example, the ‘leave-one-out test’ drops a county (for example, Tehran) from the donor pool to check if the results remain consistent. The fact that similar gaps persist even when Tehran is excluded suggests that the synthetic control method is not overly sensitive to the choice of counties in the donor pool. Additionally, the application of the penalised synthetic control method, which corrects for any mismatches between factual and synthetic Bam, supports the robustness of the findings.

Figure 2: Factual and synthetic trajectories of Bam and gap with confidence sets

Possible contributing factors to the post-disaster economic boom in Bam

The increase in economic activity in Bam County after the 2003 earthquake can be explained by several factors. First, the earthquake was geographically concentrated, allowing for a faster and more efficient disaster response compared with other types of natural disasters. This helped the region to recover quickly. Bam also had a relatively strong economy before the earthquake, with more industrial development and higher population compared with other Iranian counties, which provided a solid foundation for recovery.

A key factor in the economic boom was the significant amount of international aid, totalling over $132 million. This financial support came during a period of improved international relations under President Khatami, boosting both resources and media attention. Large-scale domestic efforts, including volunteer mobilisation and long-term government loans for reconstruction, further contributed to the economic recovery.

Additionally, the population of Bam temporarily increased as people from surrounding areas moved in to claim relief funds, which also fuelled economic activity. The influx of workers, entrepreneurs and aid contributed to the growth in NTL as a measure of economic activity in the years following the earthquake.

In summary, the boost in economic activity was driven by a combination of rapid disaster response, strong pre-disaster economic conditions, large-scale international aid and temporary migration, all of which contributed to Bam’s recovery and growth after the earthquake.

Conclusion

Our study examines the economic impact of the 2003 Bam earthquake. Using Night-time light data as proxy for regional economic activities and synthetic control method, we find that Bam County experienced a short- to medium-term boost in economic activity, driven by the event’s localised nature, Bam’s strong pre-disaster economy, and significant national and international support. But this economic growth in Bam may have come at the expense of other regions, as resources were diverted there.

The impact of the earthquake was not long-lasting, with Bam’s economy returning to its pre-disaster growth trajectory within ten years. While the study offers valuable insights, it also has limitations, including data constraints and potential biases from other events. Overall, it highlights both the benefits and challenges of disaster-driven economic changes.

Further reading

Abadie, Alberto, and Javier Gardeazabal (2003) ‘The Economic Costs of Conflict: A Case Study of the Basque Country’, American Economic Review 93: 113-32.

EM-DAT Project (2024) ‘The International Disaster Database’. Centre for Research on the Epidemiology of Disasters (CRED), University of Louvain.

Farzanegan, Mohammad Reza, and Sven Fischer (2021) ‘Lifting of International Sanctions and the Shadow Economy in Iran – A View from Outer Space’, Remote Sensing 13(22): 4620.

Farzanegan, Mohammad Reza, and Sven Fischer (2024) ‘The Impact of a Large-Scale Natural Disaster on Local Economic Activity: Evidence from the 2003 Bam Earthquake in Iran’, Empirical Economics.

Farzanegan, Mohammad Reza, Sven Fischer and Peter Noack (2024) ‘Natural Disaster Literacy in Iran: Survey-Based Evidence from Tehran’, International Journal of Disaster Risk Reduction 100: 104204.

Farzanegan, Mohammad Reza, and Bernd Hayo (2019) ‘Sanctions and the Shadow Economy: Empirical Evidence from Iranian Provinces’, Applied Economics Letters 26(6): 501-5.

Firpo, Sergio, and Vitor Possebom (2018) ‘Synthetic Control Method: Inference, Sensitivity Analysis and Confidence Sets’, Journal of Causal Inference 6(2): 1-26.

Li, Xuecao, Yuyu Zhou, Min Zhao and Xia Zhao (2020) ‘A Harmonized Global Nighttime Light Dataset 1992–2018’, Nature Scientific Data 7(168).