In a nutshell

Analysis of the incidence and restrictiveness of different types of product-specific rules of origin (PSRs) across 128 reciprocal preferential trade agreements (PTAs) for the period from 1990 to 2015 reveals the extent to which these rules undo the benefits of market access associated with preferential trade.

Controlling for preferential margins, the research shows that PTAs with more flexible PSRs are associated with a significantly stronger trade effect compared with more restrictive ones.

A simulation exercise suggests that a radical reform, leading to the adoption of flexible PSRs, would have increased global trade under PTAs on average by 2.7-4% over a 25-year period; policy-makers should move away from restrictive PSR categories towards more flexible ones.

Preferential trade agreements (PTAs) require rules of origin to establish the conditions that products must meet to be eligible for preferential market access. These rules almost invariably include product-specific rules (PSRs). They vary across partners for the same product with countries often engaged in multiple PTAs with the same partner, adding to the compliance costs of meeting origin requirements to qualify for preferential access.

Three justifications are advanced as rationale for rules of origin:

- To prevent non-signatories benefiting from preferential access in PTAs markets by little transformation (for example, repackaging).

- To prevent transhipment from low to high tariff partners within a free trade area – a phenomenon known as ‘trade deflection’. Yalcin and Felbelmayr (2019) show that transhipment is rarely profitable for PTAs among developing countries.

- To encourage vertical integration among partners as part of a development strategy. In practice, rules of origin are a nightmare for producers and customs officials alike and may undercut the objective of stimulating trade flows among PTA partners.

Rules of origin negotiated under PTAs fall outside the purview of the World Trade Organization (WTO), often leading to outcomes dominated by lobbying interests. An example is the difficulty that members of the African continental free trade area (AfCFTA) have encountered in reaching agreement on simple rules of origin in sectors with high preferential margins. Gourdon et al (2021) show that AfCFTA negotiators failed to reach agreement in sectors with high preferential margins such as automobiles, and textiles and apparel.

Following a review of the unsuccessful multilateral efforts at harmonising non-preferential rules of origin at the WTO, Hoekman and Inama (2018) conclude that some progress at reducing the trade-impeding effects of differences in rules of origin across jurisdictions could be achieved by plurilateral initiatives of cooperation under the WTO.

In a recent study, we use a gravity model of bilateral trade to explore indirectly the restrictiveness of different types of PSRs across 128 reciprocal PTAs for the period from 1990 to 2015 (Gourdon et al, 2023).

Data on preference utilisation rates are unavailable for most PTAs, so the effects of PSRs cannot be directly associated with the corresponding amount of trade realised under a specific PTA. Hence, we have to estimate the intensity of bilateral trade flows under different PSRs, controlling for the height of the preferential margin, as in Cadot and Ing (2016).

Assembling PSRs from the World Bank’s Deep Trade Agreement database

We use two PSR categories (‘wholly obtained’ and ‘substantial transformation’) to map PSRs into the seven non-overlapping PSR categories defined in Table 1. The exercise draws on three datasets:

- Bilateral trade flows from CEPII’s BACI database.

- Tariffs from the World Integrated Trade Solutions (WITS) database to derive preferential margins.

- Information about PSRs in PTAs from the World Bank’s Deep Trade Agreement (DTA) database.

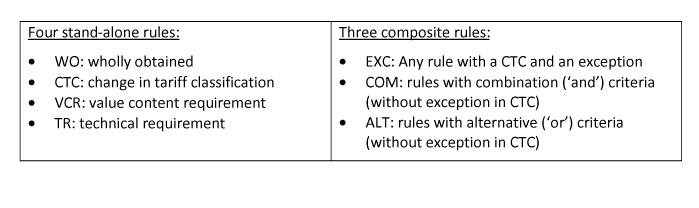

Table 1: Construction of seven mutually exclusive PSR categories

Table 1 lists the seven mutually exclusive categories we designed for this exploration. Stand-alone criteria include the wholly obtained (WO) criterion (that is, all materials entering production of the final good must originate from PTA members) and three others that belong to the substantial transformation criterion (STC), which specifies that the country of origin is the country where the last substantial transformation took place.

STC is further identified by three additional rules: change of tariff classification (CTC) at three levels (chapter, heading and subheading); a value content requirement (VCR); and a technical requirement (TR). Under the VCR, the exported good must reach a threshold percentage value of locally or regionally (that is, among PTA members) produced inputs. A TR requires that an exported product must have undergone specified manufacturing or processing operations, such as a chemical reaction.

The STC criterion is also implemented by composite rules listed on the right-hand side of Table 1. First, the three STC categories – change of chapter (CC), change of heading (CH) and change of subheading (CSH) – are used in existing trade agreements as stand-alone or in combination with other rules (COM) or as alternative rules (ALT). Second, exceptions (EXC) can be attached to a particular CTC rule, generally prohibiting the use of non-originating materials from a particular HS for goods supposed to qualify via a CTC. These seven categories are entered separately along with preferential margins at the HS6 level in panel regressions estimating sources of variations in bilateral trade at the HS6 level.

Product-specific rules of origin are widespread across the harmonised system

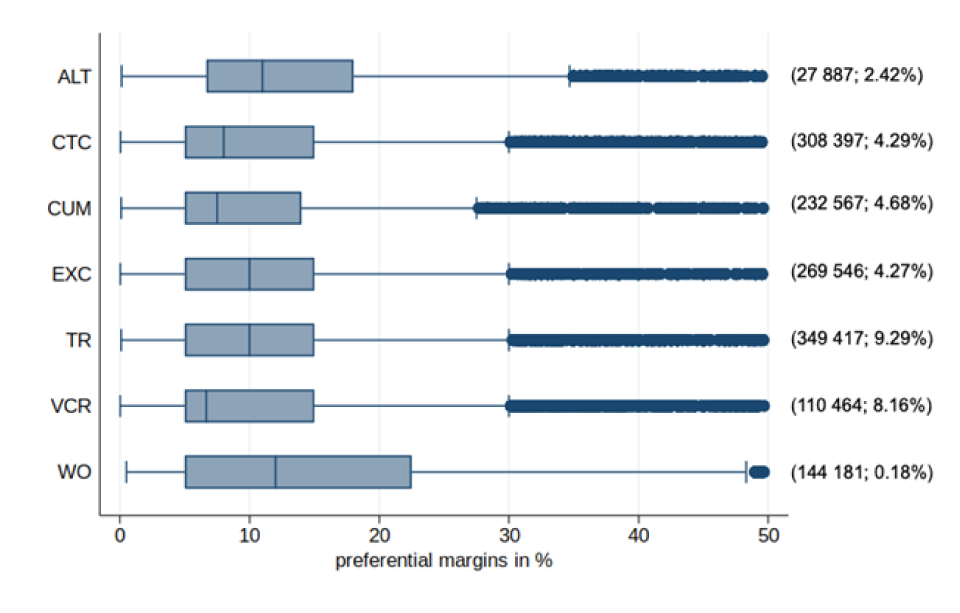

Figure 1 reports the distributions of preference margins across all seven PSR categories. Despite these efforts at clarity, one can only be sure of relative restrictiveness for different values of value-content percentages at the firm level (when percentages are available) and firms share the same technology, and for one classification among stand-alone rules, the CTC (with no exceptions attached): a change of chapter (CC) has higher compliance costs than a change of heading (CH), itself easier to satisfy than a change of subheading (CS), that is, CS ≤ CH ≤ CC across CTC categories.

About half of the observations are in the 5-15% margin range across all PSR categories. The TR and VCR categories are the most dispersed while the WO and ALT categories are the least dispersed. In sum, the seven categories are widespread, being present in all sections, with some sections having simultaneously a high combination of ALT and COM categories, the combination making it difficult to assess the restrictiveness of the PSRs on that product, and even more so at the section level.

Figure 1: Boxplots of preferential margins (in %) by PSR category (all years)

Notes: Total number of observations over the six five-year periods and share of outliers in parentheses. Preferential margins above 50% are excluded (1.2% of observations). Each whisker plot shows the interquartile range with the vertical line representing the 90th percentile. The black line in each box indicates the median of the corresponding distribution. The lines extending from the plots are respectively the upper and lower adjacent values located above the percentiles. The dots outside of the lines are outliers.

Source : Gourdon et al (2023).

The trade elasticity of preference margins is highest for PSRs with choice, least with PSRs requiring several criteria

Cross-section estimates of the correlates of bilateral trade flows at the HS6 level for each five-year period produce several notable patterns:

- First, even at this very disaggregated level, the coefficients on common language, distance, and contiguity carry the expected significant signs with stable coefficient values across years.

- Second, the dummy variable for PTA membership is always significantly positively associated with trade flows, but the coefficient estimate is lower in later years (as expected since applied tariffs fell over time).

- Third, the intensity of bilateral trade flows is both higher than in the control group (trade flows under MFN) and this is positively related to preferential margins.

- Fourth, controlling for preferential margins, except for the CTC dummy, which is prevalent across all HS categories, PSRs are not always correlated with the intensity of trade flows.

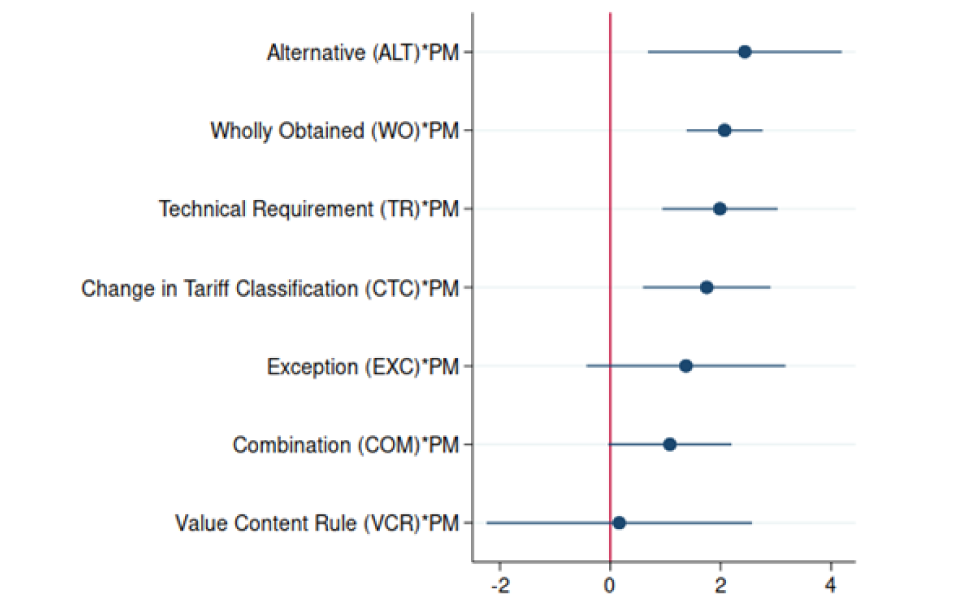

Next, panel estimates of bilateral trade flows over six five-year periods show that the major driver of the positive effects of PTAs arises through the preferential tariff. When changes in preferential margins are interacted across the seven PSR categories, the estimated response is strongest under the ALT rule followed by WO, TR, CTC and COM, while EXC and VCR are insignificant.

The values and rankings are reported in Figure 2. A similar ranking is obtained when the control group is restricted to a smaller sample restricted to trade flows between PTA members. In conclusion, the trade elasticity of preference margins is stronger for PSRs with choice (ALT) while PSRs requiring meeting several criteria (COM) have the lowest elasticity.

Figure 2: PSR responses to an increase in preferential margin

Source: Gourdon et al (2023).

Simulating more flexible PSRs

To quantify the trade effect of simplifying PSRs, we simulate a scenario in which observations with restrictive PSR categories (namely EXC, COM, TR, WO, CTC and VCR) adopt the alternative rule, ALT, arguably the most flexible PSR rule in our classification.

Adopting the more flexible ALT rule in the PTAs in the DTA database would increase bilateral trade under PTA on average by 2.7% during the sample period when using the coefficients of the full sample and by 4% when using the results of estimating the model on the PTA sample.

Controlling for the level of preferential margins, the results show that rules allowing choice between alternatives (ALT) have the strongest positive impact on bilateral trade values, while adopting stricter rules like imposing combinations of different requirements largely annihilate the positive trade effect of granting preferential tariffs.

These results are particularly relevant in the context of trade policy negotiations. In defining PSRs in PTAs, policy-makers should consider moving away from restrictive PSR categories, and thus from those associated with higher compliance costs, towards more flexible ones.

Further reading

Angeli, M, J Gourdon, I Gutierrez and P Kowalski (2020) ‘Rules of Origin’, in Handbook of Deep Trade Agreements edited by Aaditya Mattoo, Nadia Rocha and Michele Ruta, World Bank.

Cadot, O, and LY Ing (2016) ‘How restrictive are ASEAN’s RoOs?’, Asian Economic Papers 15(3): 115-34.

Gourdon, J, D Kniahin, J de Melo and M Mimouni (2021) ‘Harmonising rules of origin for the African continental free trade area’.

Gourdon, J, K Gourdon and J de Melo (2023) ‘A (more) systematic exploration of the trade effect of product-specific rules of origin’, RSCAS Working Papers.

Hoekman, B, and S Inama (2018) ‘Harmonization of rules of origin: an agenda for plurilateral

cooperation?’, East Asian Economic Review 22(1): 3-28. Yalcin, E, and G Felbelmayr (2019) ‘Rules of origin in trade arrangements: Largely unnecessary, simply protectionist’, VoxEU.