In a nutshell

No fuel subsidy in Egypt is pro-poor, but the subsidy on liquefied petroleum gas is progressive in the sense that it reduces inequality.

Decreasing the subsidy on bread to increase the subsidy on wheat would benefit the bottom four fifths of the population.

Although many of the reforms implemented by the Egyptian government seem to move in a socially improving direction, more research is needed to assess the overall impact.

There is widespread agreement that development policies should aim to promote inclusive growth. This consensus takes the view that focusing on the distributive aspect of economic growth should be central to the elaboration of economic policies.

In this context, one may wonder why we should consider equity or inequality in the formulation of public policies. There are many reasons underlying this approach. A fundamental reason for aiming to reduce inequality is linked with the intrinsic value of equality for anyone who believes that everyone is created equal.

But even if a policy-maker does not want to account for the inherent value of reducing inequality, there are two additional reasons for a more inclusive economic policy:

- First, a low level of inequality may help to promote economic growth. Berg and Ostry (2017) argue that empirical evidence points to the fact that a low level of inequality is as important as low inflation, a sustainable public budget and financial regulation in maintaining sustainable high levels of economic growth.

- Second, there is substantial evidence that there may be a link between polarisation in the distribution of income and social unrest (see Esteban and Ray, 1999, 2008). In this context, having a more equitable distribution of economic outcomes can be instrumental in protecting a country’s stability.

A policy-maker has many potential channels for reducing inequalities and improving social justice. If one wants to reduce inequality in the long run, essential policies include aiming to reduce inequalities of opportunity, such as investment in high-quality public education and health systems, and aiming to reduce gender, ethnic and sectarian discrimination.

The most important channel for reducing inequality in the short run is direct taxation of income and direct transfer programmes aimed at increasing the income of the poorest. One may also want to complement the reduction of inequality in the short run by using indirect taxation and subsidies (that is, taxing and/or subsidising consumption).

Each policy channel has its benefits and efficiency costs. A sensible economic policy consists of using a combination of all these channels.

For institutional and historical reasons, countries of the Middle East and North Africa (MENA) have relied mostly on consumption subsidies for reducing inequality. According to Sdralevich et al (2014), MENA countries spent US$237 billion in 2011 on such subsidies. That amount represents 8.6% of the region’s total GDP and 48% of total world subsidies.

Most importantly, it represents 22% of government spending in the area. Since these numbers were on the rise in later years and given the importance and magnitude of these ‘redistributive’ programmes, many economists and international institutions have pushed for reforms.

Subsidies in Egypt

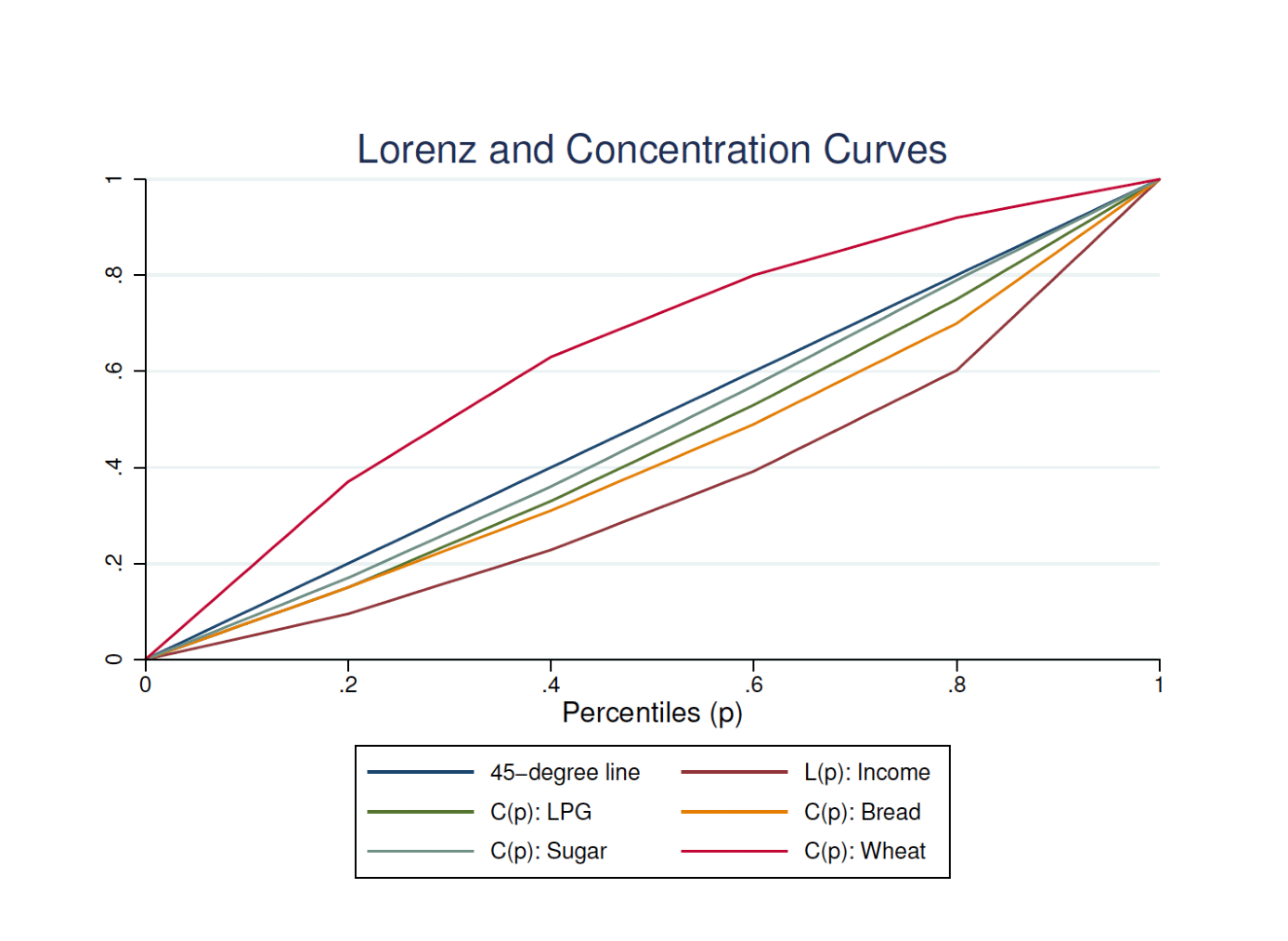

When assessing the redistributive performance of subsidy programmes, one needs first to look at the distribution of the benefits of the programme among the population using a concentration curve and to compare it with the Lorenz curve of income.

Figure 1 depicts the Lorenz curve and the concentration curves for fuel subsidies in Egypt. The concentration curves are built using information from Sdralevich et al (2014) in which they use pre-reform survey data. The concentration curve displays the cumulative proportion of government spending on an item that brings benefits to the x% poorest in the population.

The Lorenz curve is built using information on quintiles from the World Bank Open Data website. It displays the cumulative share of total income earned by the x% poorest in the population.

When a concentration curve is located above the 45-degree line, the subsidy is considered to be pro-poor. But even if a concentration curve is below the 45-degree line, a subsidy may still reduce inequality if the concentration curve is located above the Lorenz curve.

Figure 1 indicates that although no fuel subsidy in Egypt is pro-poor, the subsidy on liquefied petroleum gas is progressive in the sense that it reduces inequality. All other fuel subsidies are regressive. This means that these public spending items increase the level of inequality in Egypt.

Figure 2 depicts the Lorenz curve and concentration curves for the liquefied petroleum gas subsidy and food subsidies in Egypt. The concentration curves are built using pre-reform information from Sdralevich et al (2014). All food subsidies are progressive since all concentration curves are above the Lorenz curve. In addition, the subsidy on sugar is more progressive than the subsidy on liquefied petroleum gas; the subsidy on wheat is pro-poor.

Subsidy reforms in Egypt

Research on marginal tax reforms points to the fact that the distribution of the benefits of subsidies may be used to identify directions for marginal tax reforms (see Yitzhaki and Slemrod, 1991; Makdissi and Wodon, 2002; Duclos et al, 2008). The intuition drawn from this body of evidence is that it would be socially desirable to transfer public funding from subsidies of goods with lower concentration curves to subsidies on goods with higher concentration curves.

It appears clear from Figures 1 and 2 that a transfer from fuel subsidies to food subsidies would be desirable. Although a complete assessment requires some in-depth analysis, we can still have a first take on the reforms by looking at the two figures.

Egypt started reforming its subsidy system slowly in 2012 by increasing gasoline prices. This was followed by an increase of 16% of electricity prices in 2013. These reforms have certainly reduced inequality.

According to Banerjee et al (2017), fuel subsidies represented 22% of the total Egyptian government budget in 2012, compared with 9% in 2002. These subsidies represented 7% of total Egyptian GDP and only 17% of them benefitted household consumption.

To give an idea of the magnitude of this programme, the combined spending of the Egyptian government on education and health represented 5% of GDP, food subsidies represented 2% of GDP, food ration cards represented 0.5% of GDP and direct transfers to the poor represented 0.17% of GDP.

In July 2014, the Egyptian government started deeper reforms of public expenditure. The prices of all fuels (except for liquefied petroleum gas) were increased, with 53% of all savings allocated to health, education and social protection programmes. At first sight, it seems that the reforms are going in the right direction. Since September 2016, the government increased the price of fuels and increased subsidies on food. These reforms also seem to point in the right direction.

At the same time, VAT has been introduced. Depending on the distribution of expenditure on goods that are excluded from the VAT, this measure can be socially desirable or not. The same applies to the increase in the metro ticket price. The capital gain tax freeze for three years is almost certainly regressive.

Although we do not have information on the distribution of their expenditure, increases in the subsidies on infant formulas and paediatric medicines are probably progressive. The expansion of coverage of the Takaful (conditional cash transfers to poor families with school age children) and Karama (non-conditional cash transfers to poor elderly, disabled and orphans) programmes, the introduction of free meals in school and the new gas connections in poor areas are undoubtedly progressive.

Referring to the concentration curve in Figure 2, some future reforms reallocating the funding between food items may be socially beneficial. For example, applying a methodology proposed by Duclos et al (2008), decreasing the subsidy on bread to increase the subsidy on wheat would benefit the bottom four fifths of the population even if 24% of the amount saved on bread is allocated to deficit reduction.

Although many of the reforms implemented by the Egyptian government seem to move in a socially improving direction, more research is needed to assess the overall impact of these changes because these reforms were not marginal.

It would also be important to evaluate the effect of these and future reforms on the degree of polarisation in Egyptian society between rich and poor. Since reducing polarisation is usually linked with more political stability, this would be a topic of interest for many policy-makers. Makdissi and Mussard (2011) propose a framework for identifying directions for polarisation-reducing tax reforms, but more theoretical as well as empirical research is needed on this issue.

Further reading

Banerjee, SG, H El Laithy, P Griffin, K Clarke and M Hallouda (2017) ‘Energy Subsidies and the Path Toward Sustainable Reform in the Arab Republic of Egypt’, in The Quest for Subsidy Reforms in the Middle East and North Africa Region edited by P Verme and A Araar, Springer.

Berg, AG, and JD Ostry (2017) ‘Inequality and Unsustainable Growth: Two Sides of the Same Coin?’, IMF Economic Review 65: 792-815.

Duclos, J-Y, P Makdissi and Q Wodon (2008) ‘Socially-improving Tax Reforms’, International Economic Review 49: 1505-37.

Esteban, JM, and D Ray (1999) ‘Conflict and Distribution’, Journal of Economic Theory 87: 379-415.

Esteban, JM, and D Ray (2008) ‘Polarization, Fractionalization and Conflict’, Journal of Peace Research 45: 163-82.

Makdissi, P, and S Mussard (2011) ‘Rank Dependant Measures of Bi-polarization and Marginal Tax Reforms’, in The Measurement of Individual Well-Being and Group Inequalities: Essays in Memory of ZM Berrebi edited by J Deutsch and J Silber, Routledge.

Makdissi, P, and Q Wodon (2002) ‘Consumption Dominance Curves: Testing for the Impact of Indirect Tax Reforms on Poverty’, Economics Letters 75: 227-235.

Sdralevich, C, R Sab, Y Zouhar and G Albertin (2014) Subsidy Reform in the Middle East and North Africa. Recent Progress and Challenges Ahead, Middle East and Central Asia Department, IMF.

Yitzhaki, S, and J Slemrod (1991) ‘Welfare Dominance: An Application to Commodity Taxation’, American Economic Review 81: 480-96.

Figure 1:

Fuel subsidies in Egypt

Source: My own rough estimates using the World Bank Open Data and information from Sdralevich, et al, 2014

Figure 2:

Food subsidies in Egypt

Source: My own rough estimates using the World Bank Open Data and information from Sdralevich, et al, 2014