In a nutshell

Trade reform in the Arab region that still focuses mainly on tariff reduction will have limited growth benefits.

But if governments reduce or abolish the widespread non-tariff measures (NTMs), particularly through the elimination of quantitative trade restrictions, trade policy can become the central instrument for redressing the growth prospects of Arab countries.

Strong policy actions to address the coverage and persistence of NTMs by Arab countries will allow the realisation of expected gains from greater integration in the regional and global economy.

Over the past 20 year, the global economic community has made immense progress in reducing tariffs and other direct barriers to trade – both globally, under the auspices of the World Trade Organization (WTO); and regionally, through bilateral and regional trade agreements.

While there has been something of a regression in attitudes towards multilateralism, regional integration and trade are still viewed as clear avenues for growth and development. Yet despite previous progress, international trade is still hampered by non-tariff measures (NTMs).

These measures include non-tariff barriers (NTBs), those that are voluntarily implemented to reduce trade, and technical barriers, which include sanitary and phytosanitary standards. In general, the latter are standards not ‘formally’ designed to reduce trade, although in many cases they function as such.

NTMs usually add general hindrances to trade, including quantifiable economic costs. Findings across many quantitative studies confirm that NTMs contribute much more than tariffs to the overall level of trade restrictiveness. It is therefore imperative that their impact on trade and overall economic activity receives greater attention and more thorough analysis.

A major restriction on undertaking such analysis has been the availability of data on NTMs, mainly in terms of detailed information on standards, regulations and business practices. Given that countries have varied measures and classifications, collecting and comparing such information has been challenging.

Here, we summarise the findings of a comprehensive review of NTMs in the Arab region and their corresponding ‘ad-valorem equivalents’ (AVEs) of tariffs.

The structure and burden of NTMs

The classification of the NTMs that we use has been extensively discussed and agreed by several international organisations that form what was called the Multi-Agency Support Team for the Group of Eminent Persons on NTBs established by UNCTAD in 2006. Over the period 2007 to 2012, the classification was tested in the field for data collection, with the first version published in 2013.

The classification evolves in response to the reality of international trade and data collection needs. It comprises technical measures, such as sanitary or environmental protection measures, as well as others traditionally used as instruments of commercial policy – for example, quotas, price controls, export restrictions or contingent trade protective measures.

Also included are other ‘behind-the-border’ measures, such as competition, trade-related investment measures, government procurement or distribution restrictions. But this classification does not make judgements about legitimacy, adequacy, necessity or discrimination of any form of policy intervention used in international trade. Rather, it acknowledges their existence and is designed to organise information in a database format.

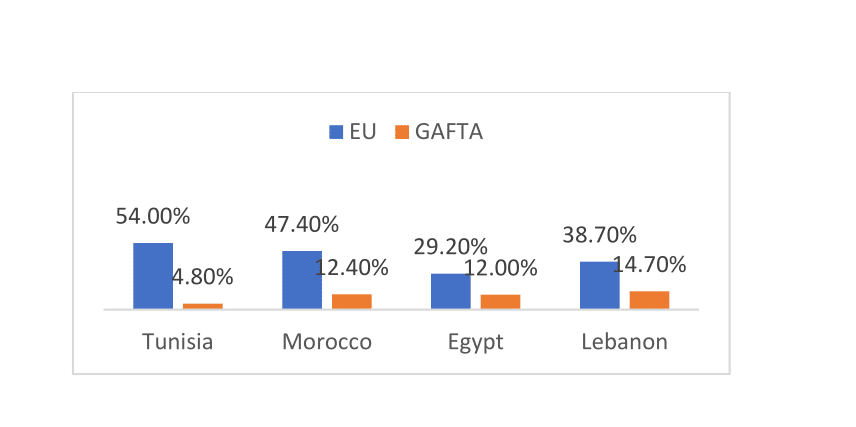

Transparent, reliable and comparable information can contribute to an understanding of the phenomenon and help exporters worldwide to access information, as is the case with tariff analysis. The World Integrated Trade Solutions (WITS) database provides details on NTMs in four Arab countries – Egypt, Lebanon, Morocco and Tunisia.

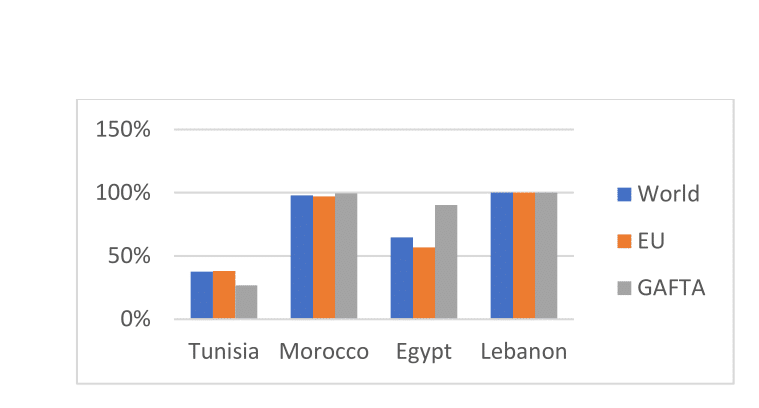

These four countries feature varying coverage of NTMs across their import portfolios. As Figure 1 shows, these can range from 20% to 100% of import values – as measured at the level of ‘harmonised system’ (HS) product codes – being subject to at least one NTM, depending also on the region of origin.

For most countries, measuring NTM coverage by product code does not differ significantly from measuring by total value of imports:

- Tunisia has the lowest relative rate of coverage of imports (in value terms) by NTMs.

- In Egypt, which trades more with the Arab region than most other Arab countries (see Figure 2), around two-thirds of its imports by value are subject to one or more NTM. But intra-Arab imports face comparatively higher NTMs (90% versus 57% for the EU), although the situation is less stark while still restrictive when measured by HS code.

- Morocco and Lebanon feature nearly complete NTM coverage of imports by product code, with the EU dominating their import portfolios. This means that all imports of Morocco and Lebanon were subject to one or more NTMs in 2012 at the product line level.

Examining the exact number of NTMs faced at product line level supplements information on general NTM coverage by indicating how complex and burdensome the environment is for any given import:

- For Tunisia, the number of NTMs per product line illustrates a very complicated trade clearance process, with an average of 12 NTMs per line.

- The NTM structure of Morocco does appear simpler, with fewer NTMs faced per product line (nine or below for 85% of products).

- In Egypt, most goods face even fewer NTMs, with 89% of HS lines facing no more than six.

- Lebanon performs the best, with 85% of goods at the HS-6 level facing only four NTMs.

Thus, the fact that most goods are subject to at least one NTM indicated in Figure 1 does not necessarily translate into an overly burdensome environment for trade. But countries with fewer imports subject to NTMs may be masking a plethora of restrictions facing certain goods.

Once NTMs are disaggregated into categories – technical, non-technical and export measures – varying performances can be seen:

- Over two-thirds of NTMs in Tunisia and Egypt are technical in nature, with 20% or fewer being non-technical, and export measures accounting for under 10% of total measures.

- Over two-thirds of Moroccan NTMs and nearly all NTMs in Lebanon are non-technical. Of the nine different non-technical measures, the ‘charges, taxes and other para-tariff measures’ sub-category is particularly driving this performance in these two countries.

- The largest sectoral coverage of NTMs is in textiles and clothing for three of the four countries, reflecting the importance of these sectors in many Arab countries and the propensity to protect them.

- In Tunisia, the largest number of NTMs is on agricultural goods, including animal, vegetable and food products, which account for half of tariff lines subject to NTMs and nearly two-thirds of all Tunisia’s NTMs.

- Morocco and Lebanon also feature many NTMs in chemicals, machinery and electrics.

- In Egypt, while textiles and clothing feature the largest number of NTMs, there are also many in animal and chemical products.

Ad-valorem equivalents of NTMs

There are two main empirical approaches to estimating ad-valorem equivalents (AVEs) of NTMs – a price-comparison and quantity-based approach. A second issue arises when dealing with NTMs, which is whether one should estimate multilateral or bilateral AVEs. We use the price-based bilateral approach.

Our results show 1,184 significant AVEs at the six-digit level. Egypt shows the lowest values of AVEs of NTMs (22% for both mean and median) followed by Lebanon (33% for the mean and 39% for the median), Morocco (40% for the mean and 44% for the median) and finally Tunisia (45% for the mean and 51% for the median).

Therefore, Tunisia seems to have the most trade-distorting NTMs, and the countries generally follow the same order when considering either the mean or the median as a central tendency.

Paradoxically, when looking at the spread of AVE values as measured by the interquartile range, we conclude that the tendency is almost the opposite of the findings for averages. Egypt records the largest spread of AVE values followed by Lebanon, Tunisia and Morocco. Morocco presents the most consistent AVE values although it surprisingly has the highest range of AVEs.

Still, we must keep in mind that, generally in comparative analysis, we pay much more attention to the spread rather than the range as this latter measure could be affected by outliers. It is also worth noting that Egypt seems to have the most symmetric distribution of its AVEs of NTMs, while the three other countries show negatively skewed distributions.

Examining the level of AVEs at the sectoral level reveals large disparities. A review of the mean and median AVEs indicates that for those sectors in which data for all four countries are available, chemicals face the highest AVEs, followed by food products and wood. But these do vary by country, with mean AVEs on wood products being negligible in Egypt, and median AVEs negligible in Egypt and Lebanon.

All AVEs of above 50% are observed only in Tunisia, specifically on imports of vegetables, metals and plastics/rubbers. The largest AVEs by country in mean value are chemicals in Egypt, textiles and clothing in Lebanon, wood in Morocco, and vegetables in Tunisia. By median, the largest are chemicals in Egypt, Lebanon and Morocco, and vegetables in Tunisia.

When compared with the NTMs facing sectors in each country, the Moroccan sector that faces the most (chemicals) also has the highest AVEs by median. While NTMs particularly affect textiles and clothing in Egypt, this sector does not have data available for AVEs.

For Tunisia, the most NTMs are in animal products, which are not reflected in AVEs, but the large AVEs on vegetable products are concurrent with this being the sector with the second-most important NTMs. In Lebanon, the sector most burdened by NTMs, metals, also has data gaps for AVEs.

What is clear from these results is that AVEs are significantly high in many sectors in the four countries, at best in some cases standing at low levels but for most sectors representing a significant numerical cost to trade.

While these AVEs plague many sectors in general, it is their high level for productive inputs that can prove destructive for domestic firms relying on quality products from external suppliers through regional and global value chains, thus harming the competitiveness of local industries and preventing their growth.

Conclusions

Trade reform in the Arab region that still focuses mainly on tariff reduction will have limited growth benefits. But if governments reduce or abolish the widespread NTMs, particularly through the elimination of quantitative trade restrictions, trade policy can become the central instrument to redress the growth prospects of Arab countries.

The reduction, simplification and harmonisation of NTMs would make pan-Arab trade agreements much more effective. Indeed, by freeing up all new routes of trade in higher value-added goods from indirect trade costs, coordinating action on NTMs will remove unforeseen obstacles and allow for the functioning of job-creating provisions of regional trade agreements.

Strong policy actions to address the coverage and persistence of NTMs by Arab countries will allow the realisation of expected gains from greater integration in the regional and global economy. Trade will greatly support the transition of the Arab industrial sector, currently dominated by the extraction of natural resources, towards an export-led manufacturing industry. Implemented over the next decade, a strategy to maximise the impact of existing trade agreements could bring another percentage point of annual real GDP growth and raise per capita incomes.

Thus, the benefits are clear of multilaterally addressing NTMs, while simultaneously promoting complementary sectoral policies and reforms. This will further cement diversified growth and prosperity across the Arab region.

Figure 1:

Imports subject to NTMs (in percentage of value)

Figure 2:

Share of imports, by region