In a nutshell

The usage of keywords – ‘corruption’, ‘bribe’, ‘embezzlement’ and ‘fraud’ – in the world’s oldest functioning Persian daily newspaper over six decades provides a measure of changing levels of corruption cases in Iran over time.

When there is a rise reported corruption scandals in Iran, internal conflict increases, as reflected in more newspaper reports of riots, strikes and anti-government demonstrations.

One important channel through which corruption may influence the number of protests is the overall performance of the economy: greater corruption reduces economic growth, which in turn lowers the opportunity costs of engaging in conflict.

Corruption in various forms has been a source of tension in Iran during both the pre- and post-Islamic revolution periods. One recent example is a three-billion-dollar corruption case at a large steel company. The amount of corruption is approximately 38% and 12% of the values of the country’s petroleum exports in 2020 and 2021, respectively.

The role of corruption in fuelling internal protests has been discussed in the international media and public spaces, but there has not been a systematic empirical investigation about this nexus in Iran. Lack of historical data on corruption is one of the factors that have hindered such investigations.

(Internal) conflict matters

Many studies have quantified the economic effects of internal conflict. For example, Collier (1999) shows that during a period of civil war, countries have 2.2 percentage points less economic growth compared with peacetime.

Other case studies have looked at the economic loss resulting from internal and external conflicts. For example, Farzanegan (2022) estimates a $3,000 average per capita loss of income in Iran during the revolution and the war with Iraq. Similar investigations have examined conflicts and economic growth during the Arab Spring: Matta et al (2019) for Tunisia; and Echevarría and García-Enríquez (2019, 2020) for Libya and Egypt.

We are not only interested in tracking conflict based on its significant economic costs: naturally, conflicts also result in significant human losses. Civil conflicts since the Second World War have led to more than 16 million casualties worldwide, far more than the human costs of international conflicts (Arbatlı et al, 2020). Farzanegan (2021) has also quantified the impact of conflict in Iran on the life expectancy of Iranians.

Our study

There are two particular challenges for empirical investigation of corruption and conflict in Iran: historical data on corruption; and the simultaneous relationship between these two concepts. In our new study (Farzanegan and Zamani, 2022), we introduce a new index of corruption based on reports from one of Iran’s main news outlets – Eṭṭelāʿāt (lit. information), which is the oldest functioning Persian daily newspaper in the world (Parvin, 1988). It has a long history of continuous publication and has tried to be an impartial provider of news.

We follow methodology developed by Dincer and Johnston (2017) and Dincer and Teoman (2019) in generating a ‘corruption reflection index’ for Iran from 1962 (the earliest year we could access the archives of Eṭṭelāʿāt) to 2019. Using such historical records, we simulate the possible reaction of internal conflict to an unexpected increase in public corruption based on its reflection in the media.

Our key hypothesis is that the response of Iran’s protest index to positive shocks in the corruption reflection index is positive, ceteris paribus.

Our main measure of internal conflict is based on Domestic Conflict Event Data from the Cross-National Time-Series (CNTS) Data Archive (Banks and Wilson, 2021). It uses the coverage of different events in major international newspapers (for example, the New York Times) and other additional reliable online news reports, reporting events such as assassinations, general strikes, terrorism/guerrilla warfare, major government crises, purges, riots, revolutions and anti-government demonstrations.

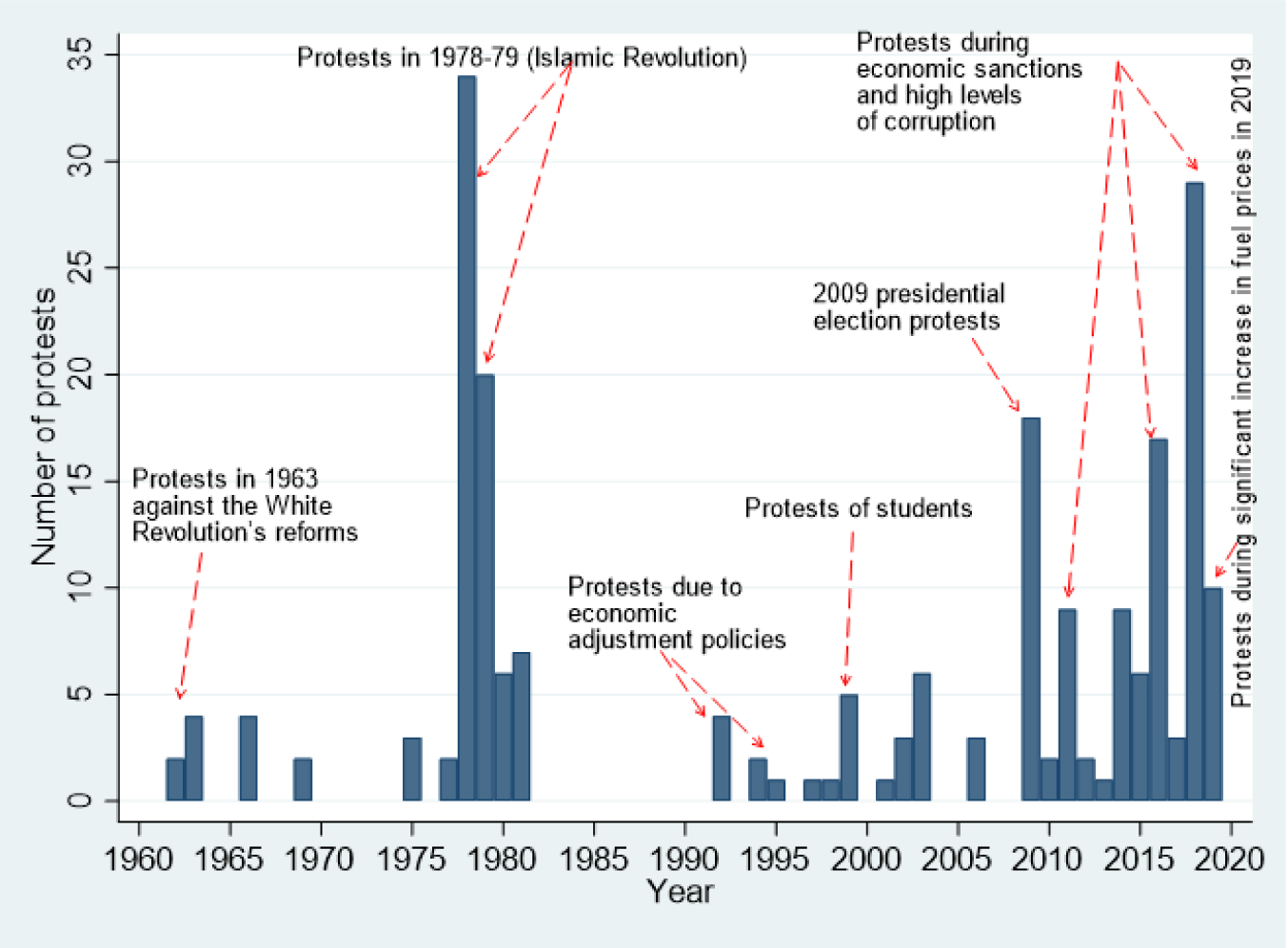

We follow Ishak and Farzanegan (2022) and use the sum of events under riots, strikes and anti-government demonstrations, which have a higher chance of occurring as a response to the institutional performance of a country, generating our news-based protest index. Figure 1 shows the development of protest index in Iran from 1962 to 2019.

Figure 1: Protests in Iran

Source: Number of protests is from Banks and Wilson (2021).

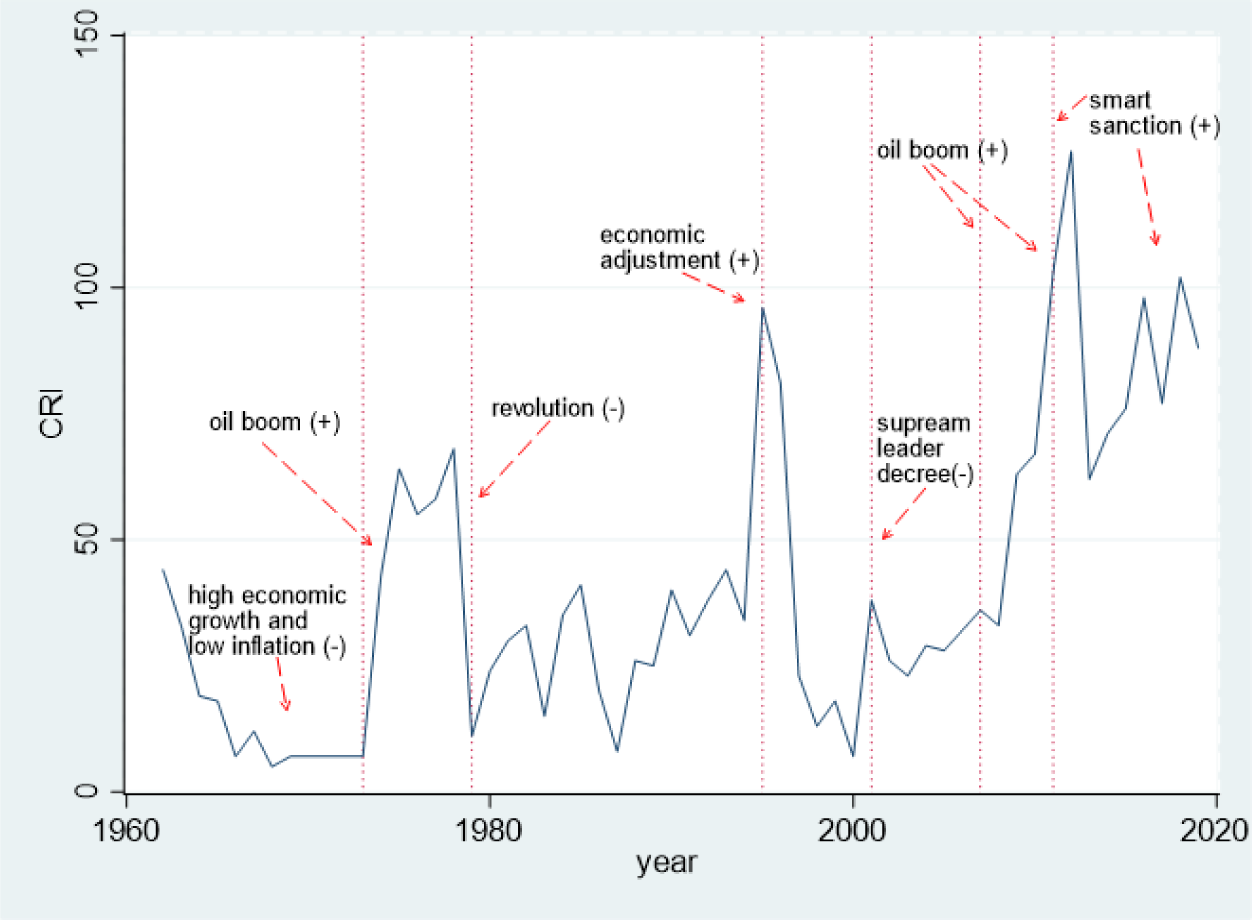

To build our corruption reflection index, we use Ettelā’āt archives, which are digitised from 1961 with every page for each month copied to a CD.

To extract the data, we reviewed each CD per month, which covers all daily prints of the newspaper, for each year from 1962 to 2019. We searched for the Persian keywords related to corruption ‘فساد’, ‘رشوه’, ‘اختلاس’ and ‘کلاهبرداری’ (Persian counterparts for the words ‘corruption’, ‘bribe’, ‘embezzlement’ and ‘fraud’). We included ‘embezzlement’ as a keyword in our research, although Dincer and Johnston (2017) and Dincer and Teoman (2019) did not.

From 1962 to 1990, both keywords ‘bribe’ and ‘fraud’ were the most common in the Ettelā’āt newspaper, but since then, we observe ‘corruption’ and ‘embezzlement’ more in media coverage. We define some criteria to determine which article or text is relevant to our index (more details are in Farzanegan and Zamani, 2022). Figure 2 represents the corruption reflection index from 1962 to 2019 for Iran.

Figure 2: Corruption reflection index in Iran (1962-2019)

Key findings

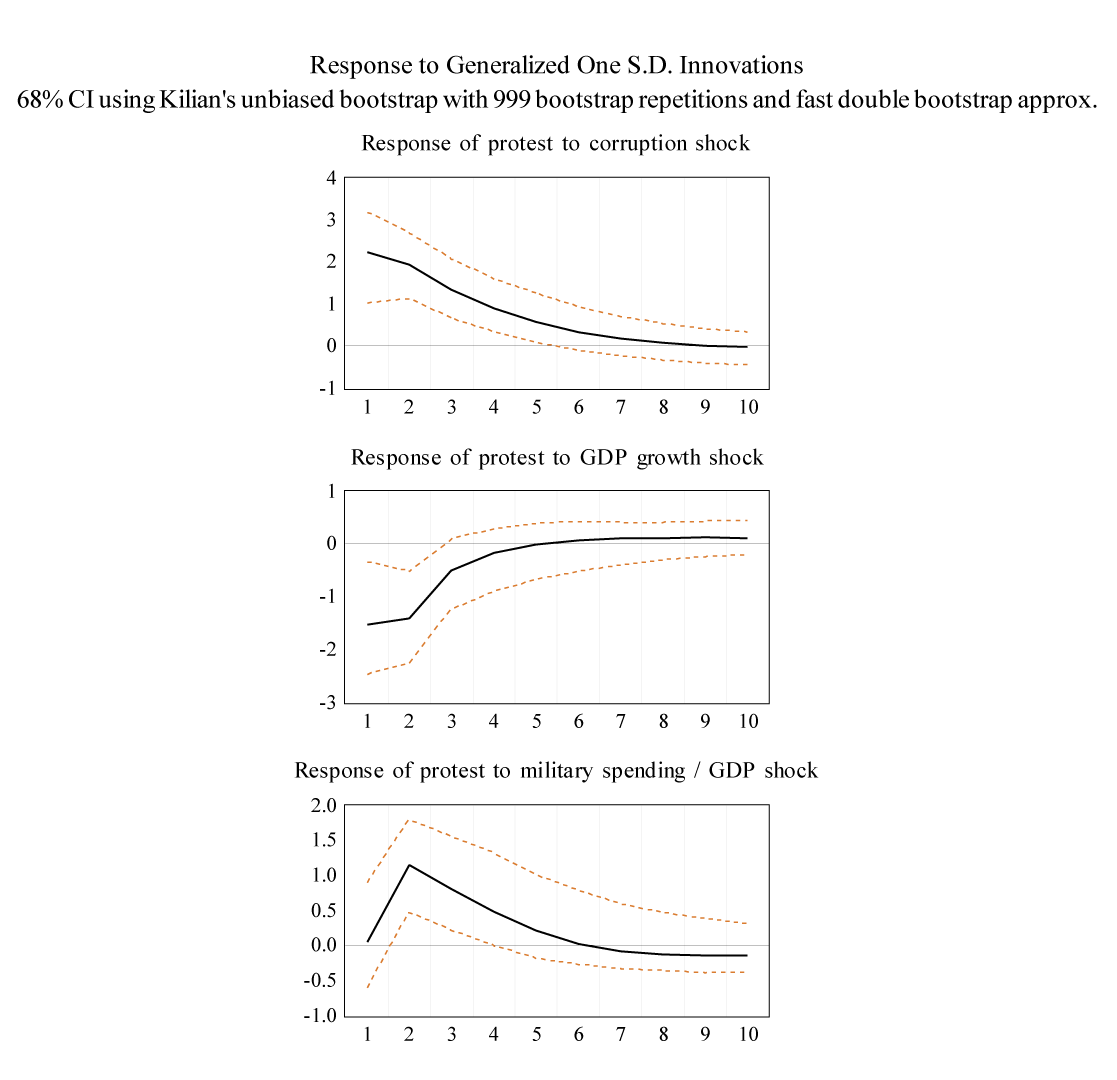

Figure 3 shows that the response of protests to a positive shock in the corruption reflection index is positive and statistically significant for the six years after the initial shock. The size of the short-term response of our counted index of protests is significant given the mean of 3.7 and median number of 1 over the period from 1962 to 2019. This finding supports our main hypothesis of the increasing effect of reported corruption scandals on internal conflict in Iran.

Figure 3: Responses to positive shock in corruption reflection index of Iran

Note: the solid line shows the responses to a shock in corruption. The dashed lines show 68% confidence intervals based on Killian bias-corrected bootstrap intervals. The horizontal axis shows the years after the initial shock. The vertical axis shows the magnitude of the response.

Possible mechanisms

We observe that the response of the inflation rate to the corruption shock is positive and statistically significant. An increase in corruption cases is associated with higher costs of doing business, which may lead to higher production costs. The producers transfer the cost to consumers and thus consumer prices will also increase.

We also find that an increase in inflation by reducing household disposable income reduces the opportunity costs of participating in protests. Although this effect is theoretically plausible, the response of protests to a positive shock in the inflation rate in Iran is not statistically significant. This may be related to the higher costs of participating in protests (for example, high repressive power of the state and severe consequences for the arrested participants), which may exceed the costs imposed on them by higher inflation.

There are two other notable observations. The response of non-military spending to a positive shock in the corruption reflection index of Iran is negative and statistically significant, while the response of military spending is positive and statistically significant. Military projects have lower levels of transparency and lower risk of detection of corruption. They are also prone to more corruption due to higher transaction values.

Further investigation supports our prior expectation that the response of protests to a positive shock in military spending is positive and statistically significant. Increasing military spending is also associated with a decreasing relative share of non-military spending. This is also evident in the negative response of non-military spending to a positive shock in military spending.

One important channel through which corruption may influence the number of protests is overall economic growth. The response of the growth rate of gross domestic product (GDP) to a positive shock in the corruption index is negative for the entire ten years after the shock, which is in line with the ‘sand in the wheels of growth’ hypothesis.

This negative response is statistically significant for the initial six years after the shock. Further investigation shows the significant negative response in the number of protests to a positive shock in economic growth rates. To put it differently, greater corruption reduces economic growth, which in turn lowers the opportunity costs of engaging in conflict.

In Figure 4, we summarise the significant responses of protests to positive shocks in key variables (corruption, economic growth and military spending share in GDP).

Figure 4: Response of protest variable to shocks in relevant variables

Conclusion

Our study introduces a new index of corruption using media coverage in Iran over the past 60 years. It is the first news-based index of corruption for Iran. We examine how protests in Iran – which is the sum of events such as riots, strikes and anti-government demonstrations – are interconnected with corruption within Iranian society, controlling for other channels. We show that the response of domestic protests to a positive shock in corruption cases is positive and significant.

Further reading

Arbatlı, CE, QH Ashraf, O Galor and M Klemp (2020) ‘Diversity and conflict’, Econometrica 88: 727-97.

Collier, P (1999) ‘On the economic consequences of civil war’, Oxford Economics Papers 51(1): 168-83.

Dincer, O, and M Johnston (2017) ‘Political culture and corruption issues in state politics: a new measure of corruption issues and a test of relationships to political culture’, Publius: The Journal of Federalism 47: 131-48.

Dincer, O, and O Teoman (2019) ‘Does corruption kill? Evidence from half a century infant mortality data’, Social Science & Medicine 232: 332-39.

Echevarría, CA, and J García-Enríquez (2019) ‘The economic consequences of the Libyan Spring: A synthetic control analysis’, Defence and Peace Economics 30(5): 592-608.

Echevarría, CA, and J García-Enríquez (2020) ‘The economic cost of the Arab Spring: The case of the Egyptian revolution’, Empirical Economics 59: 1453-77.

Farzanegan, MR (2021) ‘Years of life lost to revolution and war in Iran’, CESifo Working Paper No. 9063.

Farzanegan, MR (2022) ‘The economic cost of the Islamic revolution and war for Iran: synthetic counterfactual evidence’, Defence and Peace Economics 33: 129-49.

Farzanegan, MR, and R Zamani (2022) ‘The Effect of Corruption on Internal Conflict in Iran Using Newspaper Coverage’, Defence and Peace Economics (in press).

Ishak, PW, and MR Farzanegan (2022) ‘Oil price shocks, protest, and the shadow economy: is there a mitigation effect?’, Economics & Politics 34: 298-321.

Matta, S, S Appleton and M Bleaney (2019) ‘The impact of the Arab spring on the Tunisian economy’, World Bank Economic Review 33(1): 231-58.

Parvin, N (1998) EṬṬELĀʿĀT, Encyclopædia Iranica Foundation.