In a nutshell

Most MENA countries consider crypto assets as a legal currency, but banks are often banned from dealing with crypto transactions; in Algeria, Egypt and Morocco, cryptocurrencies are illegal as of 2024.

Countries with higher internet usage, more advanced economies and bigger populations typically experience the most cyber-attacks; cryptocurrency is one of the current major global concerns of cybercrime and MENA countries often are on the top of the list for costly cyber-attacks.

It is important for MENA countries to develop transparent legal and economic environments in order to stay up to date with the fast-moving development of fintech and generative artificial intelligence.

Digital usage is altering the way we live and work. New technologies have established new markets, which in turn creates new opportunities, competitors and problems. Artificial intelligence, blockchain, cryptocurrencies and digital assets are fast-developing technologies. They have introduced many investors to the promise of a better currency and a better world of decentralised financial transactions, free of a potentially deceitful financial sector.

Financial technology (fintech) is the term for computer programs and other technologies used to support and enable business transactions to improve their operational and allocative efficiencies. Fintech is a public ledger capable of recording the origin, movements, and transfer of anything of value securely and with complete transparency via smart contract technology.

Fintech is changing how financial institutions and markets implement their business models through the elimination and decentralisation of old fashioned and traditional transaction methods.

Fintech technology is a dynamic improvement in automating the delivery and use of financial services started with the financial institutions like machines reading the check coding to the current stage of customer orientation services such as online banking, robo-advisors, peer-to-peer (P2P) lending apps, investment apps and cryptocurrencies. According to one report (ZDNET, 2018), there are currently 47 crypto apps, among the most popular of which are Coinbase, Robinhood, Gemini, Crypto.com, Karaken, eToro and Cash App.

Countries with higher internet usage, more advanced economies and bigger populations typically experience the most cyber-attacks.

Drivers of the rapid spread of crypto assets in the MENA region include consumer trust, earlier adoption and high inflation, which raises interest in dollar-denominated assets such as stablecoins.

MENA countries’ share of the world economy is roughly about 4.8% and in 2022, the MENA region accounted for 9.2% of global cryptocurrency transactions. The United Arab Emirates (UAE) is the regional hub for crypto assets. Egypt has the fastest growing crypto and digital currencies in the region, and it is used as a saving means in lieu of fiat currencies.

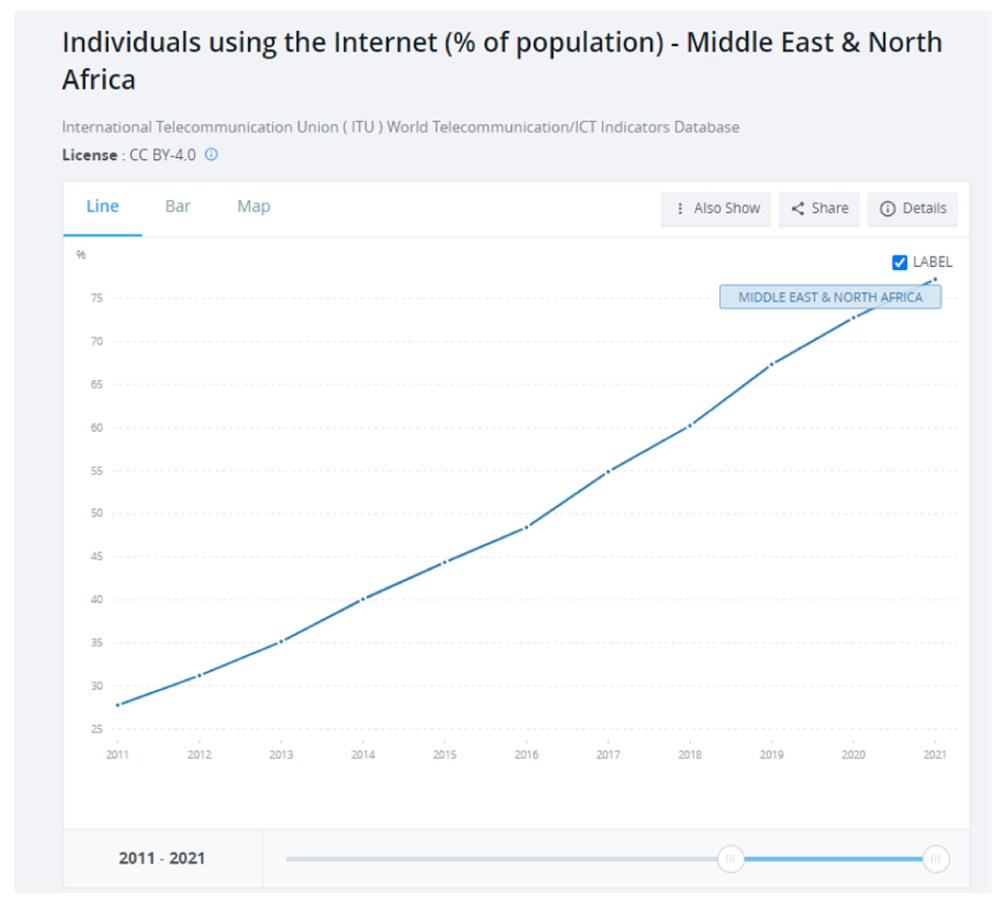

The MENA region’s increasing access to digital information and internet usage has led to an explosion in e-commerce. At the same time, cybercrime, which includes hacking, malware, online fraud and harassment, has spread across computers and digital networks.

Cyber-crime became the biggest concern of digital transactions users. MENA countries are spending enormous amounts of money on preventing cybercrimes. This has created the need for establishing a safer and more trusted digital environment in the region, which can bring empowerment, economic benefits and convenience.

MENA countries’ e-commerce transactions are highly exposed to cyber-crime. These attacks target the high wealth in certain countries such as Saudi Arabia and the UAE, which have the highest global email spam rate, with the highest cyber cost. In the first half of 2021, there was an increase of 17% of cyber-crimes in the region.

A study by Ponemon Institute and IBM stated that on average each cyber-attack occurrence costs $6.93 million, and $6.52 million for each data breach (IBM Security, 2020).

The most targeted industries that have a significant increase in industrial control system (ICS) risks include government institutions, financial services, healthcare, education and technology

Consumers International (2019) surveyed 3,000 online consumers in Oman, Tunisia, Saudi Arabia, and Egypt to help us understand MENA consumers’ experiences with e-commerce, privacy, and security online in a diverse range of markets. The survey findings were accompanied by interviews with the above MENA regional members of 9.2% global currencies transactions. Consumers International Insight Briefing – Dec 2019, ranked Saudi Arabia to have the highest global email spam rate followed by the UAE.

The major cost of cybercrimes comes from consumers, governments, and companies. It is estimated that globally the average cybercrime victims invest the equivalent of three full working days on fixing the cybercrime damages. Saudi Arabia and the UAE have experienced some of the costliest data breaches in the world – costing $5.97 million in lost business to organisations in 2017 alone.

UAE and Saudi Arabia were the highest targeted countries in the Gulf region in 2021-22 mostly with ransomware attacks originated mainly in Russia and Iran (Arab News, 2023).

Crypto crimes in the MENA account for 24% of total cryptocurrency transactions.

Cryptocurrencies are especially attractive to investors in MENA for being shariah-compliant. Some coins, protocol and crypto assets are part of Islamic finance by the ethical, inclusive, sustainable and charitable investments principles.

The chart shows the percentage of individuals using the internet in MENA. The higher the internet usage, the higher the usage of crypto assets, which will lead to a higher crypto crime.

One of the current major global concerns is cyber-crime and the MENA countries often are on the top of the list for costly cyber-attacks. Hence, MENA countries urgently need to increase regulations to curb cyber-crime.

The work has benefited from the comments of the Technical Experts Editorial Board (TEEB) of the Arab Development Portal (ADP) and from a financial grant provided by the AFESD and ADP partnership. The contents and recommendations do not necessarily reflect the views of the AFESD (on behalf of the Arab Coordination Group) nor the ERF.