In a nutshell

Embracing digital technologies in MENA financial systems is important to expand financial inclusion, to enhance access to finance and to improve the efficiency of traditional financial intermediaries.

Peer-to-peer platforms, crowdfunding and distributed ledger technology could help to unleash the economic potential of the region.

Governments need to build the right environment in terms of legal and regulatory frameworks, institutions, incentives and capacity-building.

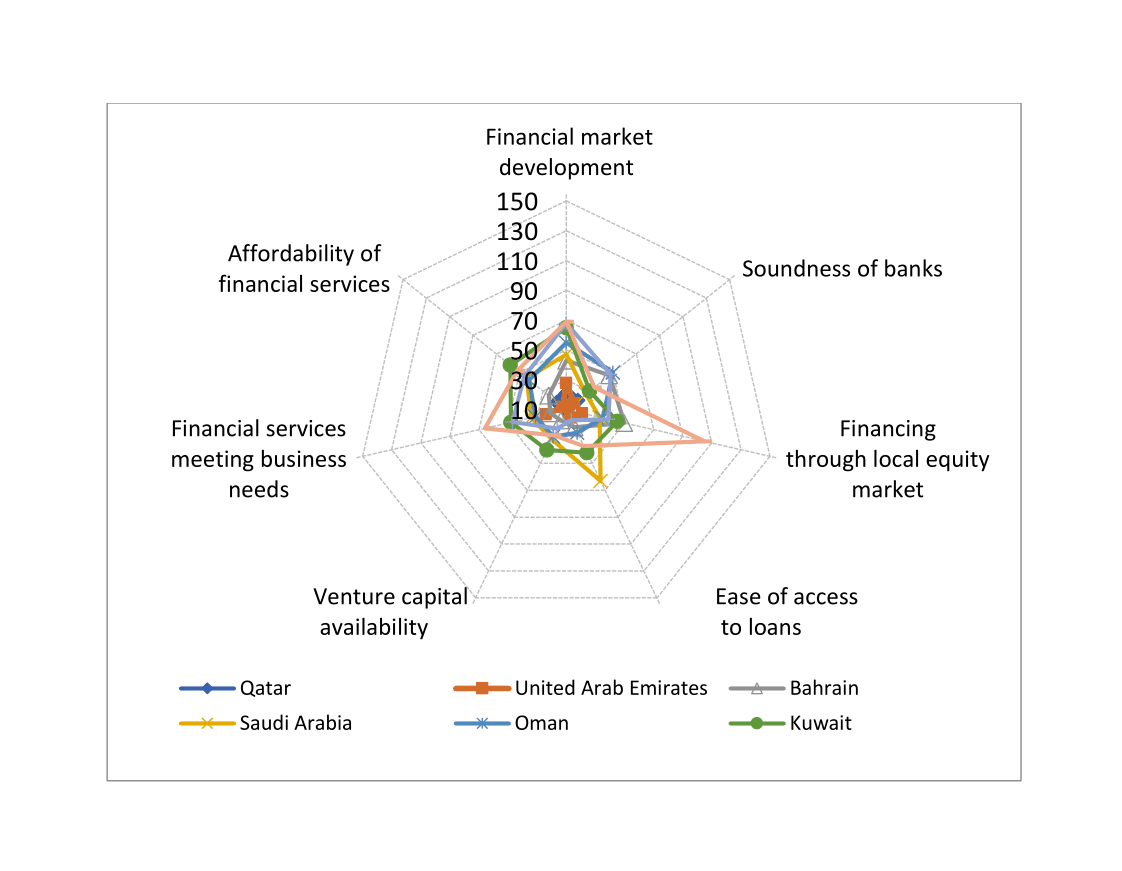

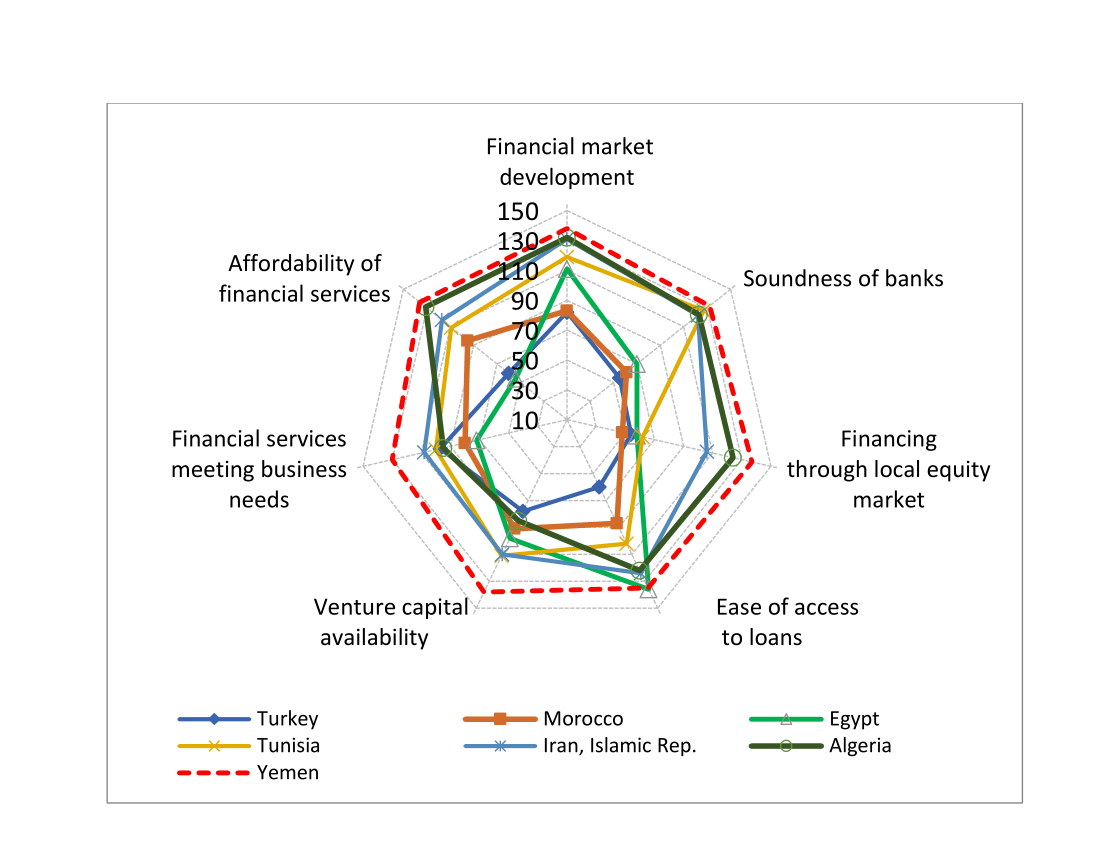

MENA countries have improved their financial systems in recent decades, but most of them are still distant from best practices at the international level. Bearing in mind that financial development encompasses not only the effectiveness of financial intermediation and markets but also the degree of accessibility to capital and financial services, the Global Competitiveness Index ranking gives a good indication of the situation in the region. Figures 1a and 1b distinguish two groups of countries:

- The first group – which includes Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) – is in the top half of the 155 assessed countries.

- The second group – which includes Algeria, Egypt, Iran, Morocco, Tunisia, Turkey and Yemen – is poorly ranked according to most sub-pillars – ‘affordability of financial services’, ‘financial market development’, ‘soundness of banks’, ‘financing through local equity market’, ‘ease of access to loans’ and ‘venture capital availability’.

Digital technologies in the financial arena

In many countries, the emergence of new digital channels of financial services provision is increasingly disrupting the financial system. Indeed, the application of digital technologies in the financial arena is covering the whole spectrum of services that have previously been offered solely by financial intermediaries.

Payments, savings, insurance, financing, asset management and advice are all now possible through innovative digital channels, automated processes and decentralised networks enabled by the conjunction of advances in distributed computing, artificial intelligence, cryptography and a mature mobile money infrastructure (He et al, 2017).

The World Bank (2014) report for the G20 emphasises the opportunities offered by the digital financial channels: ‘rapid development and extension of digital platforms and digital payments can pro¬vide the speed, security, transparency, and cost efficiency needed to increase financial inclusion at the scale required to achieve G20 goals’.

CGAP (2015) argues that these innovative financial channels are driving down transaction costs, expanding customer choice, increasing customer engagement and helping financial services providers to develop a better understanding of the risk profile of potential customers.

The study adds that the growth of smartphone penetration and the maturing of the mobile money infrastructure will support access to finance for the poor in developing economies in the near term. To catalyse these channels, the study recommends increased commitment by stakeholders, new partnership models, deeper customer understanding and better regulatory environments to enable mobile money platforms and to expand the use of new technologies.

Crowdfunding: an innovative financial channel

Crowdfunding is an internet-enabled channel to raise funds for artisans, entrepreneurs and early-stage enterprises. It emerged during the financial crisis of 2008 in reaction to the credit crunch. The large-scale adoption of information and communication technologies and the development of social networks enabled the online collection of funds in the form of donations or investment by numerous people.

In 2014, it is estimated that US$16.2 billion was raised globally by crowdfunding. In 2015, the equivalent figure was US$34 billion, comprising P2P (peer-to-peer) lending (US$25 billion), reward and donation crowdfunding (US$5.5 billion) and equity crowdfunding (US$2.5 billion).

The InfoDev (2013) report notes that crowdfunding could help developing countries to alleviate the constraints on entrepreneurial finance by facilitating access to capital for small and medium-sized enterprises, cultivating high-growth entrepreneurs, supporting access to export markets and catalysing flows of capital within and between communities.

Financial systems and digital technologies

To develop their financial systems further, the MENA countries should leverage the benefits of the digital technologies while mitigating potential risks.

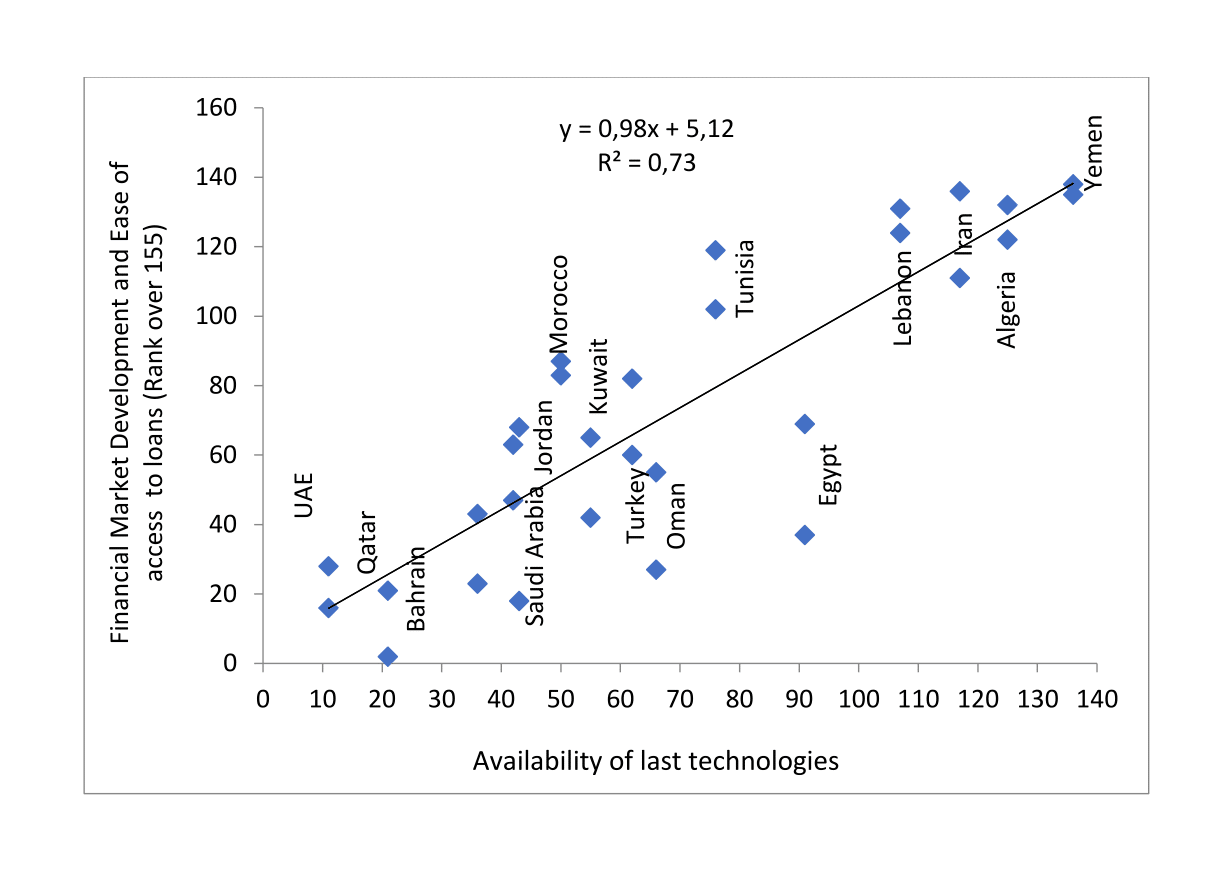

The strong relationship between the availability of the latest technologies and the development of financial markets in MENA is illustrated in Figure 2. It is clear that the first group of countries, which is endowed with a more developed financial system (here captured through the indicators ‘financial market development’ and ‘ease of access to loans’) performs better in terms of the availability of the latest digital technologies.

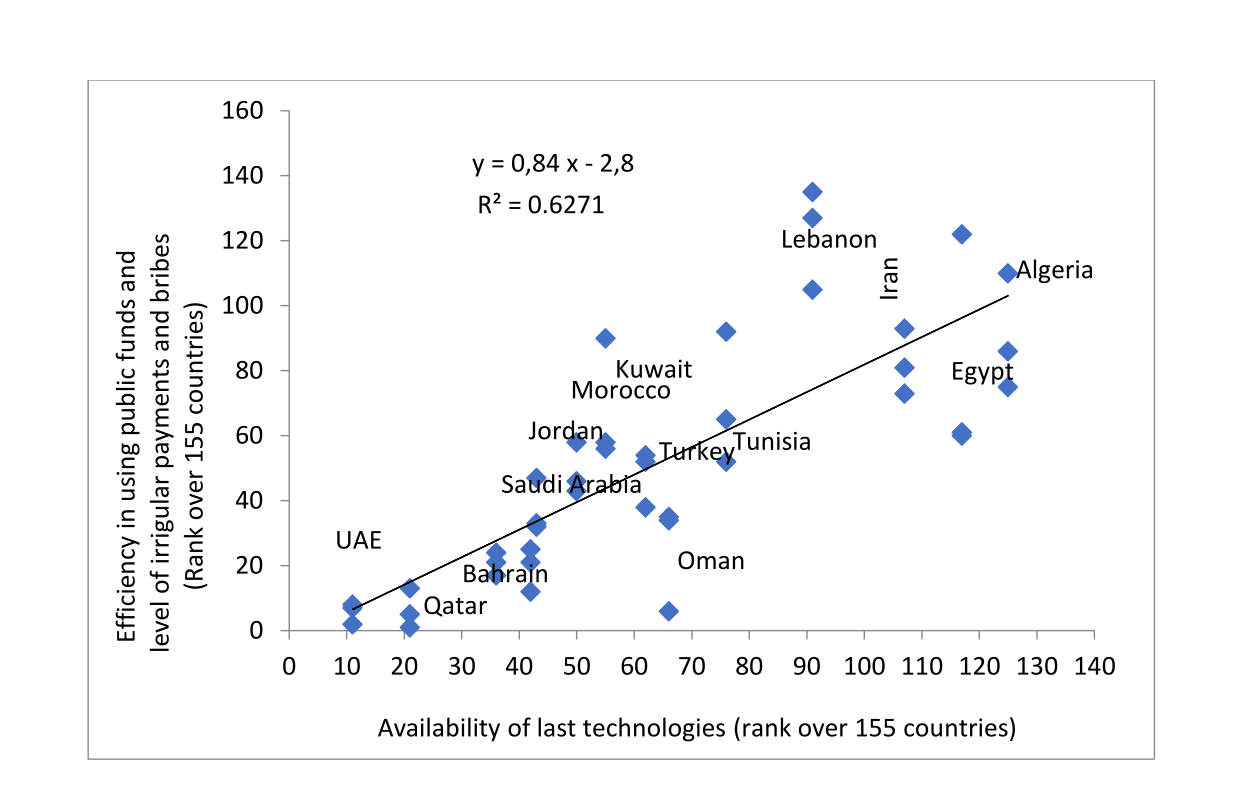

Figure 3 shows that better availability of the latest digital technologies is also strongly positively correlated with efficiency in the use of public funds and reduced scope for irregular payments and bribes.

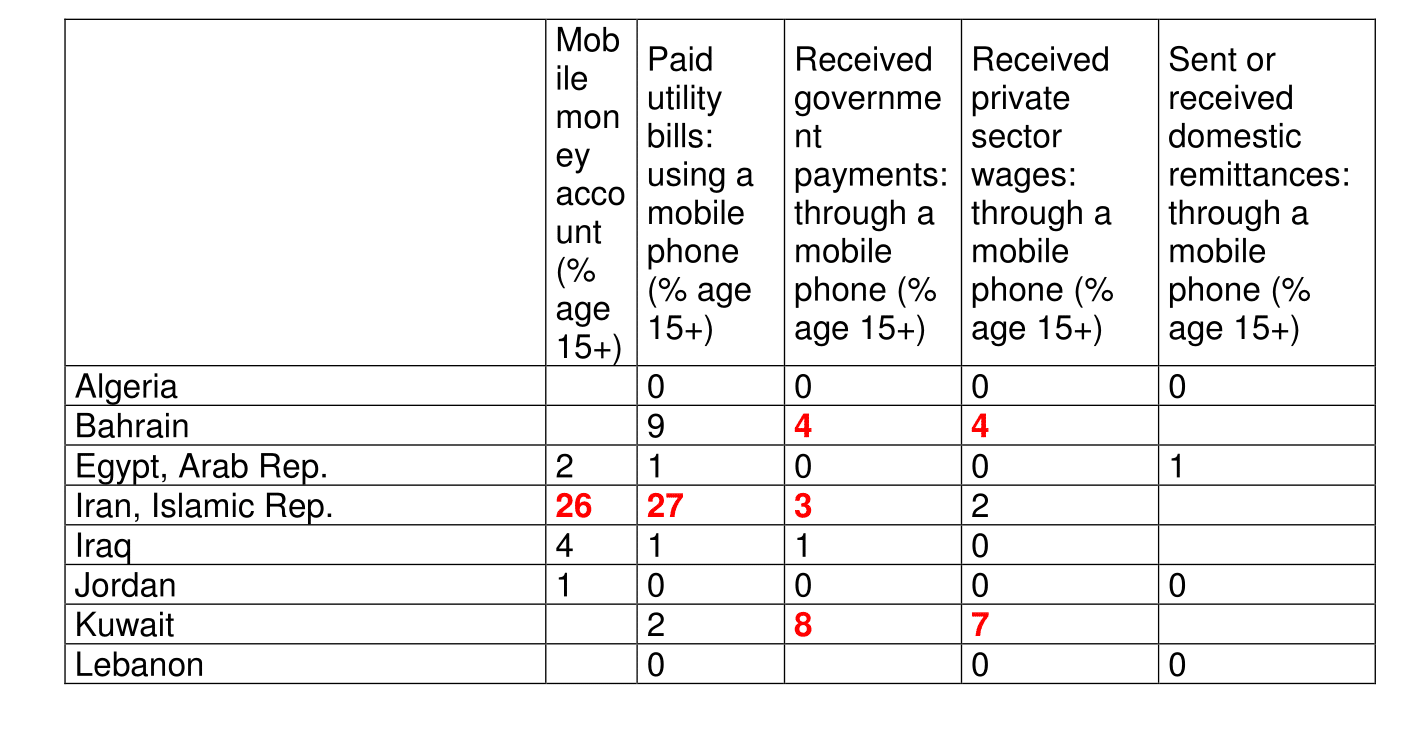

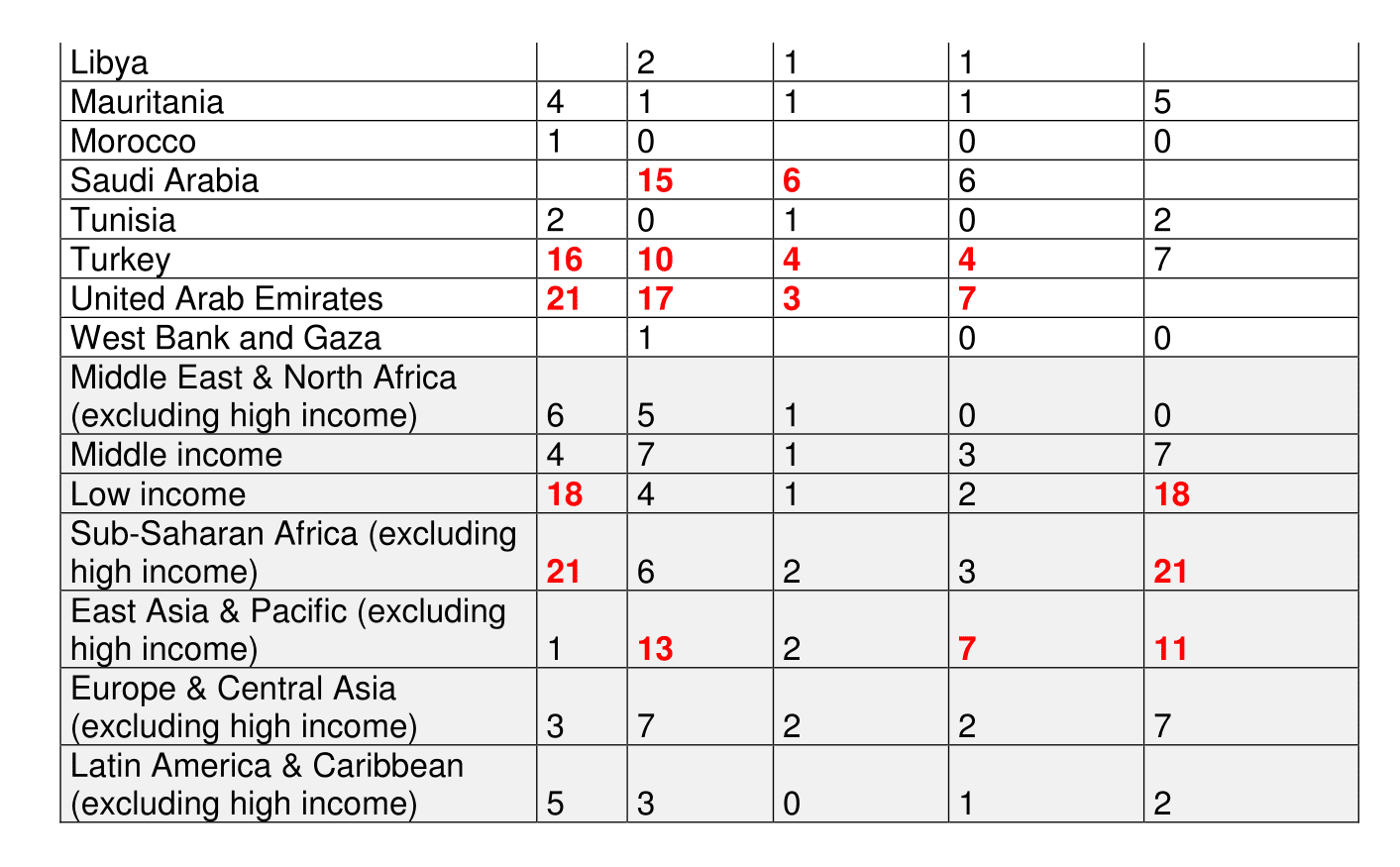

Table 1 presents the intensity of use of mobile money operations in 16 MENA countries and some other regions. Unfortunately, with the exception of a few countries, this digital channel is still underdeveloped in the MENA region compared with other regions, including sub-Saharan Africa. MENA governments could rapidly benefit from these mature technologies to improve financial inclusion and to target subsidies and social transfers (and thereby improve the efficiency of public expenditure and reduce public deficits).

Embracing digital technologies to unleash MENA’s economic potential

Embracing digital technologies in the financial systems of MENA countries is important to expand financial inclusion, to enhance access to finance and to improve the efficiency of traditional financial intermediaries. P2P platforms, crowdfunding (equity and donation-based), smart contracts and distributed ledger technology (such as blockchain) could help to unleash the economic potential of these countries.

To catalyse this potential, to ensure its sustainability and to mitigate the various risks associated with digital financial channels, the governments should build the right environment in terms of legal and regulatory frameworks, institutions, incentives and capacity-building.

In addition, without fair competition and incentives for continuous innovation, the positive disruption effects will be difficult to realise. Fortunately, there are positive signals emerging since 2017 in the region with countries trying to develop the right ecosystem for the ‘fintech’ (financial technology) industry.

For example, in 2017, the Dubai International Financial Centre of the UAE launched the Middle East’s first fintech accelerator; and Bahrain joined a partnership with the incubator Singapore Fintech Consortium to create a fintech ecosystem and a regulatory framework.

Another promising development in the region is the conjunction of the growth of the Islamic finance industry with emerging fintech start-ups. Indeed, the growth of Islamic finance has been rapid at 10-12% annually over the past two decades. By 2015, the industry had surpassed US$1.88 trillion in size.

Finally, MENA central banks should embrace the digital technologies and initiate pilot projects based on distributed ledger technology at the level of their national interbank money market. In the medium term, it might be beneficial to create a ‘central bank digital currency’ to improve peer-to-peer exchanges, couple it with mobile banking and microfinance services, and unleash the potential of fintech products.

One ambitious project is the creation of a cryptocurrency at the MENA or Organization of Islamic Cooperation (OIC) regional level by a multilateral development institution with the objective of promoting South-South cooperation in trade and investment. More details about this proposal are in Nabi et al (2014), which suggests the creation of a cryptocurrency based on intra-OIC trade and investment.

Further reading

CGAP (2015) ‘Global Landscape of Innovations in Digital Finance’.

Demirguc-Kunt, A, and L Klapper (2018) ‘Measuring Financial Inclusion: The Global Findex Database’, World Bank.

He, D, R. Leckow, V Haksar, T Mancini-Griffoli, N Jenkinson, M Kashima, T Khiaonarong, C Rochon and H Tourpe (2017), ‘Fintech and Financial Services: Initial Considerations,’ IMF Staff Discussion Note SDN/17/05.

InfoDev (2013) ‘Crowdfunding’s Potential for the Developing World’, Finance and Private Sector Development Department, World Bank.

Nabi, MS, R Abdelkafi, I Drine and S Al-Suwailem (2014) ‘Enhancing Intra-trade in OIC Member Countries through T-SDRs’, Islamic Economic Studies 23(1): 101-24.

World Bank (2014) ‘The Opportunities of Digitizing Payments’, report by L Klapper and D Singer, World Bank Development Research Group.

World Economic Forum (2017a) ‘Global Competitiveness Index Historical Dataset 2007-2016’.

World Economic Forum (2017b) ‘Networked Readiness Index Historical Dataset 2012-2016’.

Figure 1a:

The financial development ranking of MENA countries (best performing group)

Figure 1b:

The financial development ranking of the MENA countries (worst performing group)

Source: World Economic Forum, 2017a

Figure 2:

Availability of latest technologies, development of financial markets and access loans

Figure 3:

Misuse of public funds, irregular payments and bribes

Sources: World Economic Forum 2017a, 2017b

Table 1:

Intensity of use of mobile money operations in MENA and other regions

Source: Demirguc-Kunt and Klapper, 2018